Reinsurance News

retrocession

IRB Brasil Re execs say crop losses have exceeded retro limits

17th August 2022

The performance of Brazilian reinsurer IRB Brasil Re in Q2 2022 was negatively impacted by the severe drought in the southern part of the country, leading the firm to exceed the limits of its retrocession protection. Yesterday, the company announced an underwriting loss of R$661.0 million (USD 129.1m) for the ... Read the full article

James River & Fortitude Re enter into $335m LPT retro agreement

1st March 2022

JRG Reinsurance Company Ltd. (JRG Re), a primary operating subsidiary of James River Group Holdings, Ltd., has entered into a $335 million loss portfolio transfer retrocession agreement with Fortitude Reinsurance Company Ltd. Under the terms of the agreement, Fortitude Re will reinsure the majority of the reserves from the firm's casualty ... Read the full article

Property cat pricing hasn’t improved enough to justify the exposure: Everest Re CEO Andrade

11th February 2022

Property catastrophe reinsurance pricing has been on the rise for some time now, but when you consider the impacts of consecutive above-average years of natural disaster events and losses, exacerbated by climate change, it simply hasn't moved enough, according to Juan Andrade, President and Chief Executive Officer (CEO) of Everest ... Read the full article

SCOR’s lower cat exposure driven by climate change not retro pricing, says Conoscente

8th February 2022

The 11% reduction of catastrophe exposures on SCOR's P&C in-force portfolio for 2022 was driven by the reinsurer's adjusted view of risk due to climate change, as the price rises achieved on the cat portfolio offset higher retrocession rates, according to Jean-Paul Conoscente, Chief Executive Officer (CEO) of SCOR Global ... Read the full article

