Cyber insurance rates and prices in the United States declined for the second consecutive quarter in Q2 2017, as the increasing availability of capacity targeting cyber liability underwriting influences the market.

According to the latest quarterly look at global insurance rates by broker Marsh, the cyber risk underwriting segment has just witnessed its first consecutive months of rate decline in Q1 and Q2 of 2017 since 2012, following a period where prices rose consistently for a couple of years.

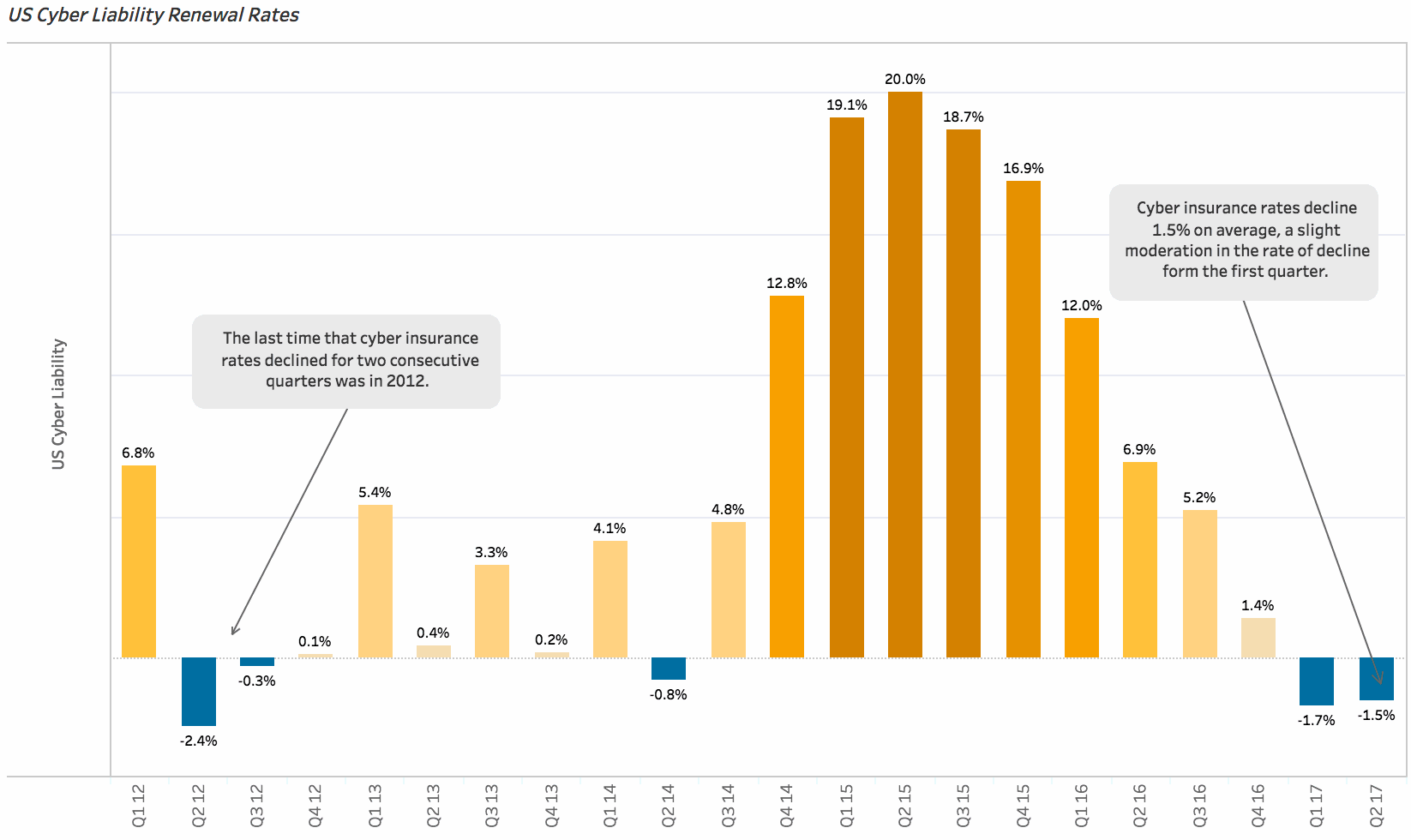

U.S. cyber liability renewal rates – Source: Marsh

Cyber liability renewal rates in the U.S. declined by 1.5% in Q2 2017, following a 1.7% decline in Q1.

The reason for the decline, after such a strong period of price increases, is the increasing attraction to cyber risks shown by many global insurance and reinsurance players.

The appetite to underwrite what is seen as a new and growing class of risk has resulted in an inflow of available capacity, while the opportunities to underwrite cyber risks are not growing as quickly as the segment would like to see.

This has resulted in a capacity overhang, with more available than is required at typical renewals, resulting in pressure on rates and pricing and inevitable declines beginning.

As well as the expansion of capacity available for cyber underwriting from re/insurers that have been in the sector for a while, there is also a growing pool of capacity from re/insurers new to cyber risks but wanting to branch out into the class.

It remains to be seen whether this attention to cyber risks will potentially be detrimental in future, as the limited underwriting opportunities mean that prices are declining perhaps more than would be advisable. This could result in higher combined ratios for cyber underwriters, which in the long-run could alleviate some of the pricing pressure.

As cyber risk underwriting expands outside of pure liability and into property, infrastructure and other related classes, it will provide further opportunities for underwriters and so soak up some of the capacity targeting the class of business. This too, in time, could help to alleviate pricing pressure.