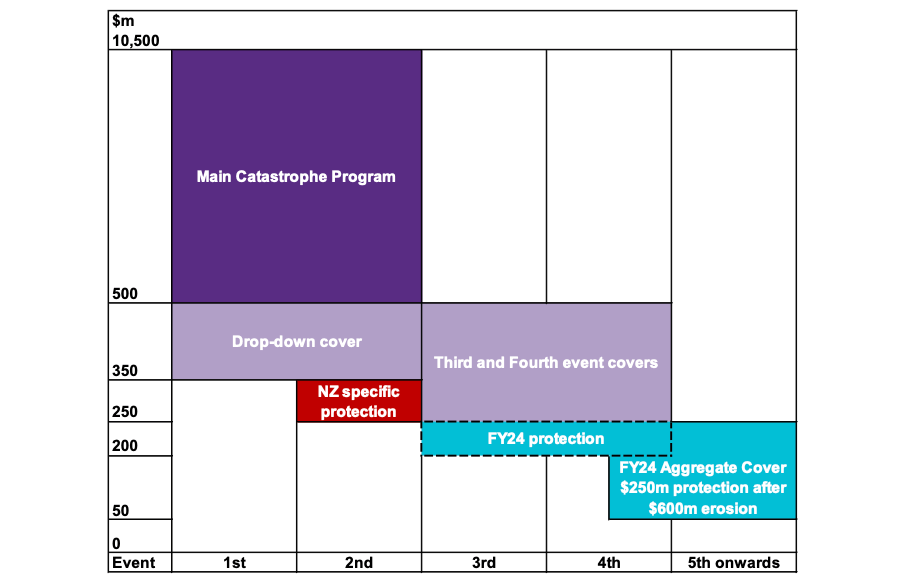

Australian insurer IAG has placed its catastrophe reinsurance program for 2024, purchasing more protection than originally expected with the main cover for two events rising by $500 million to $10.5 billion, with an unchanged attachment point of $500 million.

The 2024 calendar year reinsurance program is placed to 67.5% to reflect the insurer’s cumulative whole of account quota share (WAQS) arrangements.

The main change, year-on-year, to the firm’s catastrophe reinsurance program is that the top of tower has risen to $10.5 billion for 2024 from $10 billion in 2023.

The attachment point remains the same at $500 million and, IAG has also maintained its $150 million drop-down cover which brings its retention on the first two events down to $236 million, which is 67.5% of $350 million, again with an additional premium payable if the drop-down cover is utilised on a first event.

Third and fourth event covers of $250 million excess of $250 million is also unchanged for the 2024 program.

The insurer’s reinsurance coverage also includes additional pre-quota share third and fourth event protection of $150 million for events greater than $200 million, and aggregate cover, which has come down year-on-year, of $250 million excess of $600 million with qualifying events capped at $200 million excess of $50 million per event.

Another change to the 2024 program is the addition of further drop-down cover for a New Zealand specific second event of $100 million excess of $250 million.

Commenting on the firm’s catastrophe reinsurance renewal, IAG Chief Financial Officer, William McDonnell, noted the stabilisation of global reinsurance markets in 2023, which enabled the firm to purchase more reinsurance than it originally expected.

“The cost of the overall program is broadly consistent with our expectation and our guidance of a FY24 reported insurance margin of 13.5% to 15.5%,” said McDonnell.

After allowing for all of its reinsurance, IAG has a maximum event retention of $236 million as at January 1st, 2024.

Given the recent weather events in Australia, IAG has also confirmed that it has so far received roughly 17,000 claims from events that impacted the region in December. The majority, around 9,000 claims relate to severe storms that occurred around Christmas Day, with around 500 claims resulting from ex-Tropical Cyclone Jasper.

In December 2023, the company’s maximum event retention was $169 million, and while the ultimate cost of December natural peril claims is being determined, currently, IAG says that its natural perils costs are tracking below its natural perils allowance.

“The weather events that impacted communities across the holiday period were devastating and our thoughts are with those who lost loved ones during this difficult time. Our property assessors and partner builders are on the ground in affected areas supporting customers with emergency assessments and make-safe repairs. The safety of communities and our customers is our top priority,” said Managing Director and CEO, Nick Hawkins.