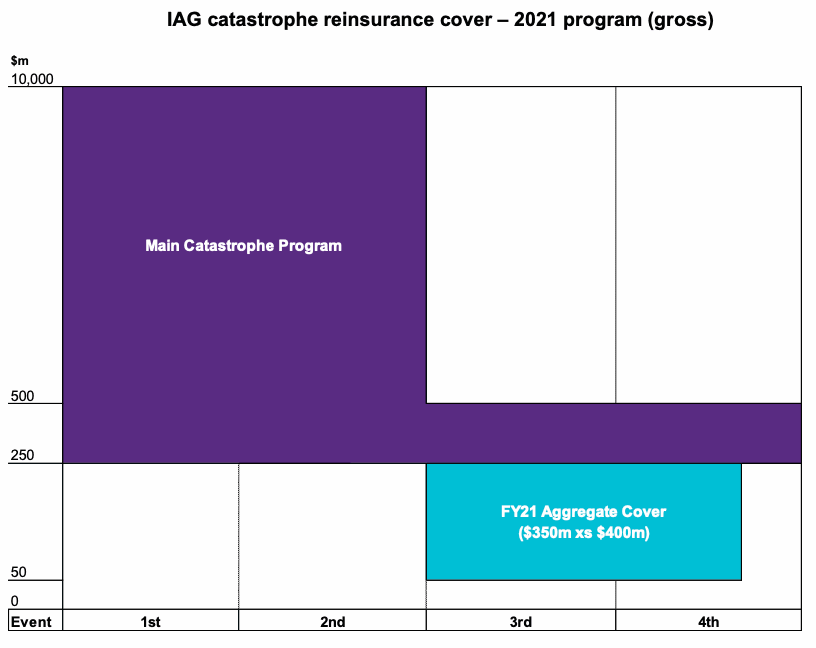

Australian insurer IAG has completed its 2021 catastrophe reinsurance program, maintaining its gross protection cover at up to $10 billion, with IAG retaining the first $250 million of each loss.

Both the level of gross protection and retention of each loss are the same as the insurer’s 2020 catastrophe reinsurance program.

IAG states that the 2021 program has been placed to the extent of 67.5% to reflect the firm’s cumulative whole-of-account quota share arrangements.

Before consideration of quota share impacts, the main features of the renewal include a main cover of up to $10 billion (including one prepaid reinstatement); the aforementioned $250 million retention; three prepaid reinstatements secured for the lower layer ($250mn excess of $250mn) of the main program; and an aggregate sideways cover for the 12-month period ended June 30th, 2021.

As previously disclosed, this aggregate layer provides $350 million of gross protection in excess of $400 million ($236 million in excess of $270 million post-quota share). With effect from January 1st, 2021, qualifying events are capped at $200 million excess of $50 million per event.

Throughout 2020 and into the 1/1 renewals, the reinsurance market continued to firm on the back of a prolonged soft market state, characterised by elevated catastrophe losses and fading investment returns on the back of the lower for longer interest rate environment.

As a result of the firming, IAG notes that it experienced a modest increase in reinsurance rates during its renewal process, with the overall cost of the program in line with expectations.

“Around 65% of the gross main catastrophe program for calendar 2021 is protected by multi-year coverage, providing certainty of future reinsurance cover. The overall credit quality of the 2021 program is strong, with approximately 90% continuing to be placed with entities rated A+ or higher,” explains the insurer.

So, after the allowance for quota share arrangements, the combination of all catastrophe covers at 1/1 results in IAG having first event maximum retention of $169 million for Australia (NZ$169mn for New Zealand); second event maximum retention of $169 million for Australia (NZ$169mn for New Zealand); and a third event maximum retention of $34 million for Australia (NZ$34mn for New Zealand).

Additionally, IAG also has stop-loss protection for retained natural perils which continues to align with the financial year. This part of its overall program provides protection of $100 million in excess of $1.1 billion ($68 million in excess of $743 million post-quota share) for the 12-months ended June 30th, 2021. For this stop-loss cover, the attachment point compares to the FY21 natural perils allowance of $975 million ($658 million post-quota share).

As well as providing details of its catastrophe reinsurance renewal, IAG has revealed that it will include the $1.15 billion pre-tax earnings impact from the provision for business interruption claims announced in November 2020 as part of net corporate expenses.