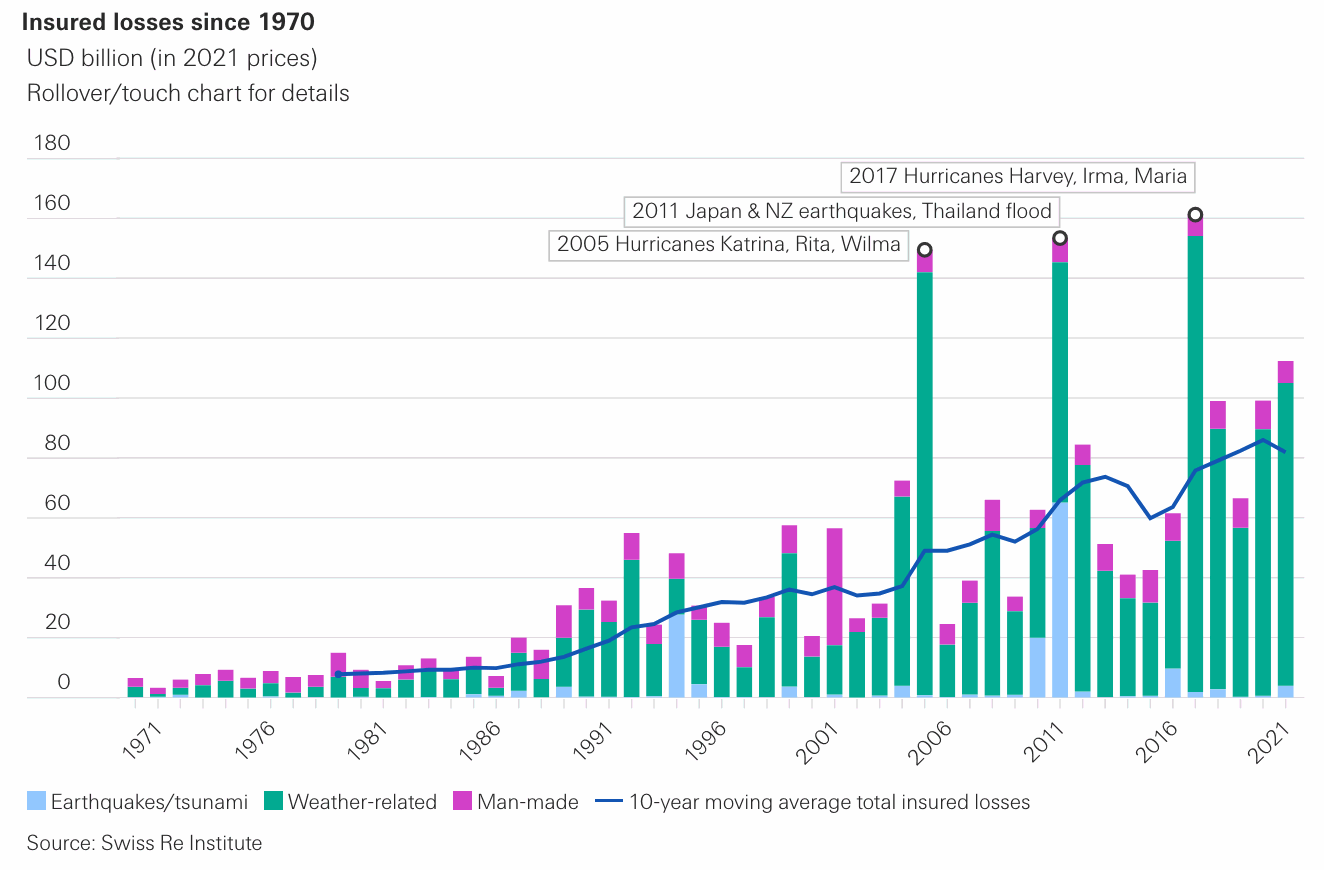

Swiss Re has estimated that insurance and reinsurance industry losses from natural catastrophe events in 2021 has increased to $105 billion, with man-made disasters resulting in an additional $7 billion of losses.

According to Swiss Re Institute’s preliminary sigma estimates, this is the fourth highest annual insured loss bill from nat cats since 1970.

While the costliest natural disaster event of the year was Hurricane Ida in the third quarter ($30 -32bn), Swiss Re notes that winter storm Uri in the first quarter and other secondary peril events account for more than 50% of total losses as a result of wealth accumulation and climate change effects.

After Ida, winter storm Uri was the second costliest nat cat event of the year for the industry, at a cost of $15 billion.

Outside of the U.S., the costliest event in Europe was the July flooding which devastated parts of Germany, Belgium and nearby countries, driving insured losses of up to $13 billion.

However, economic losses from this flood event are projected to be above $40 billion, which shows the large flood protection gap that exists in the region.

In fact, the flooding in Europe in Q3 was the costliest natural disaster for the region since 1970, and also the world’s second highest after the 2011 Thailand floods.

Jérôme Jean Haegeli, Swiss Re’s Group Chief Economist, commented: “The impact of the natural disasters we have experienced this year once again highlights the need for significant investment in strengthening critical infrastructure to mitigate the impact of extreme weather conditions.

“Investments in infrastructure support sustainable growth and resilience and need to be upscaled. In the US alone, the infrastructure investment gap to maintain critical and ageing infrastructure is USD 500 billion on average per year until 2040.

“Partnering with the public sector, the insurance industry is critical for strengthening society’s resilience to climate risks, by investing in and underwriting sustainable infrastructure.”

In June, Europe was also hit by severe convective storms, as thunderstorms, hail and tornadoes caused widespread damage to property in numerous countries. According to Swiss Re, insured losses from this event are estimated at $4.5 billion.

Insurance and reinsurance industry losses of $112 billion represents an increase of 13% on the $99 billion recorded in 2020, and is also above the previous 10-year average of $86 billion.

The insured nat cat bill for 2021 stands at $105 billion and the man-made bill at $7 billion, which is an increase of 17% and a decrease 24% on 2020, respectively.

Insured nat cat losses in 2021 are almost $30 billion above the previous 10-year average, while the insured man-made loss total is below the average by $2 billion.

Overall, economic losses from natural disasters totalled $259 billion in 2021, which is up 20% on last year’s total and also higher than the previous 10-year average of $229 million.

Economic losses attributable to just nat cats amounts to $250 billion in 2021 compared with $202 billion in 2020, and against a previous 10-year average of $216 billion.

Economic losses from man-made disasters amounts to $9 billion in 2021, compared with $14 billion in 2020 and a previous 10-year average of $13 billion.

Of course, the recent devastation caused by the December 10th and 11th 2021 convective storm and tornado loss event in the U.S. is expected to add to Swiss Re’s figures, raising both the economic and insured loss total for the industry in 2021.

While it’s very early days, broker Aon said recently that the industry faces a multi-billion loss from the US tornadoes.