Insurance and reinsurance broker Marsh’s latest Global Insurance Market Index, reveals that global commercial insurance rates increased, on average, for the third consecutive quarter in the second-quarter of 2018, with property and financial and professional (FinPro) lines driving increases, once again.

Marsh notes that overall, the global insurance market remained stable during the second-quarter of 2018, underlined by narrow price changes across most business lines and in most territories.

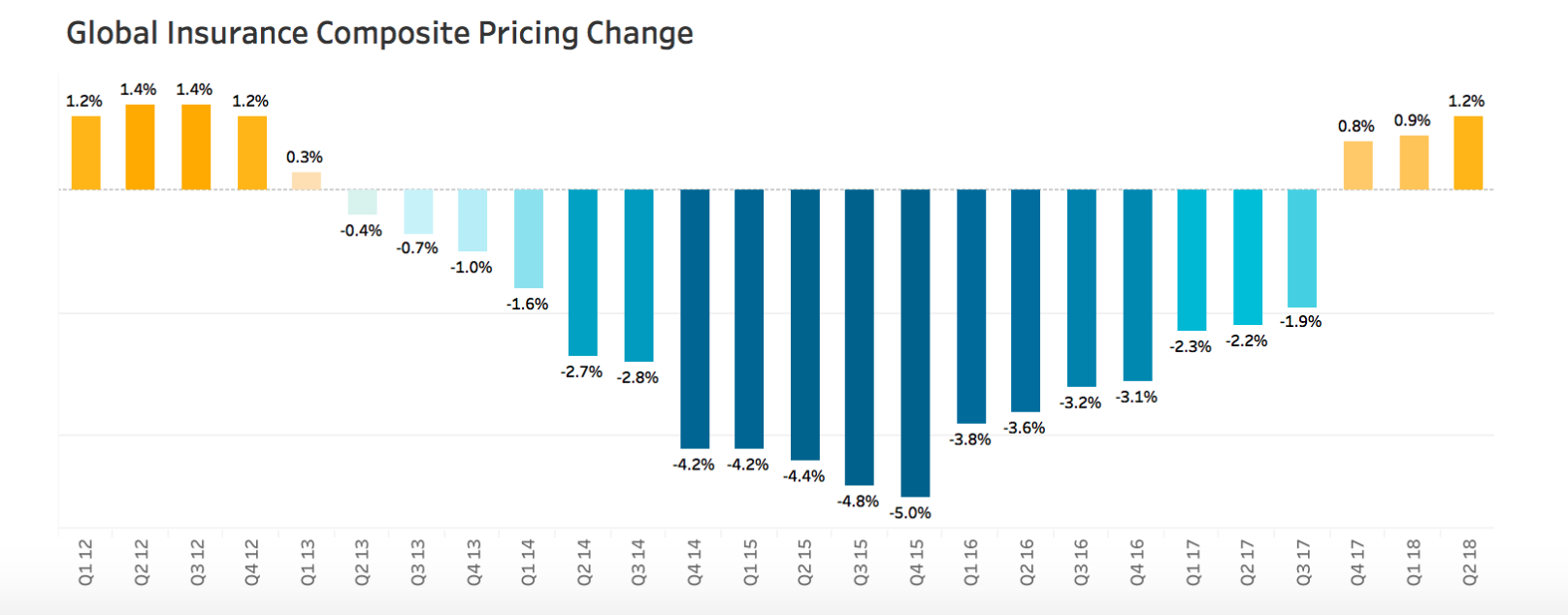

The overall, average rate increases witnessed in the second-quarter follows a similar trend to that seen in Q1, which saw average rate increases across the global commercial insurance market of 0.9%, after an average increase of 0.8% in the fourth-quarter of 2017.

Marsh announced in Q1 that price increases in property and FinPro lines drove much of the overall, average rate increase during the period, and the broker has revealed that this was also the case in Q2.

Overall, global commercial insurance rates increased by an average of 1.2% in the second-quarter, meaning that rate increases have continued to accelerate, on average, since the fourth-quarter of 2017, and on the back of more than four years of consecutive quarterly declines, as shown by the chart below, provided by Marsh.

By business line, and according to Marsh’s latest Global Insurance Market Index, FinPro lines pricing continued to accelerate in Q2, increasing by an average of 3.3%. In fact, this actually outpaced the 3.2% average rise in property pricing witnessed during the period, explains Marsh.

By business line, and according to Marsh’s latest Global Insurance Market Index, FinPro lines pricing continued to accelerate in Q2, increasing by an average of 3.3%. In fact, this actually outpaced the 3.2% average rise in property pricing witnessed during the period, explains Marsh.

Global casualty lines continued to struggle in the second-quarter, however, with pricing actually decreasing, on average, by 1.4%, which Marsh notes as an ongoing trend.

Taking a closer look at global property lines, the devastation caused by 2017 catastrophe events is clearly still having an impact on pricing, with carriers reacting to more claims notices and indemnity costs.

Despite property lines increasing by an average of 2.3%, this is a deceleration from the previous two quarters, which saw average rate increases of 2.7% and 3.2%, respectively.

Dean Klisura, President, Global Placements and Specialties at Marsh, commented: “The global property insurance market continues to be impacted by last year’s losses, and we are now seeing increases in financial and professional lines pricing in several regions. However, overall pricing is generally stable across all lines of business and market capacity remains strong.”

By region, insurance prices in the U.S. remained flat, overall, in the second-quarter of 2018. Property rates were up by an average of 3%, which was driven largely by cat-exposed risks and large layered programmes.

The increase in property, coupled with modest increases in FinPro lines and increases across D&O, employment practice liability and fiduciary liability, were offset by continued declines in casualty lines, in the U.S., explains Marsh.

In the UK, average insurance prices increased by 0.8% in Q2, driven by an average 5% increase in FinPro lines as a result of D&O and professional indemnity. Both property lines and casualty lines in the UK declined, on average, in the second-quarter.

Continental Europe saw overall, average insurance rates decline during the second-quarter of 2018, by 1.5%. While Latin America insurance pricing moderated to below the global average, during the period, and pricing in Asia also declined, albeit at a slower pace than that seen over the last three years.

Australia witnessed the steepest price increases, on average, during the second-quarter of 2018, explains Marsh, with rates increasing by 13%. According to Marsh, pricing increases were observed across all major product lines in the region.

Global, commercial insurance rates continue to increase, on average, following the impacts of 2017 catastrophe events and changing market conditions. With competition still intense across the insurance and reinsurance sector, it will be interesting to see how insurance prices react over the remainder of the year and into 2019, especially if losses pickup in the final months of the year.