Robust capitalisation continued to underpin global reinsurers’ strength over 2017 despite a lower cushion, with top companies likely to regain their ‘AAA’ capitalisation rating if 2018 is an average catastrophe year, according to a new report by S&P Global Ratings.

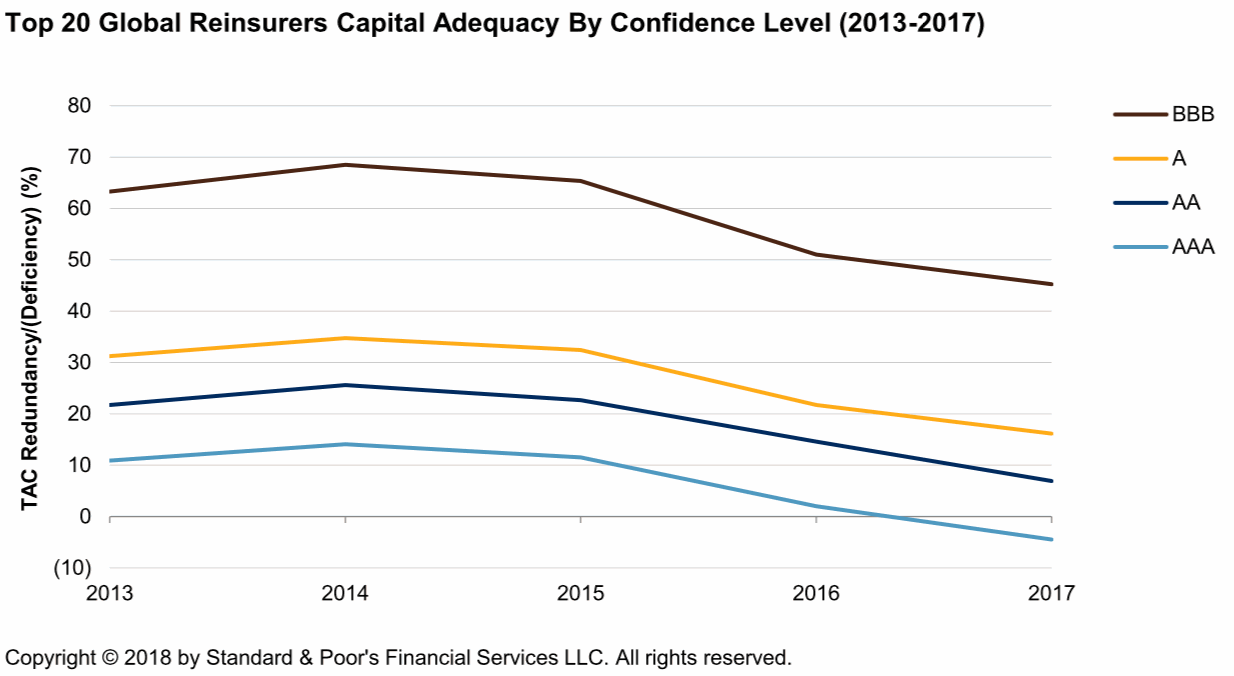

In 2017, the top 20 global reinsurers lost their capital redundancy at the ‘AAA’ confidence level for the first time since the 2008 financial crisis, but S&P reported that capital adequacy remained a strength in 2017, and was redundant by 7% at the ‘AA’ confidence level.

Combined with the industry’s increasingly sophisticated risk management practices, S&P says this favourable capitalisation underscores its stable outlook on the global reinsurance sector and on the majority of the reinsurers it rates.

Additionally, S&P suggested that if average annual property catastrophe losses total $11 billion or less for the top 20 reinsurers this year, it is likely that this group of companies could reclaim their former capital adequacy.

“If 2018 ends up being an average catastrophe year, it is not implausible to assume that the top-20 global reinsurers could regain their ‘AAA’ capitalization,” said S&P Global Ratings Credit Analyst Taoufik Gharib.

However, the rating agency added that the sector needs to preserve and solidify its capital strength to prepare for any unexpected rises in inflation, inadequate reinsurance pricing, unfavourable reserve developments, major market correction, and unforeseen ‘black swan’ events.

The report also observed that the top 20 global reinsurers have actively sought better premium rates and less volatility over the past five years as they have gradually shifted their underwriting appetite to primary and proportional reinsurance business.

It found that liability risks continue to dominate the group’s capital consumption, while catastrophe losses in 2017 weighed on reserve risk and investment risk remained fairly stable.

The group’s 7% redundancy at the ‘AA’ confidence level in 2017 compares with 15% in 2016 and 23% in 2015, while the 5% deficiency at the ‘AAA’ confidence level in 2017 compares with redundancies of 2% in 2016 and 12% in 2015.

S&P noted that the property-catastrophe/short-tail specialists subgroup was the only one that continued to benefit from a 14% redundancy at the ‘AAA’ confidence level in 2017, despite the capital impact of 2017’s catastrophe events on most reinsurers in this cohort.