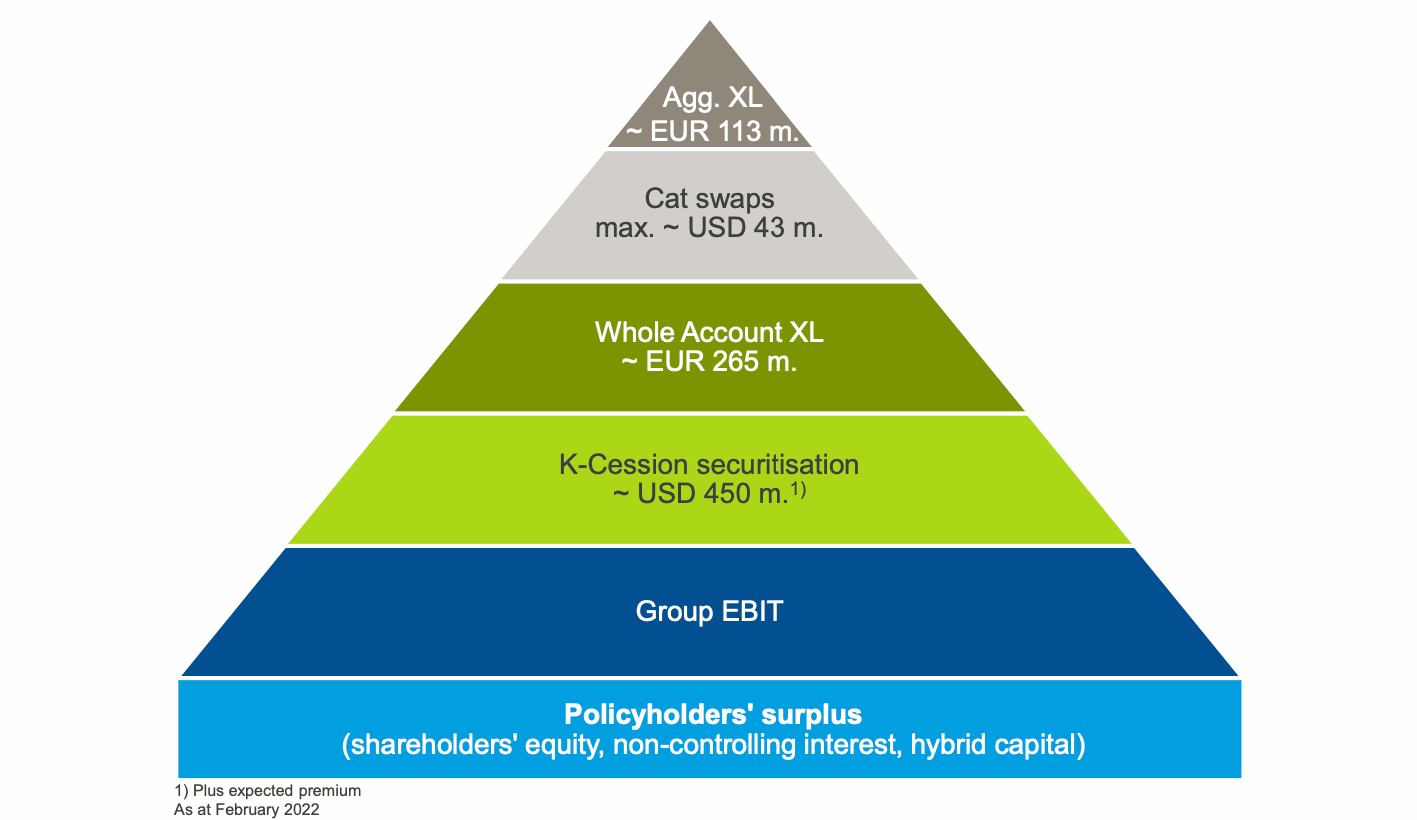

Hannover Re’s aggregate XoL retro cover shrinks by almost 50% at Jan renewal

7th February 2022

For 2022, the size of Hannover Re's aggregate excess-of-loss (XoL) worldwide retrocession reinsurance layer has decreased by almost 50% to approximately €113 million, as the German reinsurer navigated more challenging retro market conditions at the January 1st renewals. As forecast towards the end of last year, aggregate retro capacity was harder ... Read the full article

Better than expected 1/1 conditions leave Conduit Re’s Eckert bullish on outlook

21st January 2022

For Class of 2021 reinsurance start-up, Conduit Re, market conditions at the January 1st, 2022, renewals were ahead of expectations, leading the company's Chairman, Neil Eckert, to be optimistic for the months ahead. Earlier this week, $1.1 billion start-up reinsurer Conduit Re reported its January 2022 trading statement, which showed ... Read the full article

Lloyd’s underwriters expect property cat rate rises to persist: Peel Hunt

12th January 2022

After rising by around 10% at the January reinsurance renewals, property catastrophe rates are expected to gain further momentum in 2022 amid a reduction in capacity, reports Peel Hunt following discussions with underwriters from the Lloyd's market. Peel Hunt recently held its Lloyd's Tour, during which most of the underwriters it ... Read the full article

Material variances, but property retro prices rise at Jan renewals: GC

7th January 2022

With 2021 being affected by catastrophe events, property retrocession renewals experienced price increases in both aggregate and occurrence products at 1/1, according to reinsurance broker Guy Carpenter. As expected, the largest changes were in loss-affected accounts as well as low-lying aggregate placements following reductions in available capacity, says Guy Carpenter. The broker ... Read the full article

Lloyd’s gets £650m cover for Central Fund: Report

17th June 2021

The Lloyd's of London insurance and reinsurance market has taken out a £650 million cover from an investment bank and reinsurers to protect its Central Fund against significant loss events, according to a report from the FT. The Central Fund reinsurance, or perhaps retrocession, arrangement, will have a five-year term and ... Read the full article

PartnerRe launches retro & specialty reinsurance vehicle backed by Olympus

21st January 2021

Bermuda-based reinsurance company, PartnerRe Ltd., has established a new retrocession and specialty reinsurance vehicle called Laplace-C, which has secured an investment from Olympus Partners. The backing sees Stamford, Conn.-based private equity firm, Olympus Partners, look to take advantage of favourable reinsurance market conditions in both short-tail specialty and retro insurance markets. Founded ... Read the full article

