With the Texas Windstorm Insurance Association (TWIA) requiring its largest reinsurance purchase on-record given its significant exposure growth, the residual market insurer is making rapid progress, with $750 million of its traditional reinsurance needs already secured in April.

That is on top of a $1.4 billion Alamo Re 2024-1 catastrophe bond that TWIA has also secured in April, which is the largest cat bond the insurer has ever sponsored.

That is on top of a $1.4 billion Alamo Re 2024-1 catastrophe bond that TWIA has also secured in April, which is the largest cat bond the insurer has ever sponsored.

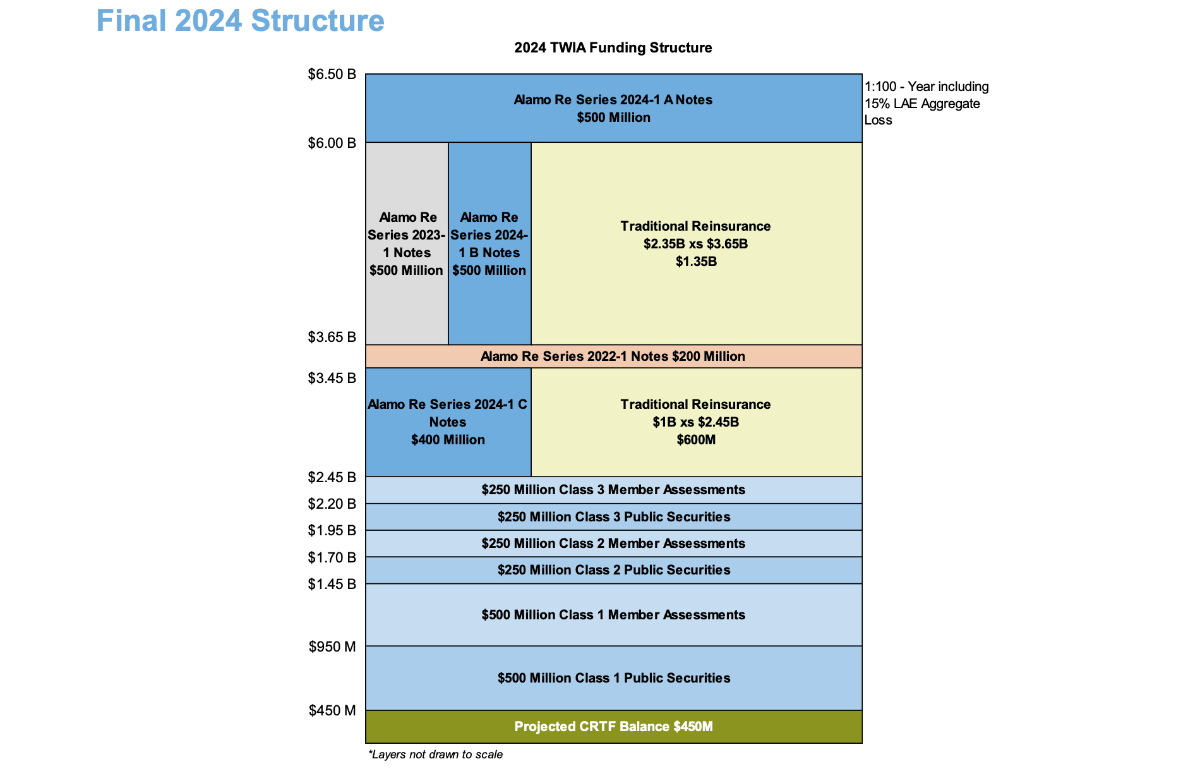

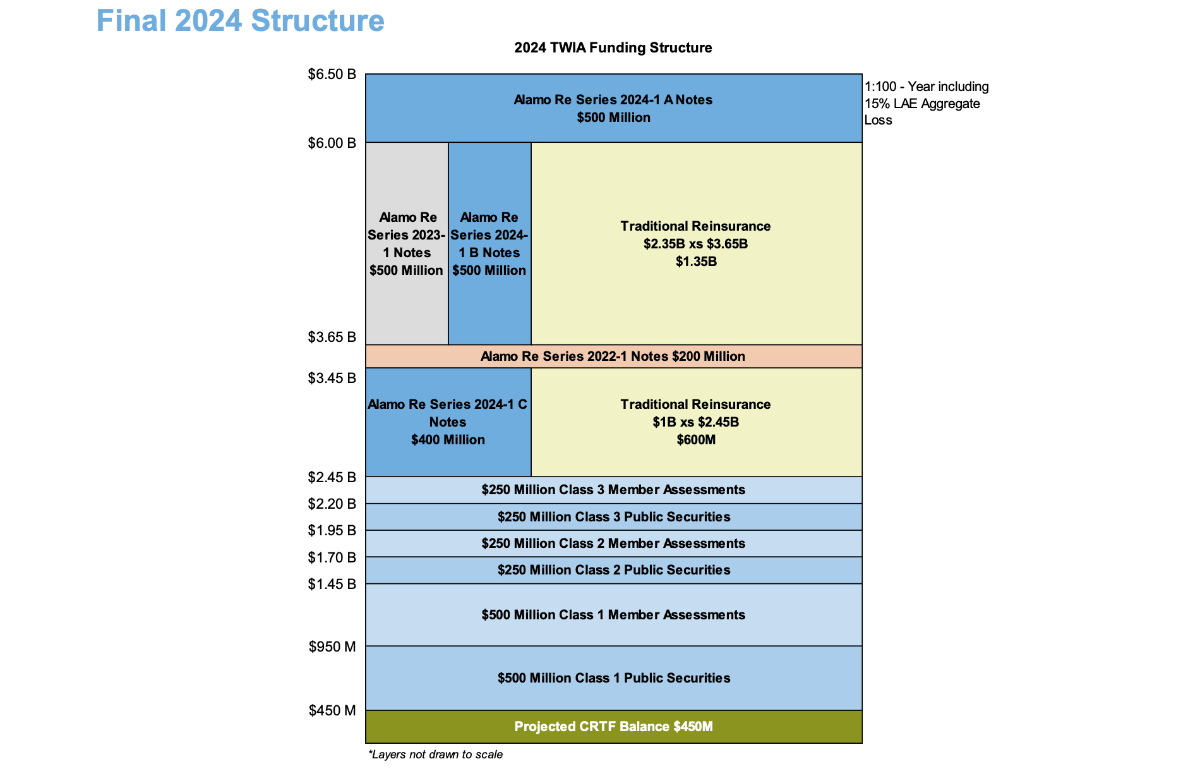

As we’d reported previously, TWIA’s Board approved the insurers 1-in-100 year PML for the 2024 storm season at the level of $6.5 billion.

That is a significant uplift from the $4.5 billion PML set for 2023, driven by exposure growth and inflation.

The Association had added more than 25,000 policies in the past 12 months alone and the result is TWIA needing to secure 81% more in reinsurance and risk transfer for 2024 than the prior year.

Which has driven a need to have $4.05 billion in reinsurance in-force for 2024, alongside $2 billion of member assessments and public securities, plus $450 million of catastrophe reserve trust fund (CRTF) funding that has been built up.

Within that $4.05 billion of reinsurance, TWIA already had $700 million in catastrophe bonds in-force, to which it has already added the new $1.4 billion Alamo Re cat bond in 2024.

As a result of this, TWIA with $2.6 billion in cat bond risk capital outstanding, which will drop down to $2.1 billion before the hurricane season, is one of the most significant sponsors in that market, our sister publication Artemis shows in its catastrophe bond sponsor leaderboard.

That leaves $1.95 billion of traditional reinsurance to be renewed for 2024, which TWIA has already made rapid progress on.

Already in its reinsurance renewal process, TWIA has placed $750 million of limit before the end of April, with further limit being secured and an expectation the full traditional reinsurance renewal will be finalised well in advance of the hurricane season beginning.

Once completed, TWIA’s funding tower will comprise of 62% catastrophe bonds and traditional reinsurance, with risk transfer the key funding source for 2024.

With the cat bonds and perhaps some of the reinsurance being multi-year in nature, this will assist TWIA in its renewals next year as well.

You can see how TWIA’s funding tower for 2024 stacks up below, with reinsurance and cat bonds filling out the top $4.05 billion, from an attachment point at $2.45 billion.

TWIA is set to receive significant support from the reinsurance and capital markets for 2024 and with hurricane forecasts suggesting a busy season, those providing capacity will be watching closely for any storm activity in the Gulf of Mexico.