After the impact of hurricane Irma, primary Floridian insurance companies reported fairly limited losses when compared with the volume assumed by the global reinsurance segment, with many primary players reporting that overall losses fell well within their respective reinsurance programmes, reports Fitch.

The ratings agency reports that a notable lack of a major landfalling hurricane in Florida for more than a decade, prior to 2017, meant that many Florida specialist insurers’ catastrophe risk management practices were largely untested.

Fitch defines Florida specialist homeowners writers as “insurers with greater than 50% of their statutory direct written premium in Florida homeowners insurance that are not a subsidiary of a large national company.”

According to Fitch, some Florida insurance companies are thinly capitalised, meaning that a catastrophe loss that exceeds ceded reinsurance limits could easily, and quickly impair capital. However, thanks to insurers in the region utilising robust reinsurance programmes, many of the companies reported that “gross losses were well within limits of their respective 2017-2018 reinsurance programs, despite Irma generating the fifth-largest amount of insured losses from an individual event.”

“The volatility that is inherent to the property insurance market in Florida and the need for robust risk transfer mechanisms was demonstrated in 2017,” says Fitch.

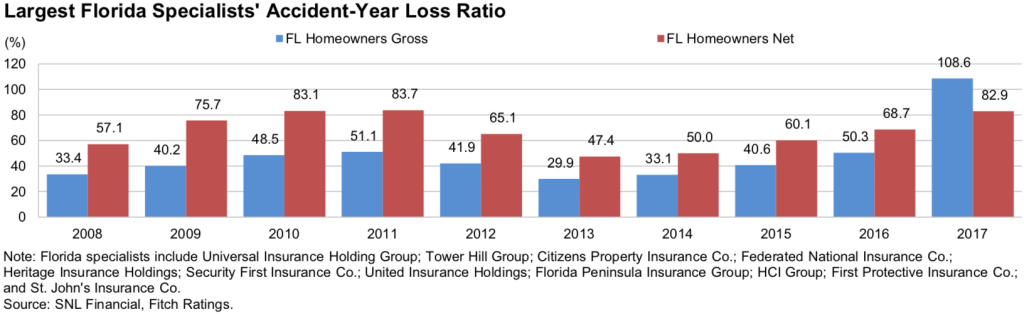

When analysing the aggregated homeowners insurance sector accident-year loss ratios for a group (11) of Florida specialist insurers, Fitch reveals the influence reinsurance utilisation had on the net results for these firms in 2017.

As shown by the above chart, the gross loss ratio for the group of Floridians increased to almost 109% in 2017, which compares to a five-year average of just over 39%. However, in 2017 the net ratio was almost 26% lower, at 82.9%, than the direct loss ratio, “due to the large percentage of ceded losses to reinsurers.”

As a comparison, for the overall P/C sector, the spread between homeowners direct and net loss ratio was just above 4%.

Clearly, Florida specialist insurers benefited hugely from their robust reinsurance programmes in 2017, a year which reminded both the insurance and reinsurance industry why they exist.

Reports are suggesting that the 2018 Atlantic hurricane season will experience average frequency, however, storm numbers are not what really matters, it is the intensity of storms and where they are steered towards that drives the potential for insurance and reinsurance industry losses.

But whatever the 2018 season brings, Fitch notes that the Florida market has many resources to meet any losses, including the regions insurer of last resort, Citizens Property Insurance Corp. and also the Florida Hurricane Catastrophe Fund, not to mention companies’ respective 2018-2019 reinsurance programmes.