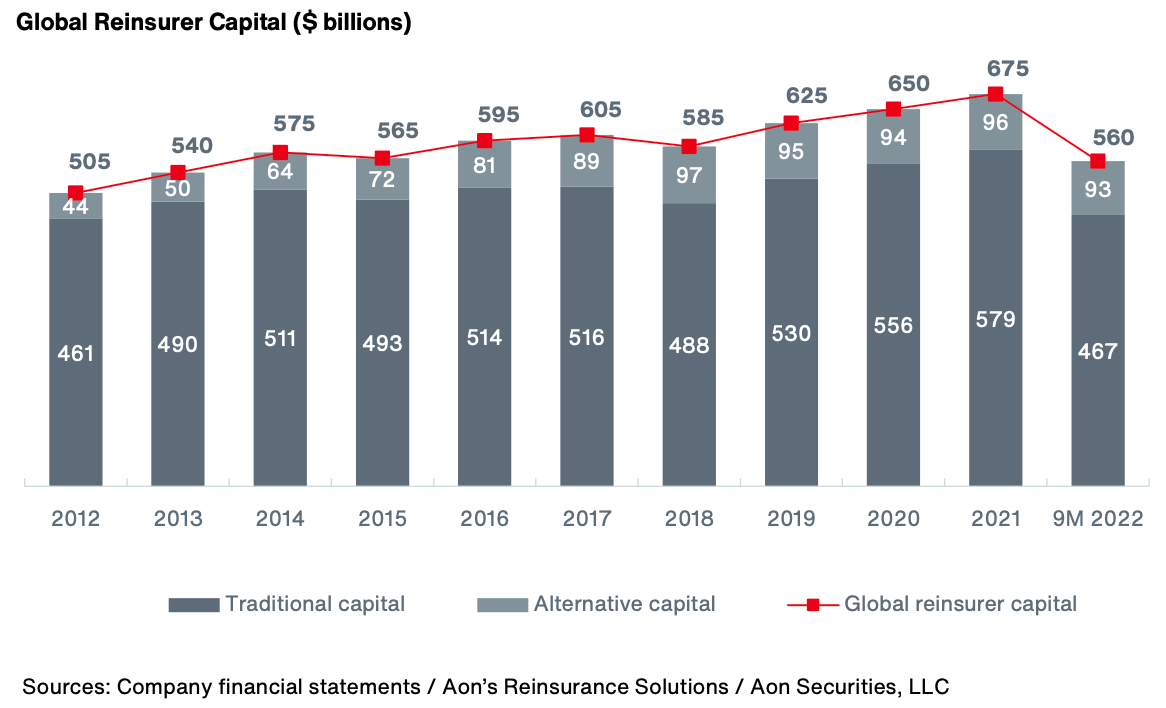

New data from insurance and reinsurance broker, Aon, finds that global reinsurance capital fell by 17%, or $115 billion, to $560 billion in the first nine months of 2022, as some of the world’s largest re/insurance groups reported some significant declines in the period.

According to Aon’s January 1st, 2023, Reinsurance Market Dynamics report, the reduction was principally a result of substantial unrealised losses in investment portfolios.

The $560 billion of dedicated reinsurance capital seen by Aon as of the end of September, 2022, is comprised of $467 billion of traditional capital, and $93 billion of alternative reinsurance capital.

When compared with the end of 2021, traditional capital fell by more than 19%, or $112 billion, while alternative capital fell by a little more than 3%, or $3 billion.

It’s also interesting to see the change in reinsurance capital from the mid-point of 2022 to the end of September, so during the third quarter of the year.

Aon reported previously that overall, global reinsurance capital stood at $600 billion as of the end of June 2022, which means the 9M 2022 total of $560 billion reflects a decline of $40 billion, or almost 7% in just three months.

From H1 2022 to 9M 2022, traditional capital fell by over 7% to the $467 billion reported by Aon today, while alternative capital declined by 2%, or $2 billion to the $93 billion reported by the broker in its January renewals report.

“Underwriting results were generally resilient in the period, despite the impact of Hurricane Ian, but investment portfolios were impacted by material unrealized losses, driven by rising bond yields, widening credit spreads and declining equity markets,” says Aon. “These effects undermined overall earnings and eroded reported book values.”

The broker also highlights the fact reinsurer management teams noted a mismatch in the major accounting regimes that were driving volatility in reported equity.

“Mark-to-market losses are being immediately recognized on the asset side, while there is little to no offset on the liability side to reflect the long-term benefits of higher interest rates. In addition, bonds are generally held to maturity and recover value as that date approaches,” explains Aon.