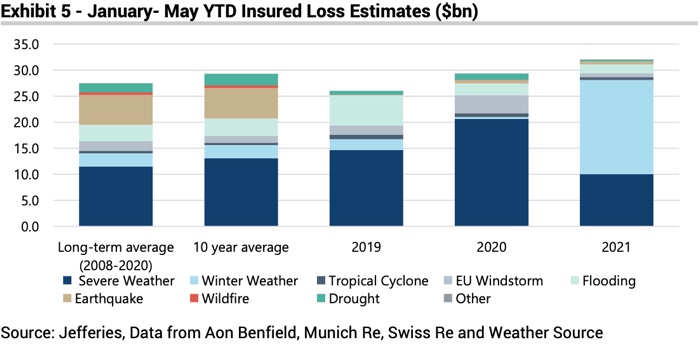

Year-to-date, catastrophe claims look to be running 17% above the long-term average (2008-2020), leading analysts at Jefferies to forecast another difficult year for the global insurance industry.

At more than $30 billion, YTD insured catastrophe losses also exceed the 10-year average by more than 9%, but is an improvement from Jefferies’ April report, which pegged YTD insured weather losses at >30% above the long-term average.

At more than $30 billion, YTD insured catastrophe losses also exceed the 10-year average by more than 9%, but is an improvement from Jefferies’ April report, which pegged YTD insured weather losses at >30% above the long-term average.

During May, says Jefferies, insured severe weather losses in the U.S. of an estimated $2.2 billion came in below average and is estimated to be less than the equivalent perils in May 2019 and 2020, serving to lower the YTD excess of claims in 2021 over the average.

Jefferies’ analysis finds that global insured cat losses in May 2021 were 54% below the long-term average, which, after the significant and costly impacts of the unprecedented U.S. winter storm in February, is a welcome change of pace.

At an estimated cost of $15.3 billion, the U.S. winter weather is the primary driver of cat claims exceeding the average YTD, says Jefferies.

This is followed by $9.6 billion of insured losses from U.S. severe weather; $2.3 billion of losses from winter weather in Europe; $800 million of European windstorm losses; $600 million of Japan earthquake losses; and $600 million of losses from flooding in Australia.

While losses are clearly running above average, as shown by the chart above, Q2 does appear more benign than Q1. As a result, analysts do not expect earnings expectations to deteriorate further ahead of the H1 2021 results.

Furthermore, many of the large catastrophe events that have occurred so far in 2021 have seen higher claims frequency and lower loss severity, meaning that most of these losses are expected to be retained by primary insurance carriers, with lesser impacts for reinsurers, say analysts.

Looking at the month of June, analysts note that as the monsoon season progresses in Asia, flood losses are to be expected. However, and as is often the case in the region, the cost for insurers and reinsurers is expected to be low given the low levels of insurance penetration.

While a relatively benign second-quarter will be welcomed by insurers and reinsurers on the back of a costly Q1, the analysis shows that YTD cat losses are still running above both the long-term and 10-year average.

Moreover, forecasters have predicted that the Atlantic hurricane season is going to produce above-average levels of activity, with the chance of landfalls also perceived to be higher this year.

After a challenging 2020, characterised by challenges on both sides of the balance sheet from the impacts of the ongoing COVID-19 pandemic, a costly start to the year and expectations for an active hurricane season, 2021 certainly has the potential to be another difficult year for the industry.