For two years in a row, the return on equity (RoE) across the Aon Reinsurance Aggregate (ARA) has fallen below the ARA cost of equity, which is expected to drive further consolidation within the reinsurance sector, according to global broker Aon.

Insurance and reinsurance broker Aon has released the latest edition of its ARA report, which analyses the performance of 23 major reinsurance companies.

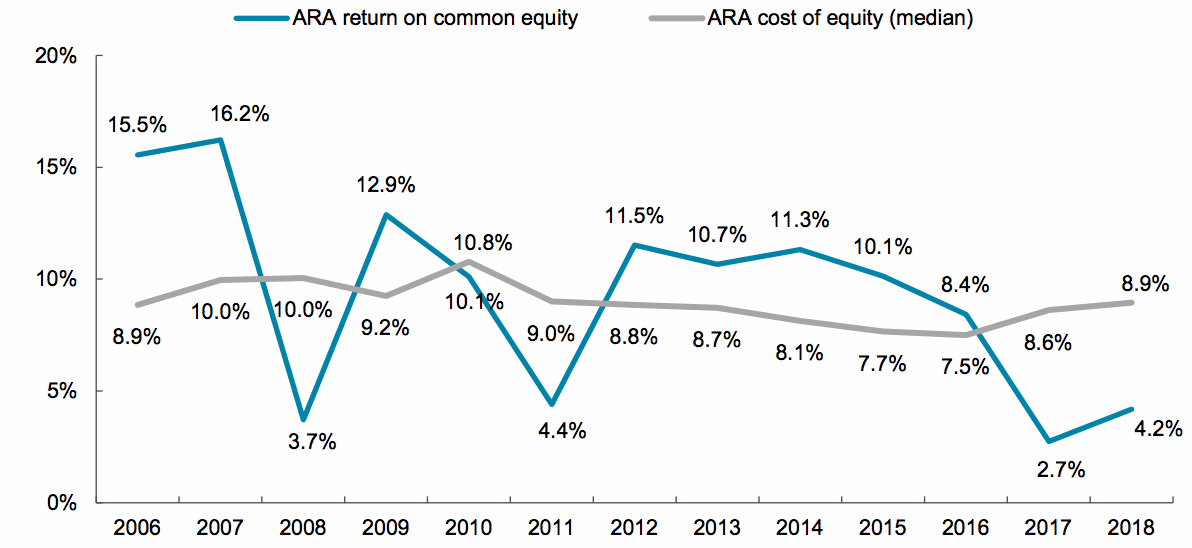

According to the report, from 2006 to 2018, the ARA RoE averages 9.4%. However, earnings over the last two years have failed to cover the cost of equity. In 2017 and 2018, the ARA RoE hit 2.7% and 4.2%, respectively, while the cost of equity hit 8.6% and 8.9%, respectively.

The chart below, provided by Aon, shows that this hasn’t happened for around five years, when earnings failed to cover the cost of equity in both 2010 and 2011, before a reverse of the trend from 2012 through 2016.

According to Aon, “This is likely to result in further pressure for consolidation within the sector.”

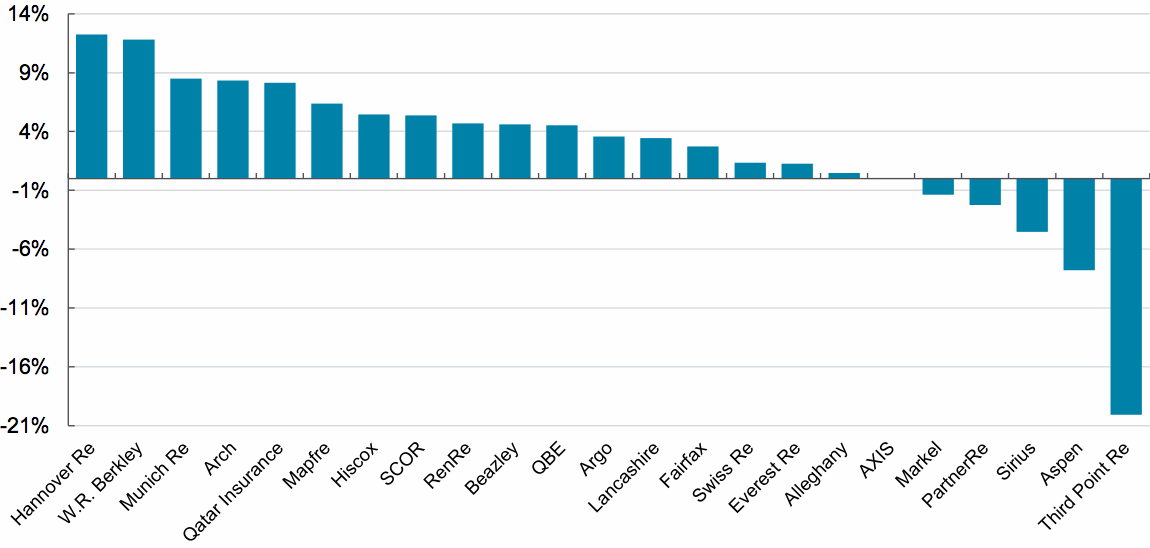

As the below chart shows, the reported RoE across the 23 companies varied in 2018, with hedge-fund style reinsurer Third Point Re suffering the steepest loss at 20%, which Aon attributes to its differentiated investment strategy.

In 2018, the ARA reported net income of $8.7 billion, which is an increase of more than 50% when compared with 2017, but still someway below the $16.9 billion reported in 2016 and is actually just the fourth time in the last twelve years net income has fallen below $15 billion.

In an increasingly competitive and changing risk landscape, profitability remains a challenge for many in the space, which in turn is driving a need to improve efficiency. Absent meaningful and sustainable rate increases it’s likely that margins will continue to thin, forcing companies to adapt in order to remain relevant, which has every chance of driving additional sector consolidation.