Reinsurance News

Reinsurance interviews

A series of interviews with prominent reinsurance industry executives, discussing the state of the global reinsurance market, opportunities for growth in reinsurance, disruptive factors and the influence of technology on risk transfer and reinsurance.

We share the same DNA with our new shareholders: CCR Re’s Montador

21st September 2023

French reinsurance company CCR Re was acquired by a consortium comprised of SMABTP and MACSF earlier this year, a deal which is positive for all parties and a good fit for the reinsurer, according to Deputy Chief Executive Officer (CEO), Laurent Montador. The two French mutual insurers, SMABTP, which specialises in ... Read the full article

Reinsurance rate changes ‘only one side of the coin,’ says Mirek Wieczorek, ICW Group

20th September 2023

In the ever-changing landscape of the re/insurance industry, the focus on rate increases has been intense in recent times, but according to Mirek Wieczorek, Head of Reinsurance at ICW Group Insurance Companies, there's more to the story than just rising rates. "It's only one side of the coin," Wieczorek states in ... Read the full article

Current market environment is positive for Brit’s growth aspirations: Jon Sullivan

19th September 2023

According to Brit Group Deputy Chief Underwriting Officer, Jon Sullivan, the current market environment is a positive for Brit’s growth aspirations particularly on the short tail lines. At the 2023 RVS Monte Carlo event, Reinsurance News spoke with Sullivan about the opportunities he sees for Brit within the current market environment. He ... Read the full article

Retentions will be key and we’re well positioned, says AM Re & ASIC CEO

15th September 2023

Going into 2024 - and with the hard market expected to remain - retentions are going to be vital, particularly in the programme space, according to Shevawn Barder, Chief Executive Officer (CEO) and Principal of AM RE and AM Specialty Insurance Company (ASIC). Speaking with Reinsurance News at the RVS 2023 ... Read the full article

CCR Re sees many opportunities to grow, says Deputy CEO Montador

15th September 2023

French reinsurer CCR Re is optimistic about the future following continued development and is confident of profitable growth, supported by its new ownership and capital injection, according to Deputy Chief Executive Officer (CEO), Laurent Montador. In an interview with Reinsurance News at the annual meeting of the reinsurance industry in Monte ... Read the full article

Most repricing completed, focus now on maintaining discipline ahead Jan renewals: UIB CEO

14th September 2023

The hard market is not necessarily over, but most of the work of repricing has been done and the market is talking more about maintaining discipline, Shaun Barrington, CEO of UIB UK, commented speaking with Reinsurance News at the RVS 2023 Monte Carlo event. He said: “I believe that the renewal ... Read the full article

Attention has switched to the client ahead of Jan renewals: Spenner, Gallagher Re

14th September 2023

After a challenging renewal at the start of this year, the attention has swung back to the client ahead of 1.1, although reinsurers will maintain underwriting discipline and safeguard more favourable terms and conditions, according to Dirk Spenner, Managing Director EMEA, Gallagher Re. Reinsurance News met with Spenner at the annual ... Read the full article

Impacts of climate change continuing to be felt around the world: PwC’s Jim Bichard

13th September 2023

With climate change topping the list once again for PwC's “Reinsurance Banana Skins" report, "it does not seem surprising" due to it being so dominant for all the major events that the industry has seen over the last 12 months, states Jim Bichard, Partner and Read the full article

NewRe has a strategy for P&C & profit over the next year: CEO Thomas Braune

13th September 2023

At the 2023 RVS Monte Carlo event Reinsurance News spoke with NewRe CEO Thomas Braune about what areas of growth he hopes to see within NewRe over the next year. “We have a strategy for property & casualty and profit, and our main focus is nat cat XL ... Read the full article

Swiss Re Reinsurance Solutions: A partner for more efficiency and innovation

13th September 2023

As the global reinsurance industry meets in Monte Carlo for the 65th edition of the Rendez-Vous de Septembre (RVS), we spoke with the Chief Executive Officer (CEO) of Swiss Re Reinsurance Solutions, Russell Higginbotham, about the division's value proposition and critical differentiators in an evolving industry. Greater efficiency and innovation were ... Read the full article

Being ‘multidisciplinary’ is key for ICW Re: Mirek Wieczorek

13th September 2023

Mirek Wieczorek, Head of Reinsurance at ICW Group Insurance Companies, has emphasized the company's versatile capabilities, describing it as "multidisciplinary" and well-prepared to thrive not only in conventional traditional markets but also in the realm of less traditional, customized, bespoke programs. In an interview with Reinsurance News, Wieczorek highlighted ICW Re's ... Read the full article

Non-cat space really attractive for Conduit Re: CEO Carvey

12th September 2023

Bermuda-based reinsurer Conduit Re has deployed more capital into non-cat classes of business and continues to explore opportunities in increasingly attractive areas, Chief Executive Officer (CEO) Trevor Carvey told Reinsurance News in Monte Carlo. As the reinsurance industry meets in Monaco for the 2023 edition of the annual Rendez-Vous De Septembre, ... Read the full article

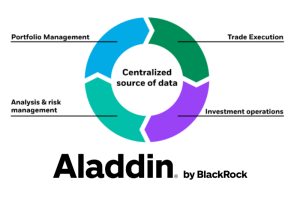

BlackRock’s Aladdin technology: Touching all aspects of an evolving investment ecosystem

12th September 2023

Unifying the investment management process on BlackRock’s technology platform, Aladdin promotes the creation of a surface for data to flow, enabling integration and data consistency for clients, according to David Schneid, General Manager of Aladdin Accounting. The platform combines sophisticated risk analytics with comprehensive portfolio management, trading, operations, ... Read the full article

Investor sentiment for accessing Lloyd’s is really encouraging: Argenta

12th September 2023

A perfect storm of premium rating, investment earnings on premiums and reserves, as well as the impressive half-year performance of Lloyd’s, means investors are expecting good things from accessing the returns of the oldest insurance market in the world, according to Argenta Private Capital Limited (APCL). Reinsurance News spoke with Robert ... Read the full article

With renewals approaching it is important for reinsurers to maintain discipline: SiriusPoint

12th September 2023

In a complex risk environment, and with renewals approaching, it is important for reinsurers to maintain discipline, said David Govrin, SiriusPoint’s Chief Underwriting Officer, at the Rendez-Vous de Septembre in Monte Carlo. “Market conditions for reinsurance have steadily improved in 2023. We are seeing improved economics for property cat, as well ... Read the full article