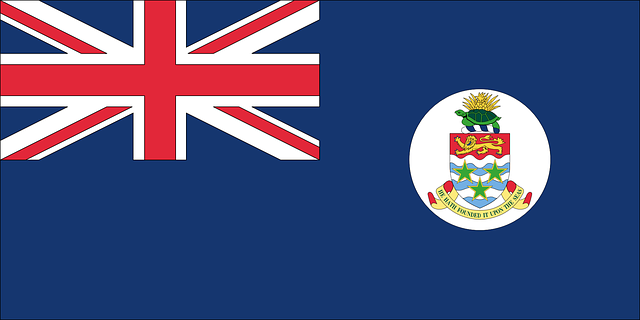

International law firm Conyers has said that it is expecting the status of the Cayman Islands on the European Union’s tax blacklist to be temporary, with the jurisdiction already looking to begin the removal process.

The EU confirmed today that the Cayman Islands had been added to its list of non-cooperative jurisdictions due to a technical breach relating to the regulation of collective investment vehicles (CIVs).

The EU confirmed today that the Cayman Islands had been added to its list of non-cooperative jurisdictions due to a technical breach relating to the regulation of collective investment vehicles (CIVs).

The Cayman Islands Government has stated that these concerns over CIVs were addressed in a recent law, which was passed on January 31, 2020 and enacted on February 7, but the EU has said that the jurisdiction “did not deliver on their commitment on time.”

Officials have now been contacted to begin the process of removing the jurisdiction from the blacklist at the earliest possible time, which is currently understood to be October 2020.

The Cayman Islands maintains that it has cooperated with the EU to enhance its good tax governance over the past two years, and says it has adopted more than 15 legislative changes.

Premier McLaughlin has said the jurisdiction “remains fully committed to cooperating with the EU, and will continue to constructively engage with them with the view to be delisted as soon as possible.”

Some commentators have suggested that the blacklisting of the Cayman Islands just weeks after Brexit is no coincidence, and is indicative of the UK’s loss of influence regarding EU scrutiny of its overseas territories.

As a re/insurance industry hub, the blacklisting of the Cayman Islands could be a concern for companies with operations in the territory, although it is unclear whether any concrete sanctions will be imposed by the EU.

Blacklisted jurisdictions could potentially incur a set of countermeasures from EU member states, including increased monitoring and audits, withholding taxes, special documentation requirements and anti-abuse provisions.

However, Conyers does not believe there is a risk of any targeted or direct sanctions for the Cayman Islands at this time, and says that the jurisdiction’s inclusion on the list will likely have limited potential impacts for the time being.

Bermuda – also a British territory and industry hub – found its way onto the EU tax blacklist last year, but was later removed after taking steps to comply with the requirements of the listing process.

Earlier today, the EU confirmed that Bermuda had been returned to its ‘white list’ of fully cooperative tax jurisdictions, after working to implement further positive steps.

The EU agreed to begin compiling its list of non-cooperative jurisdictions in December 2017 to prevent tax avoidance and promote good governance principles such as tax transparency, fair taxation or international standards against tax base erosion and profit shifting.