Data from our mid-year 2022 reinsurance renewals survey reveals that carriers are expected to adopt various strategies as they struggle to secure the desired level of reinsurance at what’s been described as a very late June 1st, 2022, renewals.

With the June reinsurance renewals having a heavy focus on the stressed Florida property market, insurance and reinsurance industry commentary has suggested that some might struggle to fill their reinsurance towers as sellers’ appetite for property catastrophe exposure in the state continues to wane.

With the June reinsurance renewals having a heavy focus on the stressed Florida property market, insurance and reinsurance industry commentary has suggested that some might struggle to fill their reinsurance towers as sellers’ appetite for property catastrophe exposure in the state continues to wane.

Issues in the state run deep, and outside of the uncertain impacts of storms ahead of what’s expected to be an above-average Atlantic hurricane season in 2022, includes widespread challenges around litigation and fraud.

While Florida’s special session, which convened this week, is looking to reverse some of the trends hindering the market, it’s unclear how influential any potential legislative changes will be and how long it will take for these measures, if enacted, to have a positive impact on the Florida property insurance marketplace.

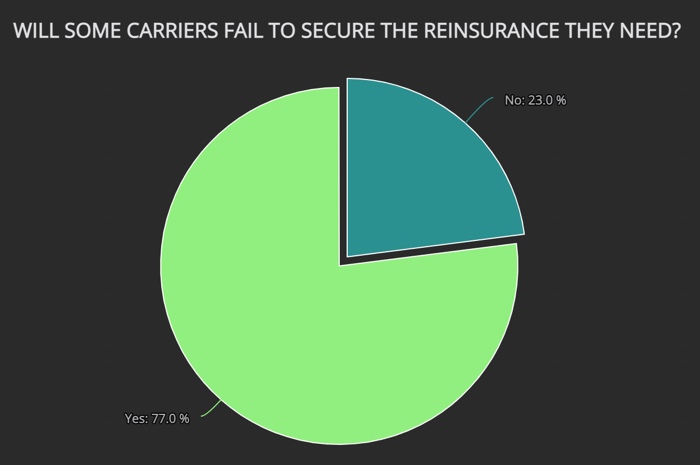

Out of the hundreds of responses from identifiable market participants, of which 70% make or provide input to reinsurance buying decisions, a significant 77% expect that certain carriers will fail to secure the desired level of protection at the mid-year renewals.

The reality is that numerous reinsurers have pulled back from the Florida property market to avoid the volatility, and while price increases are expected to accelerate at June 1st, the responses to our survey suggest that rate alone is not enough to entice providers of capacity, especially for the lower, more risky layers of reinsurance programs.

Of course, there are other strategies carriers that fail to procure sufficient reinsurance can adopt to offset the challenges of retaining more risk on their balance sheets.

According to the survey results, the most likely strategy these buyers will adopt at June 1st is to write smaller line sizes or reduce portfolios, with 71% of respondents choosing this option.

Almost 43% of respondents expect these carriers to purchase back-up covers after the mid-year renewals, while roughly 39% see these companies looking to the capital markets for alternative forms of risk transfer, such as derivatives.

For 25% of respondents, there’s an expectation that carriers who fail to secure enough reinsurance protection at the mid-year renewals will completely withdraw from lines of business.

We’ve made the full results of this global reinsurance market survey freely available to our readers and we’re happy to discuss the results with industry participants and to discuss sponsorship enquiries from those looking to raise their profile in the reinsurance sector. Contact us.