Increasingly open and transparent data is vital in order to drive a greater understanding of, and demand for, flood insurance around the world, and will ultimately help to narrow the flood protection gap, according to Dr. Andrew Smith, Chief Operations Officer (COO) of UK-based flood risk modeller, Fathom.

Globally, flood exposures continue to drive significant economic and re/insurance industry losses on an annual basis.

Globally, flood exposures continue to drive significant economic and re/insurance industry losses on an annual basis.

While government involvement and initiatives in some parts of the world attempts to address the lack of flood protection, overall, flood penetration rates remain woefully low and as a result, the flood protection gap is vast.

Add to this the impacts of climate change and rising sea levels, alongside the potential for more severe adverse weather events, and it’s easy to see why natural catastrophe protection gaps are viewed as one of the biggest challenges and opportunities for the risk transfer industry.

In light of this, Reinsurance News spoke with co-founder and COO of Fathom, Dr. Smith, about how best to narrow the flood protection, and, what Fathom is doing to tackle the issue.

“We believe that the best way to narrow the flood insurance protection gap is to drive demand for flood insurance, and the way to drive demand for flood insurance is to provide consumers with the tools to identify and make a judgment on their own exposure. We believe that increasingly open data, including flood hazard data that can be viewed by the public, will drive this change.

“In parallel with the insurance sector embracing more applicable and relevant flood models it will engender confidence to identify and develop this market thereby closing this gap by understanding today’s risks more appropriately,” he explained.

Both in the U.S. and globally, continued Dr. Smith, vast areas of flood risk remain unmodeled, and, combined with a lack of data, this hinders the ability to accurately quantify and therefore price flood risk moving forward.

The climate is changing and perils, such as hurricanes – which often drive significant flood events – are evolving and driving a need for the industry to adapt both underwriting and pricing in order to adequately account for climate change.

“We know that hurricanes are evolving and so relying on historical record alone is becoming increasingly problematic; observations of what hurricanes did decades ago is not representative of what they do today. Basing your pricing, underwriting or exposure or reinsurance management on historical observations alone is no longer reliable.

“However, understanding risk in the current climate state is a good starting point. Even in the US, existing FEMA flood data have been proven to significantly underestimate exposure nationwide. Insurers are currently pricing and underwriting yesterday’s flood risk, while climatic shifts have altered the risks of today.

“This will be most keenly felt in the US, where models based on historic hurricane tracks may be increasingly biased when attempting to accurately price the true current risk as atmospheric and sea-surface temperatures increase,” said Dr. Smith.

Expanding on this, he underlined that companies might not be able to rely on both their previous experience or their models to provide them with an accurate and reliable view of the exposure.

“Incomplete flood data in the US market hinders the ability of insurers to understand their exposures even under current climate scenarios. For example, during Hurricane Harvey c75% of the population that were flooded were outside of the FEMA floodplain. Fathom’s models provide a far more comprehensive view even under current scenarios.

“Spatially incomplete or poor-quality models prevent insurers from confidently expanding their exposure. Ultimately, insurers will only be able to withstand the increased losses we expect in a warming world if they can diversify their portfolios with low risk assets and ubiquitous models used by insurers may not reliably identify those low risk areas,” said Dr. Smith.

One form of insurance that is gaining momentum and which is widely used in the insurance-linked securities (ILS) space, enabling vital protection and rapid post-event payout, is parametric insurance.

Dr. Smith told Reinsurance News that while there is clearly growing interest in developing parametric trigger products for flood, the biggest challenge here, when compared to other perils, is the definition of the trigger.

“We still only have limited ability to observe and quantify the magnitude of flood events in real time. Even in the USA, the river gauge network is relatively sparse, and gauges may be inaccurate or fail during high flow events. Observations of rainfall are equally problematic, and the different methods of observing rainfall (ground-gauges, radar, satellite, etc) often show poor correlation with each other.

