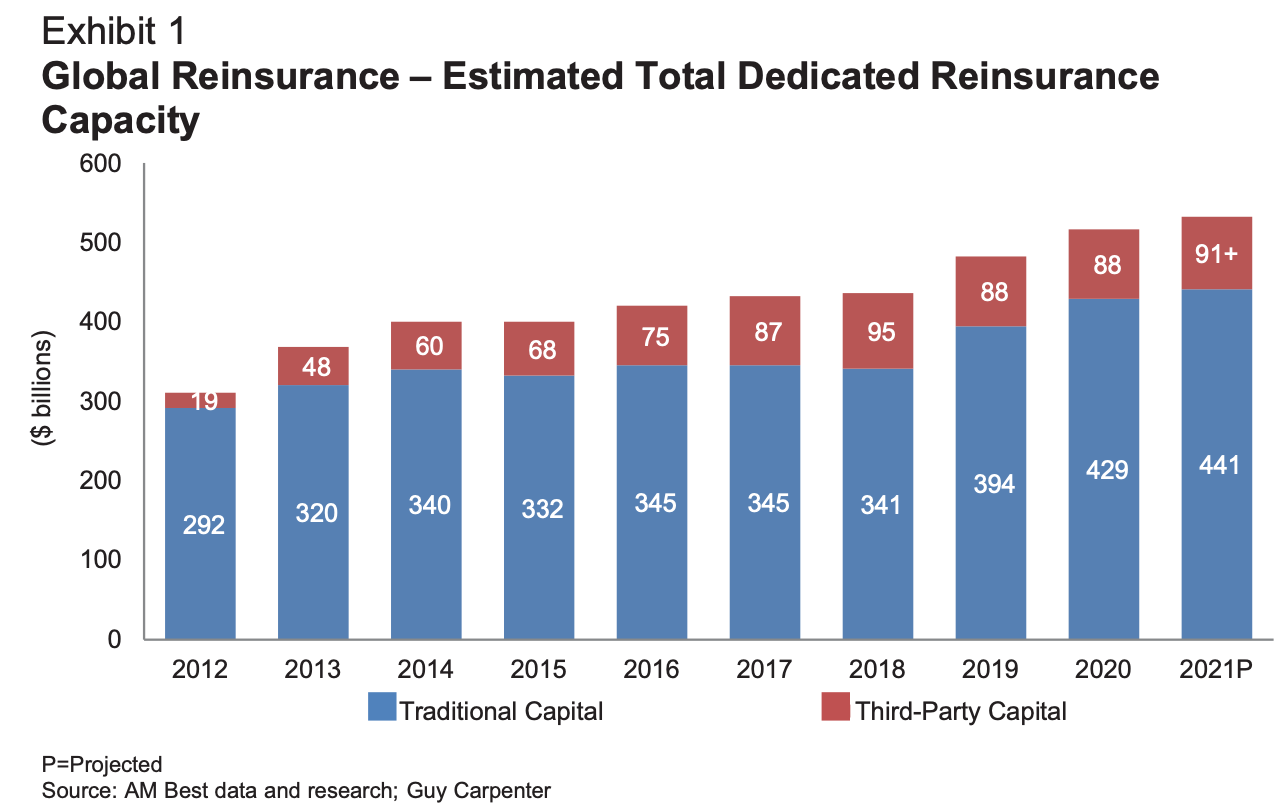

New projections from AM Best estimate that dedicated global reinsurance capacity could be at a level of around $532 billion in 2021, representing a 3% increase over the year-end 2020 figure of $517 billion.

This estimate accounts for a $2 billion increase in traditional reinsurance capacity, which the rating agency puts at $441 billion, and a $3 billion increase in third-party capital, which is recorded at $91+ billion.

The year-end 2020 figure was itself $35 billion, or 7%, higher than the year-end 2019 figure of $482 billion, AM Best’s data shows.

The rating agency wholly attributed the increase between 2019 and 2020 to a rise in traditional reinsurance capital, which grew from $394 billion at year-end 2019 to $429 billion by the end of last year.

Analysts noted that the onset of the COVID-19 pandemic brought significant volatility to the reinsurance segment in the first half of 2020, due mainly to equity market fluctuations and conservative initial incurred but not reported (IBNR) margins for COVID losses.

However, as 2020 progressed and countries implemented stimulus and economic relief programs, the equity markets rebounded and interest rates decreased.

This was particularly notable for the top 10 reinsurers, who saw a 9% increase in fixed-income market values as well as a 19% increase in equity market values. These increases and other factors resulted in the growth in available capital of roughly 12% for the top 10.

But while the influx of new capital into the reinsurance segment was widely publicized, AM Best reports that the overall impact of these new ventures was relatively restrained given the lag required to deploy the capital, along with relatively more attractive opportunities on the primary side.

The overall increase in dedicated reinsurance capacity is also noteworthy given the loss-affected operating results across the industry, although the result was in many cases driven heavily by investment market performance.

“The increased risk and associated required capital for traditional reinsurers continues to drive capital utilization levels up,” AM Best stated. “Although the largest reinsurers continue to find ways to expand the overall capital base with diversification strategies and access to cheap debt financing, hardening market conditions continue to stress overall risk-adjusted capitalization levels.”

“This is consistent with AM Best’s view that the segment is in the early stages of a hard market cycle,” the rating agency continued. “As pricing conditions continue to improve and underwriting results become more favorable, we expect the required capital burden to diminish and capital utilization levels to begin to fall.”

AM Best’s estimate for available capital in 2021 includes a 3% increase in traditional reinsurance capital, to $441 billion, driven primarily by anticipated improvements in underlying performance by many companies in 2020, which is expected to continue during 2021.

This is a result of the ongoing rate increases in both primary and reinsurance lines since last year.

Although these pricing developments are a direct response to continued heightened catastrophic activity, coupled with adverse loss cost trends in casualty lines, the net effect is favorable and more stable underwriting results, a trend that AM Best expects will continue at least for the next couple of years.