European re/insurer Zurich has made some adjustments to its reinsurance coverages for 2024 with the addition of a new $300 million top catastrophe layer to its Europe all perils tower, while the retention on its U.S. all perils tower has come down by $50 million to $600 million.

Alongside the release of a strong set of results for 2023, Zurich has today provided an update on its reinsurance arrangements for the year ahead, with some notable changes from last year’s programme.

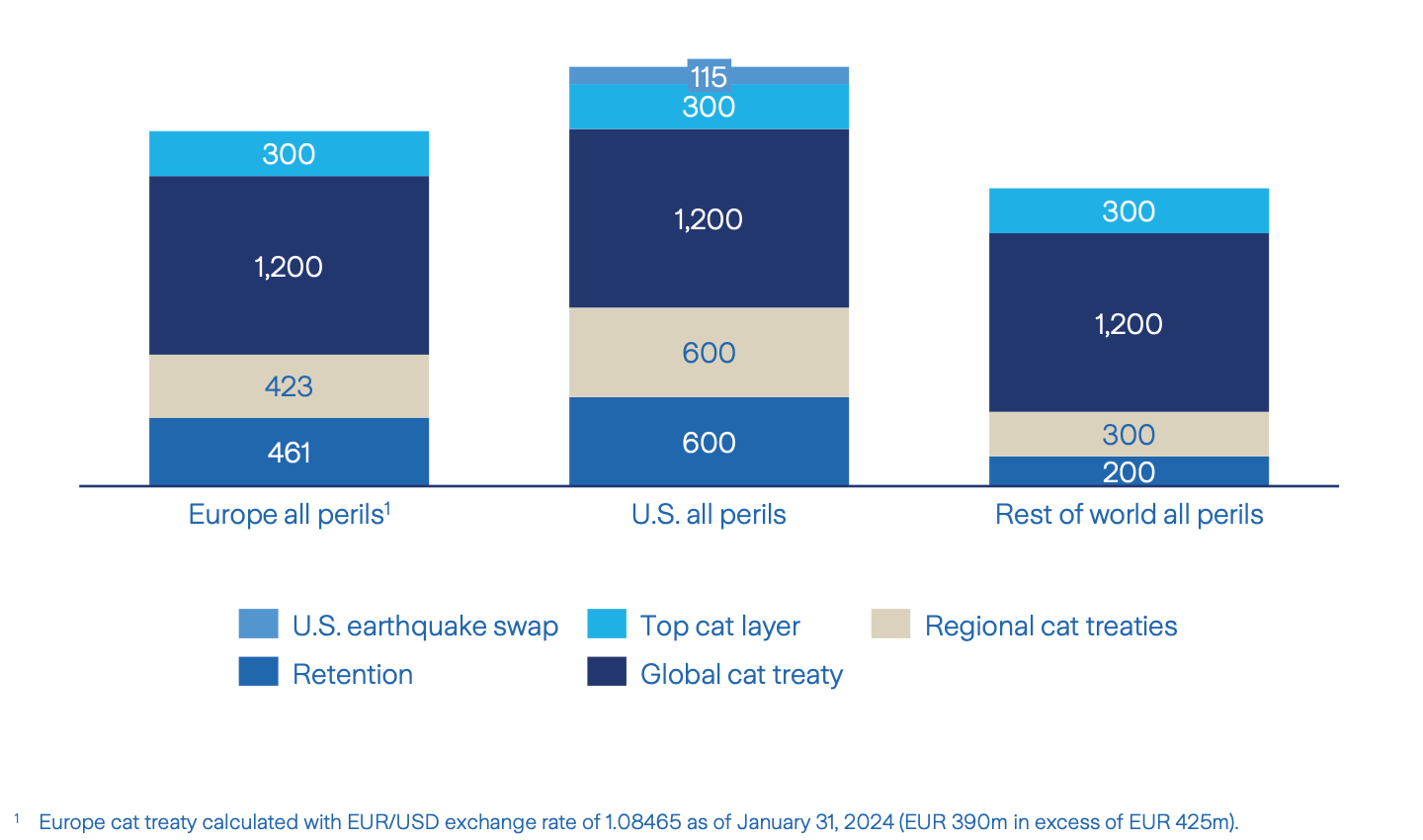

Starting with the carrier’s European tower, the retention is basically the same at $461 million. Above this, and also practically unchanged year-on-year is $423 million of regional catastrophe treaties, and then above this an unchanged $1.2 billion global catastrophe treaty.

For 2023, this is where the top of the European all perils tower ended, but for this year, Zurich has secured a $300 million top cat layer to sit above the global cat treaty, which extends the top of this tower to $2.384 billion for 2024.

Given the severe flooding and hailstorms across Europe in 2023, notably in the third quarter, it’s not too surprising to see a global insurer like Zurich opt to purchase additional reinsurance protection this year.

On the U.S. side, the retention has come down from $650 million in 2023 to $600 million for 2024, meaning the firm’s reinsurance protection will attach earlier for the U.S. all perils agreements. Above the retention sits $600 million of regional cat treaties, up from $550 million in 2023, and then an unchanged $2.1 billion global cat treaty, and then above this an unchanged $300 million top cat layer.

Above this top cat layer is where Zurich has made another adjustment for 2024, shrinking the size of its U.S. earthquake swap from $200 million to $115 million, while the swap has also dropped down and now attaches much lower for 2024. Last year, Zurich introduced the U.S. earthquake swap for the first time, but it attached at $3.25 billion, whereas for 2024 it attaches at $2.7 billion.

A diagram of Zurich’s 2024 reinsurance programme can be seen below, and you can see last year’s here.

For the tower on the right, Zurich’s rest of world all perils programme, coverage is unchanged from 2023.

It’s also worth highlighting that Zurich’s Farmers Reinsurance all lines quota share treaty from the Farmers Exchanges has increased for 2024, rising from an 8.5% quota share to 10%.

The adjustments to its reinsurance arrangements for 2024 suggests further exposure growth for Zurich. In 2023, the company recorded strong growth across all businesses, and expects the positive momentum to persist.