The staff of the Texas Windstorm Insurance Association (TWIA) plan to recommend that lawmakers consider new ways to reduce the insurer of last resort’s future reinsurance purchases following its largest reinsurance purchase on record in 2024, driven by significant exposure growth.

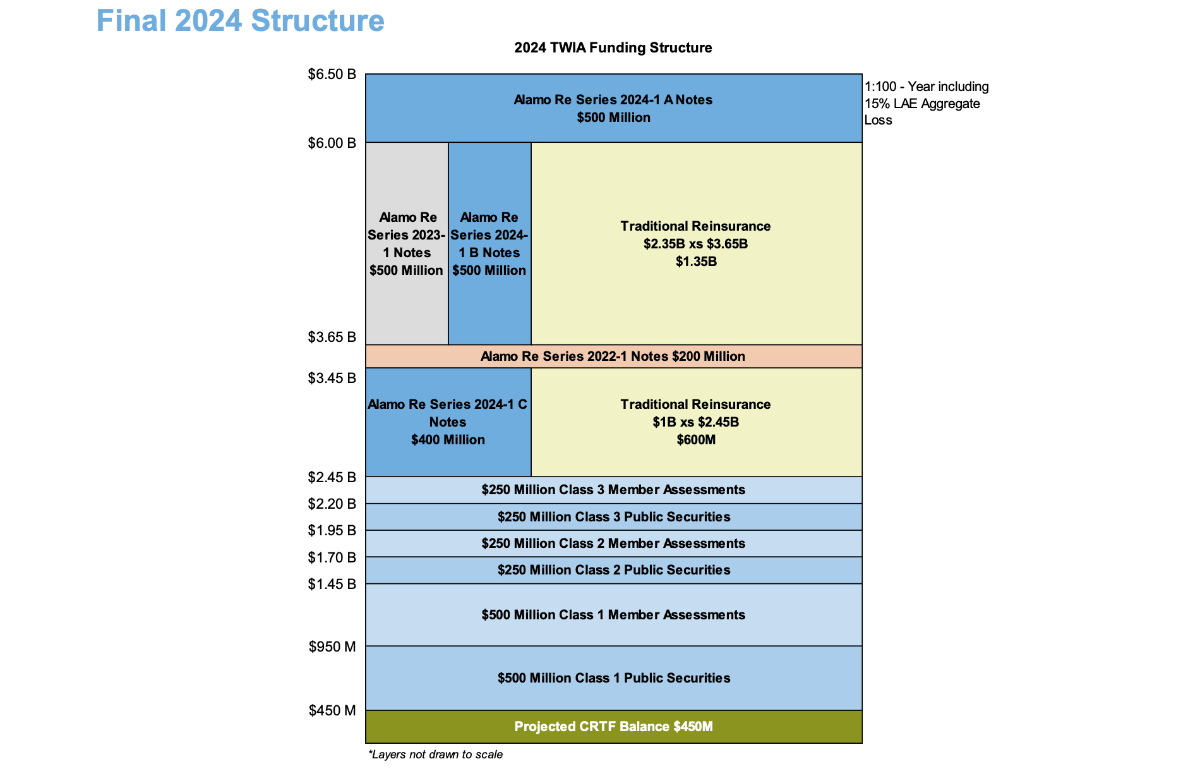

Of TWIA’s record $6.5 billion funding tower for 2024, reinsurance overall makes up roughly 62% at $4.05 billion, while catastrophe bonds are set to make up 32% of the total, including the $1.4 billion Alamo Re 2024-1 catastrophe bond secured in April, which is the largest cat bond the insurer has ever sponsored.

Of TWIA’s record $6.5 billion funding tower for 2024, reinsurance overall makes up roughly 62% at $4.05 billion, while catastrophe bonds are set to make up 32% of the total, including the $1.4 billion Alamo Re 2024-1 catastrophe bond secured in April, which is the largest cat bond the insurer has ever sponsored.

As mentioned, TWIA’s need for more funding is driven by its exposure growth.

With exposure expected to keep growing, staff and the Board of the Association intend to find ways to stop the reinsurance purchase from running higher. The ideal approach is of course to raise some of the other statutory funding contributions.

As Reinsurance News understands, a range of considerations will be presented to the Texas legislature in the next edition of TWIA’s biennial report, due later this year.

While not making any full recommendations at this stage, the staff and Board of TWIA reportedly want to get the legislature focused on helping to contain its reinsurance costs and making better use of other funding sources.

Looking at TWIA’s final 2024 funding structure, a clear reliance on reinsurance can be seen, so it is no surprise that Texas’ insurer of last resort would like to balance its sources. However, whether the legislature responds positively to the aforementioned considerations is not yet clear.