The government of the Philippines is set to receive a $52.5 million payout under its World Bank issued catastrophe bond, after risk modeller and calculation agent AIR Worldwide determined that super typhoon Rai (locally known as Odette) breached the trigger for wind.

As first reported by Artemis, the Philippines government will make a recovery under the terms of its IBRD CAR 123-124 catastrophe bond transaction, which was issued in November 2019.

As first reported by Artemis, the Philippines government will make a recovery under the terms of its IBRD CAR 123-124 catastrophe bond transaction, which was issued in November 2019.

The $225 million deal, issued by the World Bank on behalf of the country, provides the Philippines with $150 million of tropical cyclone disaster insurance coverage on a modelled loss basis (the Class B tranche), and $75 million of protection against earthquake risk (the Class A tranche).

Our insurance-linked securities (ILS) focused sister site, Artemis, was the first media source to report that the $150 million Class B tranche faces at least a 35% payout of principal, which translates to $52.5 million, as a result of super typhoon Rai.

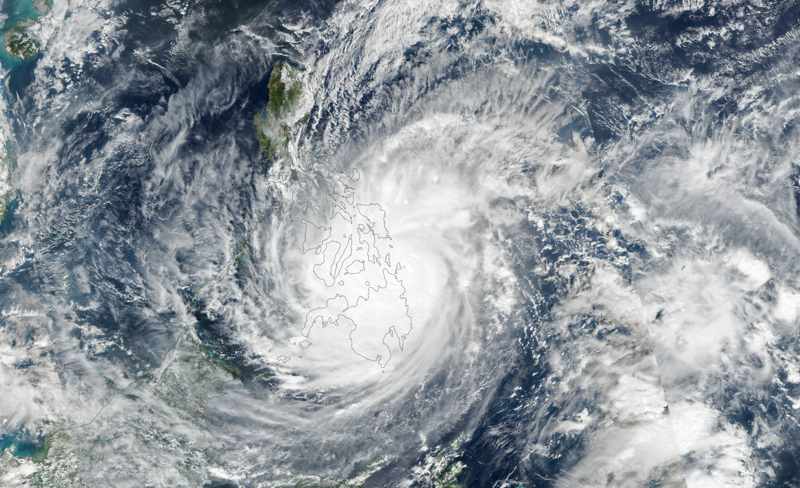

Typhoon Rai came ashore in mid-December 2021 with sustained winds of around 110 knots. The storm continued to have very strong typhoon strength winds as it crossed the Philippines and created a wide footprint of damage in its wake.

In the aftermath of the typhoon, the Philippines Government Treasury department issued a notice to the calculation agent, AIR Worldwide. This requested that an assessment be made to determine if super typhoon Rai might have triggered its catastrophe bond.

After running its models, AIR Worldwide has now resolved that the event parameters breached the parametric trigger for wind, which in turn triggered the lowest level of payout under the terms of the transaction.

As explained by Artemis, depending on how severe a qualifying loss event is and how high the resulting modelled loss has been calculated at, the $150 million Class B tranche of notes can payout in increments of 0%, 35%, 70%, or 100% of principal.

In this instance, the calculation report shows that just the wind parameters have breached the 35% trigger threshold. However, Artemis notes that the calculation process still has to consider precipitation from the typhoon and that this could actually drive the loss of principal even higher, although this remains uncertain.

But what is clear is that the country is going to receive a payout of $52.5 million for the event from its catastrophe bond protection.

The Philippines government’s Department of Finance has now confirmed the triggering of the catastrophe bond.

Finance Secretary of the Philippines, Carlos Dominguez III, said: “Our successful cat bond issuance in 2019 has now yielded tangible results that will benefit communities most vulnerable to the devastating effects of climate change.

“This financial instrument is just one among the several innovative strategies that the government is undertaking to improve our resilience against natural calamities.”

Adding that the country, “Will continue to tap the international financial markets and create innovative structures and projects to achieve our goal of being a world leader in the fight against the climate crisis.”

In a statement, the Philippines Department of Finance has said that the payout leaves it with $97.5 million of insurance coverage for future strong typhoon impacts.

“The results of the event calculation for the wind parameters reached the partial trigger for the bond, thus resulting in a $52.5 million payout for the government. The level triggered was for a ‘Yolanda’-type event, or a 1-in-19 years severity typhoon hitting the Philippines,” said the department.

Adding that, “A second calculation will be done for the bond once precipitation data becomes available in the coming months.”

This latest catastrophe bond payout will provide the Philippines with vital disaster risk financing as it recovers from a major natural catastrophe event.

Once again, it shows the increasingly valuable role that innovative, capital markets-backed solutions such as cat bonds can play in protecting some of the world’s most vulnerable against the financial impacts of large catastrophe events.