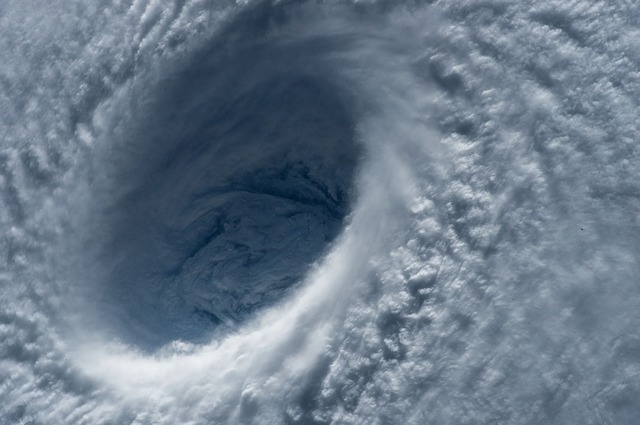

Swiss Re has become the first reinsurer to offer cover for losses related to typhoon warning for Hong Kong businesses, where the overall impact of this level of typhoon warning to Hong Kong’s economy is estimated at U.S. $627 million a day.

The typhoon cover, Insur8, indemnifies against loss of earnings and extra operating costs that result from a typhoon warning signal of strength 8 or above.

The typhoon cover, Insur8, indemnifies against loss of earnings and extra operating costs that result from a typhoon warning signal of strength 8 or above.

Dylan Bryant, CEO North Asia Swiss Re Corporate Solutions, said; “Typhoon warnings are a significant cause of economic loss and business disruption in Hong Kong. Official figures show there can be as many as four warnings each year, lasting an average of 13 hours each.”

Insur8 combines parametric solutions and non-damage business interruption tools with its weather data modelling expertise, providing a pre-agreed pay-out amount based on the Hong Kong Observatory warning signal, rather than any loss or damage sustained to physical assets, ensuring businesses can quickly recover from earnings volatility.

A typhoon warning occurs on average 1.4 times per year and often means employees and customers are unable to reach firms, which then suffer from loss of productivity and revenue and could be hit with heavy reimbursement costs if events have to be cancelled or postponed.

Swiss Re said it developed Insur8 after recognising a gap in existing property and business interruption insurance products which had often resulted in substantial economic losses remaining uninsured.

Bryant explained that with Insur8 “businesses can quickly access liquidity and manage earnings volatility for non-damage business interruption from typhoon warnings.

“Our innovative solution bridges longstanding protection gaps and provides access to fast and transparent claims payments.”