January reinsurance renewals adequate. Capital blamed as momentum stalls

4th January 2021

The January 2021 reinsurance renewal season is largely concluded and while the overall perception from the market appears to be that pricing was adequate, it's clear that momentum stalled as the year drew to a close. We say largely concluded as there are some programs that remain unfilled, particularly in the ... Read the full article

Survey: 32% say Covid-19 to increase reinsurance & retro buying

31st March 2020

With already a few hundred responses collected from our new survey on the re/insurance market implications of the Covid-19 coronavirus pandemic, it's clear the market is expecting that long-term the crisis will drive an appetite for greater protection. Our ... Read the full article

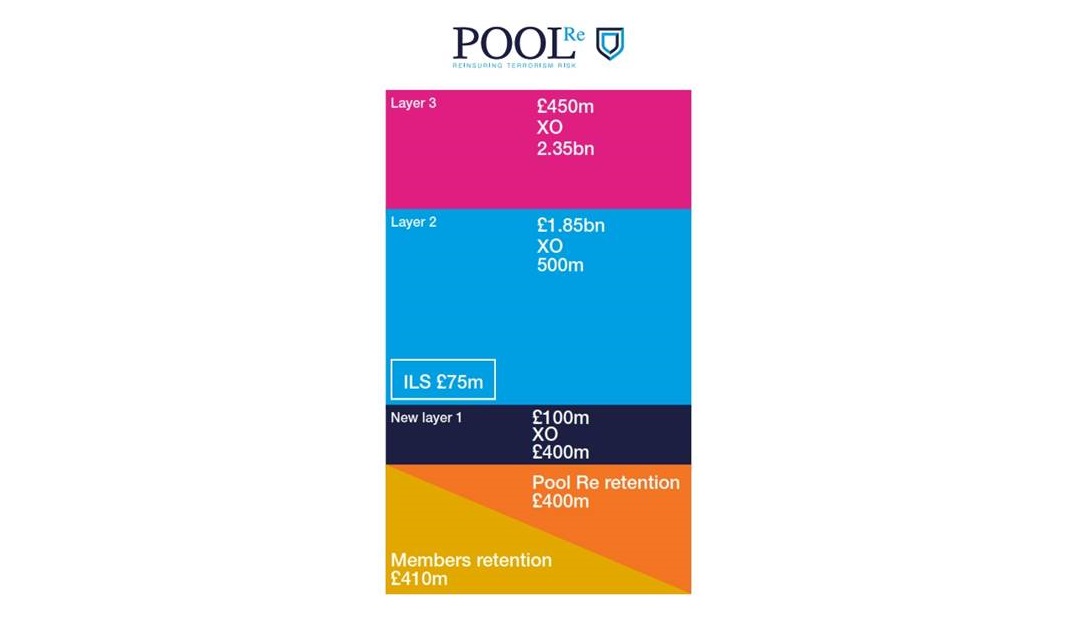

Pool Re completes record £2.4bn retro program

4th March 2020

UK government-backed terrorism reinsurer Pool Re has completed placement of a £2.4 billion retrocession program, its largest to date. Led by Munich Re, the £2.4 billion cover represents a £100 million expansion from its 2018 placement and includes £75 million provided by Pool Re’s terrorism catastrophe bond launched last year. The ... Read the full article

Peak Re renews, expands Lion Rock Re sidecar for 2020

7th January 2020

Hong Kong-based global reinsurer Peak Re has renewed and upsized Lion Rock Re, the first Asian sidecar. At $77 million, Lion Rock Re II saw investors exceed the $75 million raised by the sidecar’s first iteration in 2018. To effect the arrangement, Lion Rock Re II entered into an exclusive quota ... Read the full article

Non-marine retro renewals hit by ILS capacity squeeze: Willis Re

6th January 2020

Capacity constraints from the insurance-linked securities (ILS) market resulted in a challenging renewal for the non-marine retrocessional market, according to Willis Re, the reinsurance arm of global insurance brokerage Willis Towers Watson. Analysts noted that ILS capacity has been a driving force of retro capacity in recent years, but is now ... Read the full article

- ← Previous

- 1

- 2

- 3

- 4

- Next →