“Visual-band satellite imagery is often hampered by cloud cover, whilst synthetic aperture radar (which can ‘see’ through cloud) struggles to resolve flooding in urban areas. It is likely that hybrid model-remote sensing triggers are the way forward here, and it is an area of active research and development for us,” he explained.

Fathom recently announced its participation in a U.S. partnership that is designed to open flood mapping and coastal risk data analysis to the public, the only UK firm to be involved in the First Street Foundation project.

The company launched its updated U.S. flood model, Fathom-US, via the Nasdaq platform in the middle of last year and are now partnering with Xceedance for their on-demand CAT modelling services.

As Fathom continues to evolve, Dr. Smith explained where he sees opportunities for the company to assist the insurance and reinsurance sector as it adapts to this new landscape.

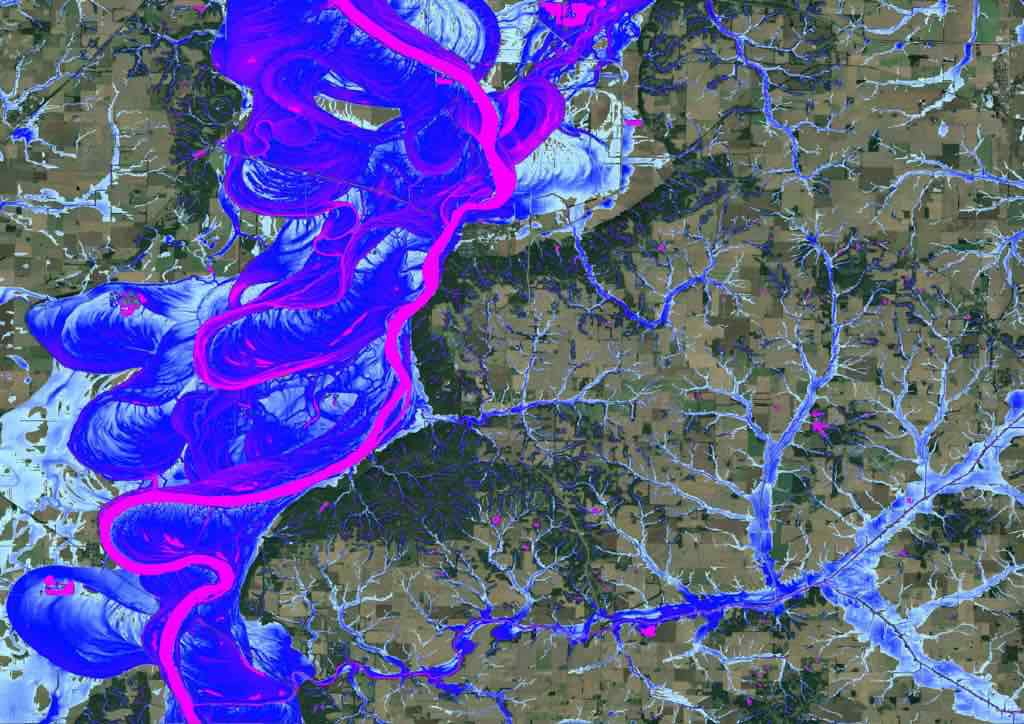

Fathom US flood risk map – Mississippi

“Fathom’s models provide a view of flood risk consistently across the US and globally. The model frameworks themselves can be deployed quickly and repeatedly unlike, for example, the FEMA catalogue. This ability allows us to provide updated views of risk based on the latest datasets and science and even provide views of risk under future climate scenarios.

“At Fathom we’re building comprehensive flood models under multiple time-horizons, including an updated view of today’s risk. This will provide insurers and reinsurers a more relevant perspective of their flood risks today and enable them to understand the longer term impacts of climate change.

“Fathom are unique in that their flood methodology and model validation is all peer reviewed and published in the leading scientific journals, allowing insurers and reinsurers to really delve into the science and understand how the models work. This transparency is critical if the insurance sector is to fully adapt to this new reality,” he said.