Reinsurance News

Hannover Re

Vantage Risk names José Miranda as Risk Analytics Lead

4th March 2022

Recently launched Bermudian reinsurer Vantage Risk has appointed José Miranda as Risk Analytics Lead, where he will continue to be based in Bermuda. Miranda joins from Hannover Re where he held the role of Senior Catastrophe Analyst for just over a year. Within that role he oversaw catastrophe models and internal quoting ... Read the full article

Hannover Re transfers record $2.7bn+ in cat bonds

21st February 2022

Last year, Hannover Re transferred over $2.7 billion in catastrophe bonds spread across 11 bonds to the capital market for its clients breaking record volume. The reinsurer facilitated for its customers the placement of covers against losses from natural disasters such as floods, storms, earthquakes and wildfires on the capital market. The ... Read the full article

Hannover Re and SCOR differ in retro cost strategy: Jefferies

10th February 2022

According to analysts at Jefferies, the industry has been redirected from rapidly rising rates to surging retrocession costs amidst the 1/1 renewal results, resulting in a divergence in strategy between reinsurance giants, Hannover Re and SCOR. During the report, Jefferies analysts highlighted that Hannover Re’s retrocession program shrank considerably at ... Read the full article

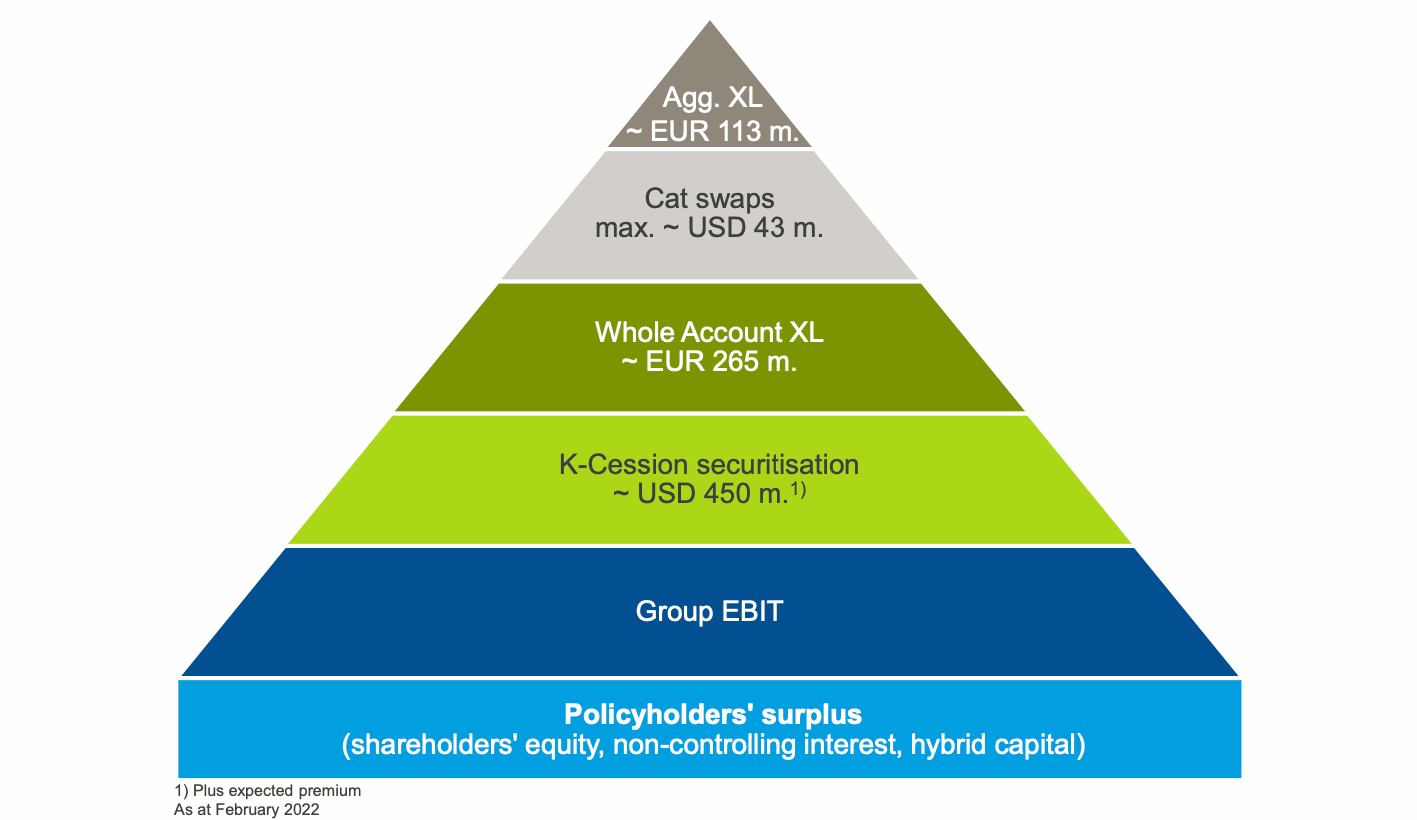

Hannover Re’s aggregate XoL retro cover shrinks by almost 50% at Jan renewal

7th February 2022

For 2022, the size of Hannover Re's aggregate excess-of-loss (XoL) worldwide retrocession reinsurance layer has decreased by almost 50% to approximately €113 million, as the German reinsurer navigated more challenging retro market conditions at the January 1st renewals. As forecast towards the end of last year, aggregate retro capacity was harder ... Read the full article

