US primary insurer Allstate has successfully filled out a $400 million gap fill layer of protection in the per occurrence tower for its Nationwide excess catastrophe reinsurance program, while also significantly expanding its Florida coverage.

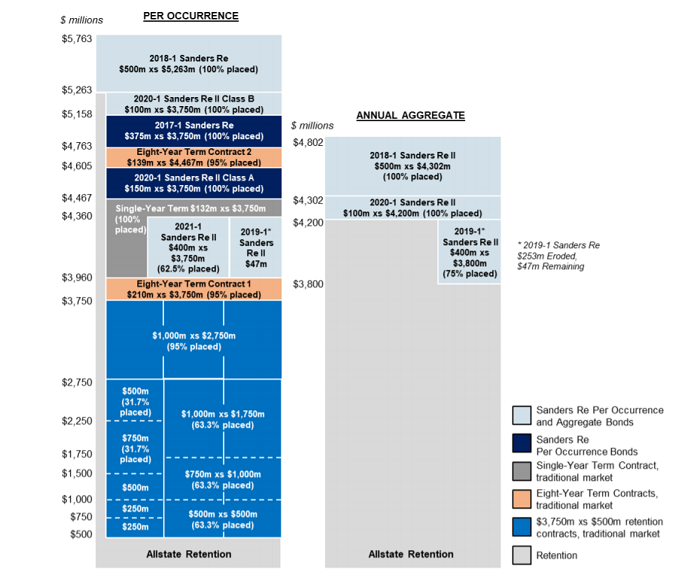

The company recently disclosed that it had eroded $253 million of its 2019-1 Sanders Re II catastrophe bond, leaving just $47 million of the $400 million limit remaining, given that only 75% of it was placed.

In order to replace this protection, Allstate has since filled out the gap with $250 million of coverage from a new 2021-1 Sanders Re II bond, and a single-year term contract that provides a $132 million limit in excess of the minimum $3.750 billion retention.

Allstate announced earlier today that it recorded net income of $1.6 billion for the second quarter of 2021, up from $1.2 billion for the same period last year, boosted by improved investment income results.

As in the Q1 update, Allstate’s Nationwide program provides coverage on up to $5.763 billion of losses, after a $500 million retention, up from just under $5 billion last year, with some other expanded layers adding in total roughly $770 million of reinsurance.

In addition, Allstate revealed that it has increased the number of contracts in its Florida excess catastrophe reinsurance program to ten contracts covering up to $1.24 billion, up from four contracts coving up to $633 million last year.

The ten contracts reinsure Allstate’s Castle Key subsidiaries for personal lines property excess catastrophe losses in Florida, and include seven contracts placed in the traditional market, Castle Key’s reimbursement contracts with the Florida Hurricane Catastrophe Fund (FHCF), and the Sanders Re 2020-2 Contract placed in the ILS market.

Specifically, the mandatory FHCF contracts now provide $253.1 million of limits in excess of a $103.6 million provisional retention, compared with $130.6 million of limits in excess of a $51.3 million retention previously

Likewise, the below FHCF contract now provides three limits of $60.0 million in excess of a $40.0 million retention, versus three limits of $31.3 million in excess of a $20 million retention previously.

The largest changes, however, were in the excess agreements, which now consist of six contracts providing $939.1 million in limits in excess of a $100.0 million retention, instead of a single agreement providing one limit of $264.1 million in excess of a $20 million retention.

These six excess agreements include a two-year contract providing $264.1 million in limits, a three-year contract providing $264.1 million, one annual contract providing $264.1 million, and three annual contracts providing $160.0 million, $315.0 million, and $200.0 million.

Additionally, the Sanders Re 2020-2 Contract, which runs through to May 31, 2023, provides limits of $275 million in excess of a $100 million retention and in excess of ‘stated reinsurance’ and is 73% placed.