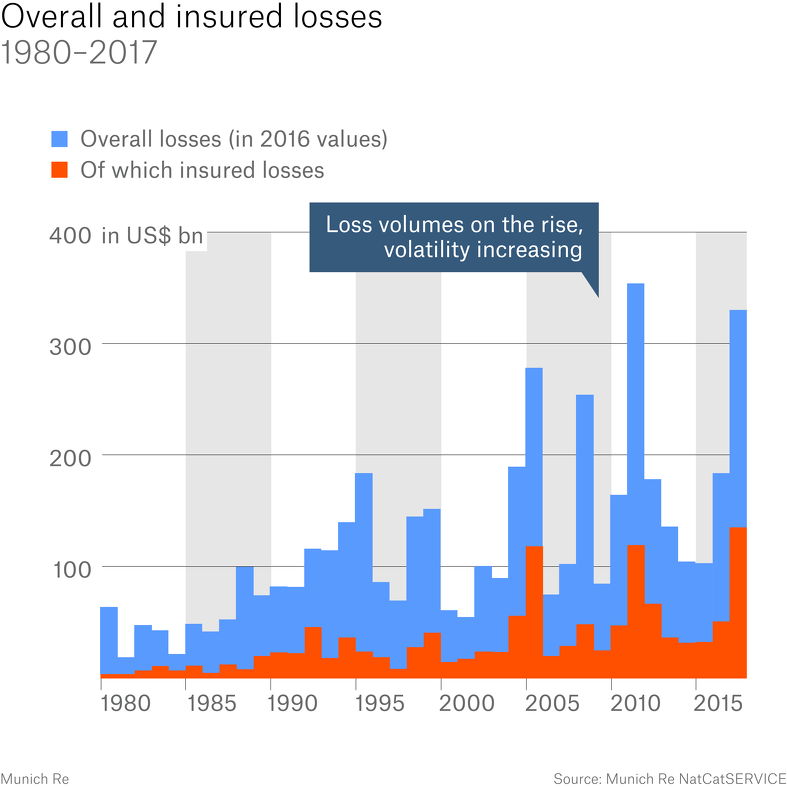

At $135 billion, insured losses from global natural catastrophe events in 2017 were nearly triple the ten-year, inflation-adjusted average of $49 billion, driven by the costliest hurricane season on record, according to reinsurance giant Munich Re.

Economic losses from natural catastrophes totalled a huge $330 billion in 2017, making it the second-costliest year on record for nat cat events, and almost double the ten-year, inflation-adjusted average of $170 billion.

Economic losses from natural catastrophes totalled a huge $330 billion in 2017, making it the second-costliest year on record for nat cat events, and almost double the ten-year, inflation-adjusted average of $170 billion.

According to reinsurance giant Munich Re, roughly 65%, or $215 billion of the overall loss came from the extremely active and damaging 2017 Atlantic hurricane season, which included hurricanes Harvey, Irma, and Maria, and what’s become the costliest hurricane season on record.

Munich Re states that natural catastrophe events in 2017 show how low insurance penetration is across the globe, in both developed and emerging markets, with just 41%, or $135 billion of the overall loss being covered by re/insurance.

Ernst Rauch, Head of Climate & Public Sector Business Development, Munich Re, commented; “The above-average share of insured losses this year masks the reality of how little coverage many parts of the world still have. In many developing countries, losses from natural catastrophes often remain almost totally uninsured. And even in highly developed countries like the US, whose share of insured losses is significantly greater, more widespread insurance coverage would still be very beneficial to the economy.

“Though there was in fact a slight silver lining among all the clouds: Irma and Maria meant that some Caribbean islands were hit twice in a row by severe hurricanes this year. Yet only a few days after the events, the CCRIF (Caribbean Catastrophe Risk Insurance Facility), a public-private regional insurance pool, was able to pay out around US$ 50m in emergency funds. Munich Re supports the development of such pool solutions that can do much to help close the gaps in cover that exist in many low-income countries.”

As noted by Rauch, the U.S. took on a larger share of the losses than usual, at 50% compared with the long-term average of 30%. According to Munich Re, when considering the whole of North America, the share of losses increases to 83%.

President and Chief Executive Officer (CEO) of Munich Re, US, Tony Kuczinski, commented; “This hurricane season is a stark example of the incredibly important role that Munich Re plays in helping people and communities rebuild in the wake of natural catastrophes. And we learned from these events. First, that mitigation and improved risk management, such as stronger building codes in Florida, can work to reduce losses and promote life safety.

“Second, there continues to be a substantial insurance gap, even in a highly developed market like the United States where, for example, the vast majority of home and small business owners do not purchase flood insurance. Our industry’s risk expertise, capital strength, and claims-handling infrastructure are critical to finding meaningful solutions, and Munich Re is an active participant in the public-private partnership that seeks to offer more flood insurance options and promote flood protection.”

Outside the Atlantic hurricane season, European farmers were hit by very low temperatures which damaged crops and resulted in billions of dollars of damage, In Asia, an extremely severe monsoon season claimed the lives of 2,700 people, with a number of regions being impacted.

Overall, roughly 10,000 people lost their lives as a result of natural catastrophes in 2017, which is above that seen in 2016, but below the ten-year average of 60,000.

Hermann Pohlchristoph, Munich Re Board Member responsible for Asia-Pacific, commented; “In the Asia-Pacific region, natural catastrophe losses were thankfully less severe than in previous years: at US$ 33bn, they were below both last year’s total of US$ 96bn and the ten-year average of US$ 85bn. At the same time, the numbers show how alarmingly sparse insurance cover still is in Asia: only 8% of losses there were insured. And yet appropriate insurance solutions do exist, which can significantly help get people and economies back on their feet financially after a natural disaster.”