Insurance technology funding in the third-quarter of 2018 was driven by the needs of so-called “unicorns”, typically defined as insurtech start-ups valued at over $1 billion, as these high-growth tech companies need capital to drive growth.

Start-ups that achieve unicorn status tend to need large amounts of capital to help them deliver on promises made to investors in earlier funding rounds.

Product development needs capital investment, especially when it involves significant technical expertise in delivering artificial intelligence and machine learning, as too does marketing to drive customer acquisition and retention, as well as customer satisfaction.

With many of the insurtech unicorns looking to deliver game-changing approaches to building policyholder relationships, delivering insurance and providing risk transfer, the amount of funding these start-ups are raising is increasing significantly.

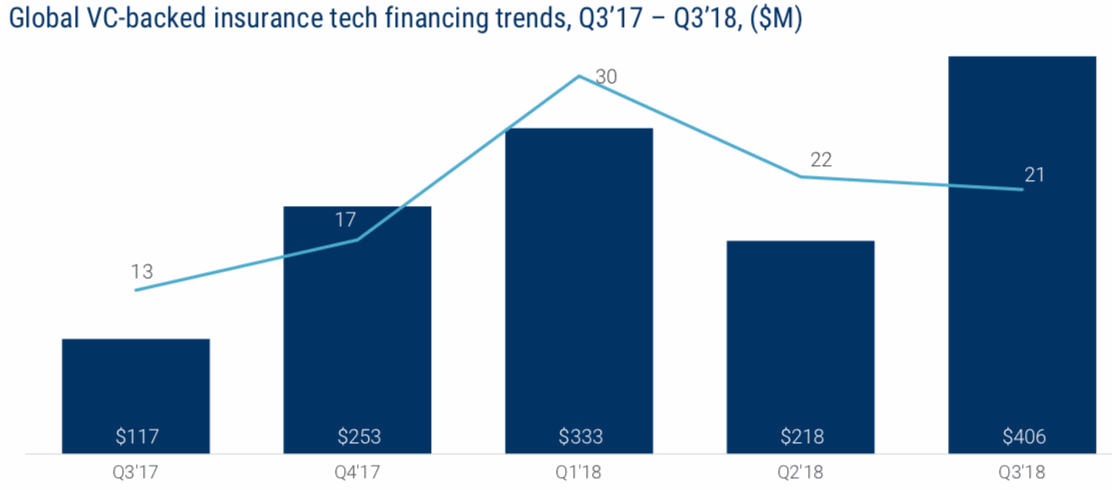

CB Insights highlighted this trend in its latest quarterly Global Fintech Report for Q3 2018.

The company noted that insurtech funding volume in Q3 was boosted by the provision of mega-funding rounds to insurtech unicorns during the period.

What this means is the average size of venture funding round for insurtechs was considerably higher during the quarter, as despite their only being one less deal struck in the quarter, the amount of funding raised by insurtechs was not far off double the previous quarter.

Leading the way with its funding round in the third-quarter of 2018 was the deal that saw Google’s parent Alphabet investing $375 million in heath insurtech start-up Oscar Health.

Oscar has also arranged an all-important multi-year quota share reinsurance arrangement with AXA’s International Employee Benefits Division in 2018.

Other big funding rounds seen in Q3 were a $90 million round for Series E funding round for Metromile Inc. (which was led by Tokio Marine Holdings and Intact Financial), as well as a $100 million round for insurtech Root.

We’re likely to see this trend, of larger funding rounds, continue as insurtech start-ups begin to gain some scale and look to drive their product development roadmaps further and faster, in order to satisfy their appetites for growth.

At the same time insurtech start-ups are going to require funding to drive customer acquisition as well, given this is how they need to demonstrate the viability of their business models, following on from which insurtechs are likely to need to double-down on their customer support activities as well.

The one thing that funding will likely not assist with is the unsustainable loss ratios that some insurtechs are dealing with today.