Australian insurer IAG has fallen to a half-year loss of $460 million despite recovering $90 million of catastrophe costs under its aggregate reinsurance cover.

The company’s loss over the H1 2021 period compares with a return of $283 million for the same period in the previous year.

The company’s loss over the H1 2021 period compares with a return of $283 million for the same period in the previous year.

However, IAG’s insurance profit actually improved over this time by 33.1% to $667 million, helped by 3.8% growth in gross written premium, which was driven by rate improvements.

Instead, results were weighed down by the previously reported $865 million impact of pandemic-related business interruption claims, which led IAG to complete a $650 institutional placement in November.

“We have seen a strong under lying performance across our businesses over the last six months and we will build on this performance as we sharpen our focus to deliver a stronger, more resilient IAG,” said Nick Hawkins, IAG Managing Director and Chief Executive Officer.

“Growth was predominantly driven by rate increases in our commercial and home insurance businesses in Australia and across all key classes in New Zealand. It was also underpinned by some customer growth in New Zealand’s direct brands and high retention rates in our commercial portfolios in Australia,” Hawkins explained.

“We are acting decisively to address the issues facing our business. We are working with the broader insurance industry to get clarity on how our business interruption policies should be interpreted in the context of COVID-19, and we continue to make progress on our customer remediation program.”

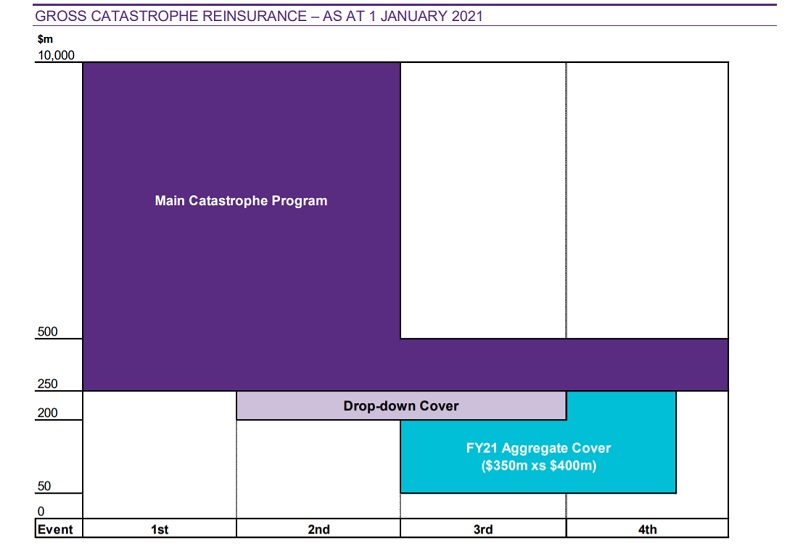

Last month, IAG reported on the catastrophe reinsurance coverage that it had secured at the January 2021 renewals, which included maintaining its gross protection cover at up to $10 billion, with IAG retaining the first $250 million of each loss.

Both the level of gross protection and retention of each loss are the same as the insurer’s 2020 catastrophe reinsurance program.

The program also includes second and third event drop-down covers of $50 million, reducing the cost of these events to $200 million, and three prepaid reinstatements secured for the lower layer of the main program.

After allowance for the cumulative quota share arrangements in place, the combination of all catastrophe covers resulted in IAG having maximum event retentions (MERs) at 1 January 2021 of $169 million, $135 million and $34 million respectively for a first, second and subsequent event.

IAG also has stop-loss protection for retained natural perils which provides protection of $100 million in excess of $1.1 billion for the 12 months to 30 June 2021. The attachment point compares to the FY21 natural perils allowance of $975 million.

And the company has a quota share agreement with Munich Re in respect of 30% of its combined CTP book which covers all CTP written in NSW, the ACT and South Australia. The CTP quota share runs in conjunction with the whole-of-account agreements, meaning 62.5% of IAG’s CTP book is currently subject to quota share