Talanx Group’s net income tops €1 billion for the first time

4th February 2022

Germany's Talanx Group, the parent of reinsurer Hannover Re, has announced that in 2021, its net income exceeded the €1 billion threshold for the very first time, supported by increased earnings across its primary business and reinsurance operation. Back in 2018, Talanx published a number of goals for the period up ... Read the full article

Hannover Re expects improved rate trends to persist at upcoming renewals

3rd February 2022

Sven Althoff, Board Member for Property and Casualty (P&C) at global reinsurer Hannover Re, said this morning that the company expects the "broad trend of improved rates will continue to apply both at the insurance and at the reinsurance level" at the April and mid-year renewals. Early this morning, Hannover ... Read the full article

Hannover Re grows book by 8.3% at Jan 1 reinsurance renewals

3rd February 2022

German reinsurance giant Hannover Re achieved average inflation and risk-adjusted price increases of 4.1% at the January 1st, 2022, reinsurance renewals, as the company grew its book by 8.3%. Hannover Re notes the influence of considerable natural catastrophe losses on market pricing, especially in Europe and North America, alongside the low ... Read the full article

Fitch highlights strong 9M earnings from Europe’s top 4 reinsurers

15th November 2021

Europe’s four biggest reinsurers are said to have demonstrated strong earnings improvements over the course of 2021’s first nine months, despite what was a period of heavy catastrophe losses for the sector. Fitch Ratings' analysts explained how Munich Re, Swiss Re, Hannover Re and SCOR all posted ... Read the full article

Hannover Re sheds stake in HDI as firm underlines ‘pure reinsurer’ focus

11th November 2021

Global reinsurer Hannover Re has announced the sale of its 49.8% stake in joint venture HDI Global Specialty SE to majority shareholder HDI Global SE. The deal underscores Hannover Re’s overarching ambition of repositioning itself as a pure reinsurer. Concurrently, the sale is seen as a way to free up capital for ... Read the full article

Hannover Re’s 9M net income hits €856m despite above-budget major losses

4th November 2021

Global reinsurer Hannover Re has reported a 28% rise in net income for the first nine months of 2021 to €856 million, despite catastrophe losses in the third quarter pushing the firm's major loss expenditure above budget. Across the business, gross written premium (GWP) increased by 12% in the first nine ... Read the full article

Hannover Re’s E+S Rück expects rising reinsurance prices in Germany

18th October 2021

E+S Rückversicherung AG, the Hannover Re subsidiary responsible for the Group's German business, is anticipating appreciable adjustments to reinsurance prices and conditions in the property market in Germany following catastrophic weather events in the country. In Germany alone, low pressure system 'Bernd' is expected to drive insurance industry losses of more ... Read the full article

Hannover Re commits to net zero targets in reinsurance & investments

13th October 2021

Hannover Re is committing to achieve net zero emissions in business operations by 2030 and in its reinsurance portfolio and investments by 2050, as part of its targets to support the Paris Agreement on climate change. The reinsurer plans to develop methods to determine the greenhouse gas emissions of reinsured customer ... Read the full article

Hannover Re to explore advanced underwriting with Dublin-based R&D project

1st October 2021

Global reinsurer Hannover Re plans to invest over €6 million in Dublin Digital – a research and development (R&D) programme aimed at delivering a competitive edge via next generation d underwriting. To facilitate this, the company plans to create up to 16 positions in Dublin over the next 3 to 4 ... Read the full article

Further reinsurance price adjustments are ‘unavoidable’, says Hannover Re

13th September 2021

Global reinsurer Hannover Re expects further price increases in property and casualty reinsurance and improvements in terms and conditions in 2022, as heightened risk awareness drives greater demand for high-quality protection. "In property and casualty reinsurance there is a need for further rate increases. Only in this way will reinsurers be ... Read the full article

Europe’s major reinsurers grew 11% at mid-year 2021 renewals: Litmus Analysis

2nd September 2021

Europe's four major reinsurers renewed roughly €12 billion of treaty premium at the mid-year 2021 reinsurance renewals, with an average risk-adjusted price increase of 2.1%, according to research from Litmus Analysis. The €12 billon of renewed treaty premium represents growth of 11%, which is an improvement on the 5% growth recorded ... Read the full article