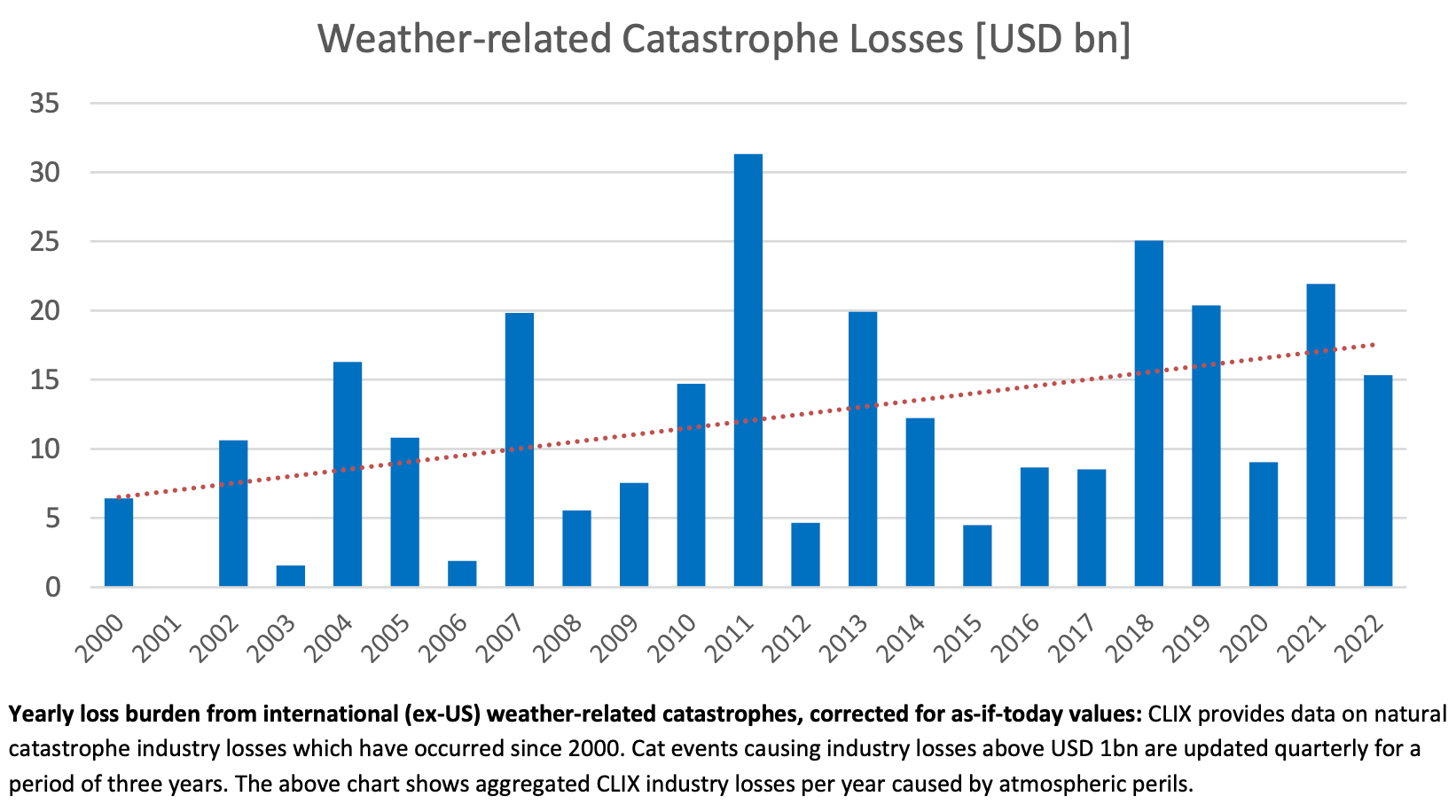

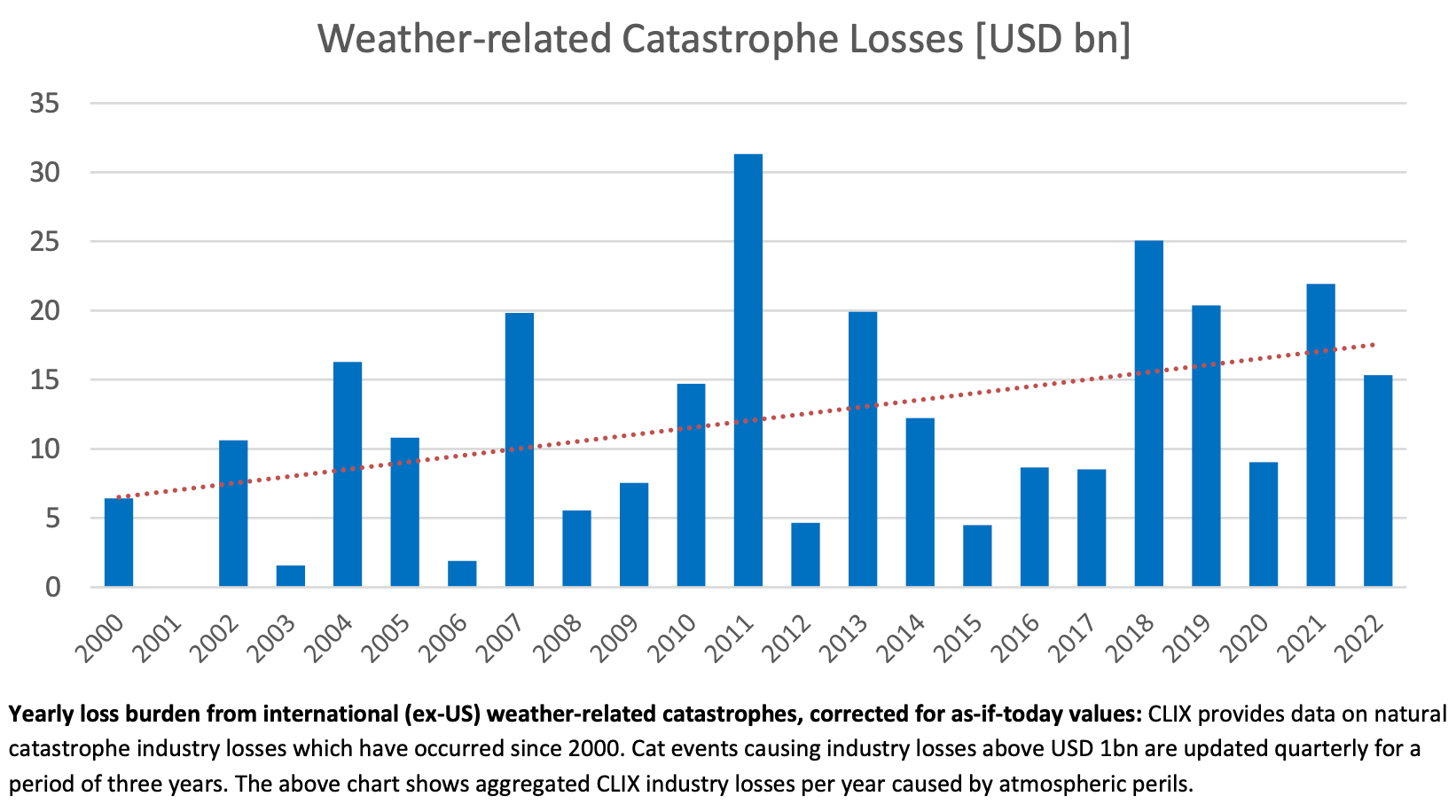

CRESTA, the re/insurance industry organisation that provides a global standard for risk accumulation zones and cat industry losses, has released its Q4 update of the CRESTA Industry Loss Index (CLIX), highlighting a significant rise in weather-related catastrophe losses over the last 20 years.

CRESTA states that the CLIX index provides industry loss data on international Cat events which have generated losses to the insurance industry in excess of $1 billion (excluding the US).

CRESTA states that the CLIX index provides industry loss data on international Cat events which have generated losses to the insurance industry in excess of $1 billion (excluding the US).

For last year, the flooding in Eastern Australia in late February/early March was the largest event, which CRESTA estimates generated an industry loss of $4.7bn, slightly above catastrophe loss aggregator PERILS estimate of $4.3bn in September.

This is followed by the European Windstorm Series in February and the Fukushima Earthquake in March, which caused industry losses of $4.2bn and $3.9bn, respectively.

Matthias Saenger, Technical Manager of CLIX, commented, “The CRESTA CLIX industry loss database goes back to 2000 and therefore allows users to analyse trends in the frequency and severity of major natural catastrophe events.”

CRESTA suggests that while losses from major weather catastrophes in the years 2000 to 2009 totalled $81bn (adjusted to reflect current values), they almost doubled to $150bn in the period from 2010 to 2019.

Further, the first three years of the current decade appear to confirm this trend, with $46bn of losses incurred by the insurance industry to date due to atmospheric perils.

Saenger added, “This is critical information for underwriters who are addressing a dynamic risk landscape driven by climate change and the growth in insured values.

“Only by properly understanding these trends, can natural catastrophe insurance and reinsurance be offered on a sustainable basis, helping to alleviate the capacity constraints currently observed in the market.”