According to Aon’s Reinsurance Aggregate (ARA), the sector’s H1 combined ratio improved from 104.4% last year to 94.0% in 2021, despite natural catastrophe losses more than doubling this year.

Aon notes that the impact of COVID-19 losses was much reduced, revealing the underlying benefit of the compounded rate increases achieved over the last few years.

The result was that all companies except one achieved underwriting profitability on their total P&C business in the period.

This was despite natural catastrophe losses of $4.9 billion, which contributed 5.1 percentage points to the ARA combined ratio, with Winter Storm Uri constituting the largest single loss.

The ARA underwrites over 50% of the world’s life and non-life reinsurance premiums and is considered by Aon to be a reasonable proxy for the reinsurance sector as a whole.

The 22 companies included in the study are Alleghany, Arch, Argo, Aspen, AXIS, Beazley, Everest Re, Fairfax, Hannover Re, Hiscox, Lancashire, Mapfre, Markel, Munich Re, PartnerRe, QBE, Qatar Insurance, RenRe, SCOR, Swiss Re, SiriusPoint, and W.R. Berkley.

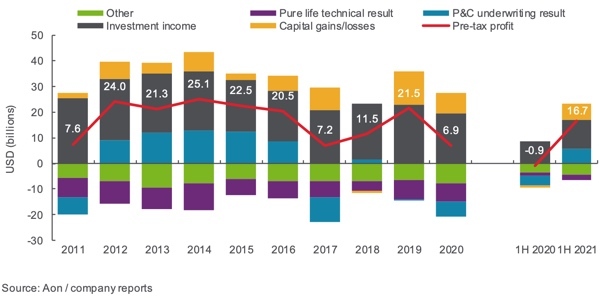

The ARA reported a pre-tax profit of $16.7 billion in the first half of 2021, compared with a pre-tax loss of $0.9 billion in the first half of 2020, which was heavily impacted by the onset of the pandemic).

This was driven by a P&C underwriting profit of $5.8 billion, investment income of $11.3 billion and capital gains of $6.3 billion, Aon reports.

The impact of COVID-19 on the ARA’s reported results diminished quite significantly in the first half of 2021.

On the P&C side, new incurred losses totalled $0.7 billion, contributing 0.7pp to the combined ratio, although companies writing significant volumes of life and health reinsurance business incurred additional losses of $2.0 billion from this area of their business, largely relating to excess mortality.

Aon also found that the development of prior year P&C reserves remains favourable overall, but the support to earnings from this source is much reduced. Across the ARA as a whole, releases stood at $1.2 billion in the first half of 2021, reducing the combined ratio by 1.2pp.

ARA cash and investments totalled $886 billion at 30 June 2021, unchanged relative to the end of 2020.