US specialty insurance group Assurant has expanded its 2019 property catastrophe reinsurance program, while reducing its per-event retention from $120 million in 2018 to $80 million.

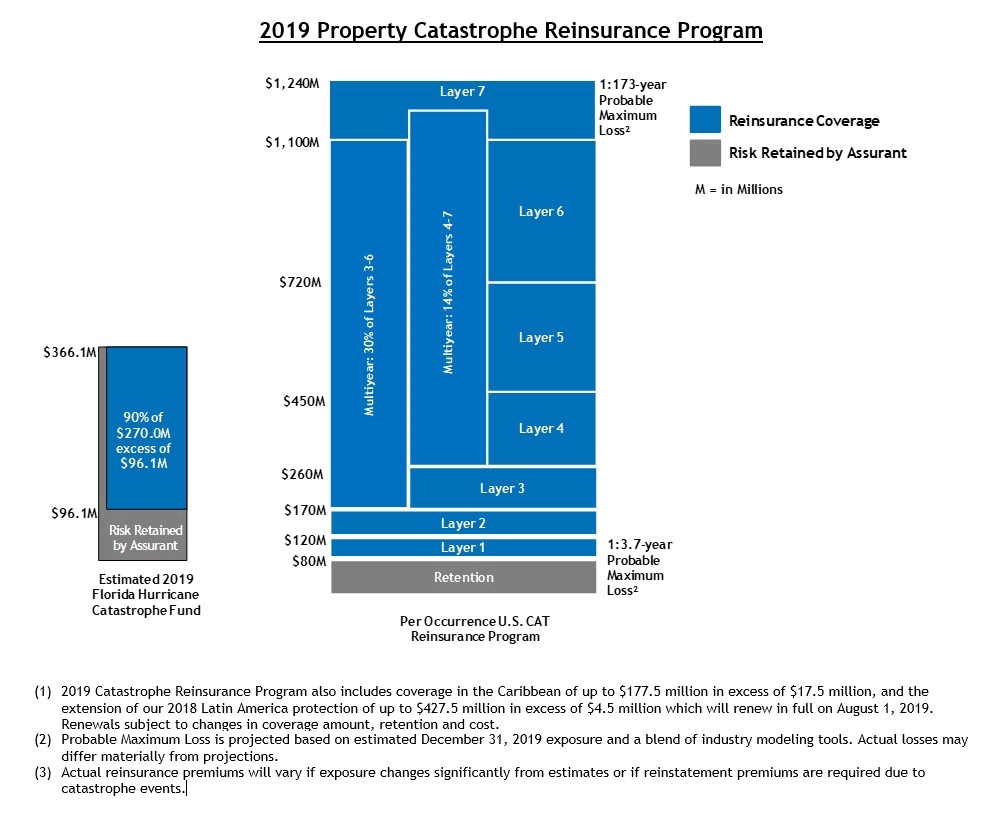

The U.S. Program provides $1.16 billion of coverage in excess of a $80 million retention per-event with a projected probable maximum loss (PML) of approximately a 1-in-173-year storm, based on projected modelled loss estimates.

Multiyear reinsurance contracts cover approximately 35% of reinsurance layers.

All layers of the program allow for one automatic reinstatement, except Layer 1 which has two reinstatements, and that provides multi-event protection in which higher coverage layers drop down to $120 million as the lower layers and reinstatement limit are exhausted.

2019 reinsurance premiums for this program are estimated to be approximately $165 million pre-tax and is said to reflect the significant decrease in catastrophe per-event retention and modest growth in exposure.

Assurant says coverage was placed with more than 45 reinsurers that are all rated A- or better by A.M. Best.

The 2019 Catastrophe Reinsurance Program also includes coverage in the Caribbean of up to $177.5 million in excess of $17.5 million, and the extension of Assurant’s 2018 Latin America protection of up to $427.5 million in excess of $4.5 million which will renew in full on August 1, 2019.

Probable Maximum Loss is projected based on estimated December 31, 2019 exposure and a blend of industry modeling tools. Actual losses may differ materially from projections.

Actual reinsurance premiums will vary if exposure changes significantly from estimates or if reinstatement premiums are required due to catastrophe events.

“We are pleased to complete our 2019 catastrophe reinsurance program, which this year includes a significant reduction of our per-event retention to $80 million, as we look to lower our catastrophe exposure and produce more predictable earnings and cash flow,” said Assurant President and Chief Executive Officer Alan Colberg.

“At Assurant, we manage risk to protect and support our policyholders when catastrophes occur. Going forward, we will continue to evaluate options to further reduce our catastrophe exposure,” Colberg added.