Catastrophe insurance data provider PERILS has raised its industry loss estimate for the East Coast Low that hit Australia in February 2020 to AU $954 million (US $683 million).

This updated estimate, which comes six months on from the event, is significantly higher than PERILS’ initial loss estimate of $794 million.

This updated estimate, which comes six months on from the event, is significantly higher than PERILS’ initial loss estimate of $794 million.

The increase of $164 million is due to the addition of $100 million in property losses and the inclusion of motor losses for the first time which totalled $64 million, analysts explained.

The estimate marks the first time a market loss footprint is available at this level of granularity for an Australian East Coast Low event.

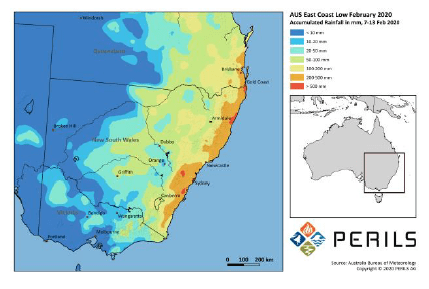

Australian East Coast Lows are very intense low-pressure systems classified as extratropical cyclones which affect an area stretching from South East Queensland to North East Victoria.

The East Coast Low of February 2020 was a typical example of such an event and caused very intense rainfall, flash and river flooding and strong winds along the Australian east coast from early to mid-February 2020.

In combination, these weather features caused widespread damage primarily along the coastal areas of New South Wales (88% of the industry loss) and South East Queensland (11% of the industry loss).

Property contributed the vast majority of losses with 93% attributable to this line of business, while motor losses represent some 7% of the total industry losses.

“This release is of particular market relevance as it is the first time a detailed industry loss footprint has been made available for an Australian East Coast Low event,” said Darryl Pidcock, Head of PERILS Asia-Pacific.

“The event was part of a very active Australian summer season which included the Australian Bushfire and Hailstorm events,” he continued. “The PERILS Database for Australia now contains detailed industry loss data for flood, tropical and extratropical cyclones, hail and bushfire events.”

Pidcock added: “We could not pursue our goal of increasing data availability without the support of our insurance partners. That support is vital to the ongoing evolution of best practice in the context of natural catastrophe risk management both in Australia and beyond.”