A report from MarkLogic Corporation, which is based on research undertaken by Research in Insurance, claims that inefficient processes and complex legacy IT systems are a hindrance to the insurance industry’s digital transformation efforts.

Ultimately, the report finds a disparity between what insurance companies want to do and what they can actually achieve with their existing systems and processes.

Ultimately, the report finds a disparity between what insurance companies want to do and what they can actually achieve with their existing systems and processes.

The research for the report includes in-depth interviews with more than 200 senior industry professionals and reveals that 90% of survey respondents do not have a single unified view of their clients. However, at the same time, 70% of respondents said that achieving a single unified view is either critical or very important to their operations.

Chief Strategy for Insurance at MarkLogic, Steve Forcash, said: “Insurance companies have an enormous amount of data available to them; in many ways it is their most important asset – but only if they can access it and leverage it across the enterprise.

“This research highlights the enormous challenges insurers face in extracting data from multiple, siloed sources and using this to enhance efficiencies and improve customer experience in all areas, from pricing and underwriting to claims.”

The rise of advanced technology and its growing focus on the risk transfer industry has come at a time when insurers and reinsurers are under pressure to improve efficiency to lower costs, while at the same time are under growing pressure to find ways of remaining relevant to customers in a rapidly evolving operating landscape.

The world is transitioning to become truly digital, with interconnectivity increasing at an unprecedented rate across numerous industries in all parts of the world, and it’s important for re/insurers to stay on top of this and keep pace with changing consumer demands.

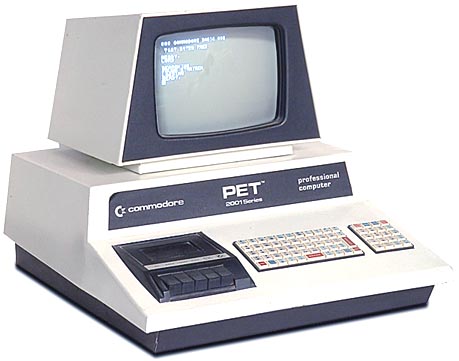

The report finds that a large number of insurers still rely on complex, legacy IT systems that house vast amounts of data siloed across the business. Some 55% of survey respondents feel that the complexity of their systems is the main barrier preventing them achieving a single unified view. At the same time, more than a third said that an inability to integrate data across the business prevents them achieving a single unified view.

“In order to differentiate in an increasingly competitive industry, insurance companies must become more customer-oriented. Other industries, plus InsureTechs, have raised the bar, and insurers need to respond.

“This means adopting the innovative technologies that will allow them to achieve a single customer view by integrating data stuck in silos and legacy systems and becoming truly customer focused,” said Forcash.

Over 50% of the insurance professionals that took part in the survey recognise the benefits of achieving a single unified view, and 56% agreed that it would result in improved customer satisfaction, and 53% said that it will support improved customer loyalty and retention.

Furthermore, just under half of respondents feel that achieving a single unified view will actually help with fraud detection, while 39% believe it will reduce overall risk.

Overhauling complex, legacy IT systems and processes is both costly and timely, and presents different challenges for companies of all shapes and sizes. While larger players might have the capitalisation to become truly digital, the amount of data they hold is so vast that it requires more work to achieve a single unified view. On the other side of the spectrum, while smaller, more nimble players might have less data and processes to bring together, they might lack the funds and manpower to fully achieve a single unified view.

Despite the challenges, companies are becoming increasingly aware of the benefits and the potential opportunities for growth that might come from the utilisation of new and efficient processes and IT systems.