Insurers in Australia have now received more than 135,000 claims related to the severe flooding in Southeast Queensland and New South Wales, taking the insurance and reinsurance industry loss estimate above the $2 billion mark.

The latest figures from the Insurance Council of Australia (ICA) show an increase in total claims of 7.3% on Friday’s total, with claims in New South Wales rising by almost 12% over the weekend.

Based on previous flood events, the ICA pegs the total cost of all claims at $2.035 billion, compared with a bill of $1.89 billion on Friday March 11th.

Early estimates suggested that this event, which commenced in February 2022, could result in an insurance industry loss of more $2 billion, and it’s expected that claims will rise further in the coming days.

Furthermore, analysts have warned that reinsurers are likely to assume the majority of the losses from this flood event, with many insurers already highlighting their maximum retentions and others saying they expect to make recoveries.

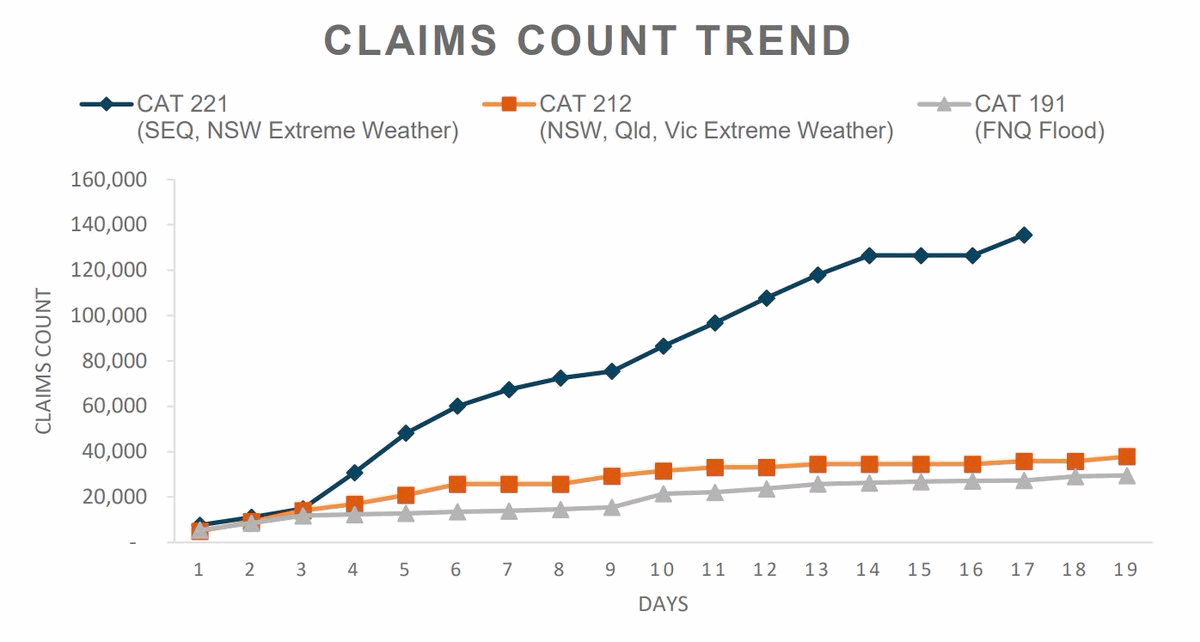

The chart below, provided by the ICA, compares the current flood disaster versus last March 2021 which was ultimately seen as a roughly $751 million event by PERILS, and another comparable cat event in the far north Queensland area, which was a roughly $1.2 billion insurance industry loss.

In light of the floods, some MP’s in the country are calling for the expansion of the cyclone reinsurance scheme to cover fires and floods.

The scheme, which is backed by a $10 billion government guarantee, looks to protect more than 500,000 properties in the path of cyclones and cyclone-related flooding in the country’s north.