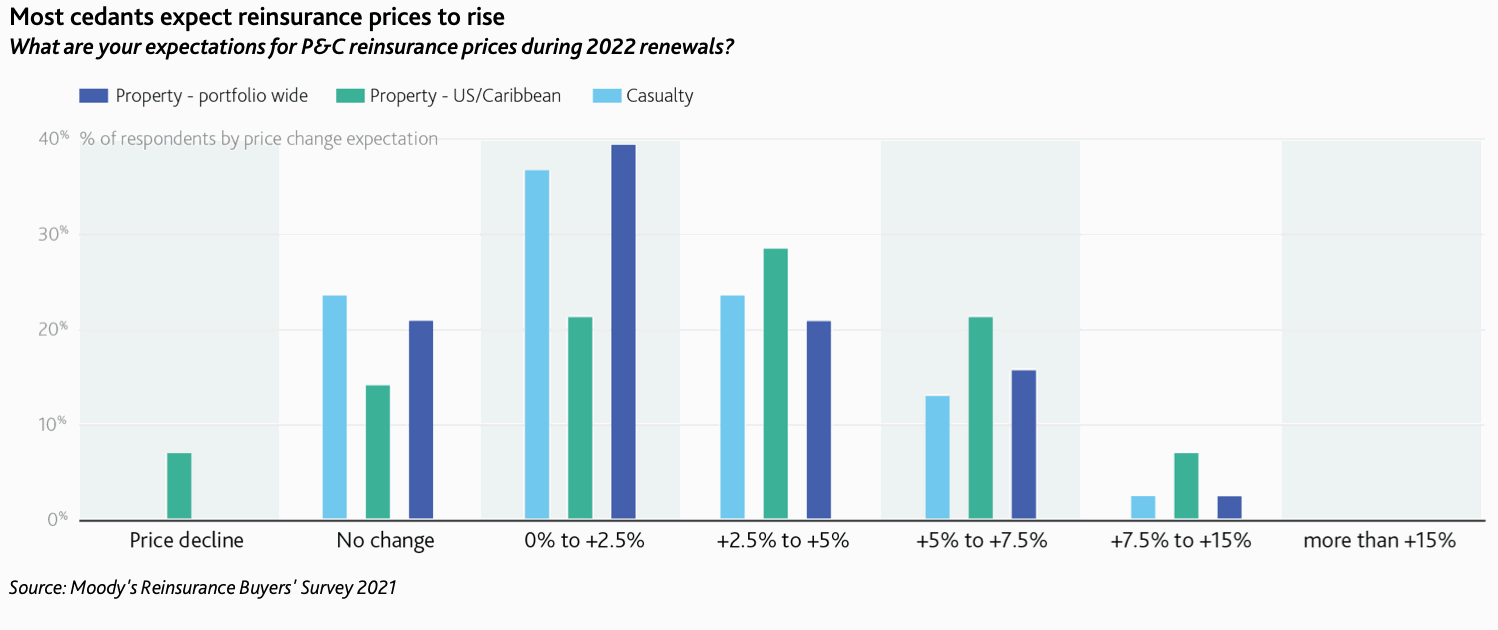

The results of a new survey by Moody’s show that property and casualty (P&C) reinsurance buyers expect prices to rise further in 2022 across all lines, but only at a low single digit percentage range.

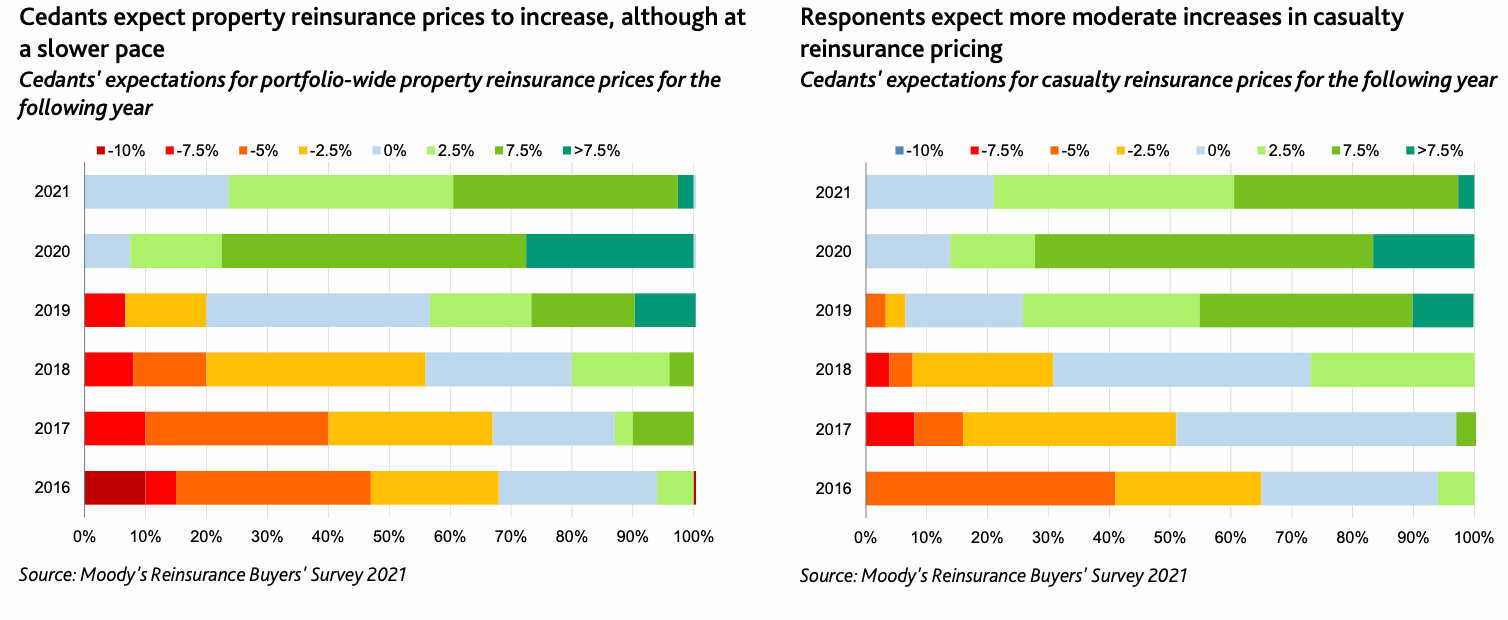

This expectation compares with the high single digit or even double digit increases that the market has experienced in previous years.

According to Moody’s, buyers primarily attributed continued price increases to rising loss costs, and a realization that prices were previously too low for the associated risks.

The rating agency suggested that the anticipated slowdown in price growth could reflect increased reinsurance capacity as underlying profitability improves.

Large losses related to Hurricane Ida in North America could also potentially give greater uplift to reinsurance prices than respondents previously anticipated.

Overall, 76% of the buyers that responded to the Moody’s survey expected price increases to continue through the 2022 reinsurance contract renewals. But they also agreed that price increases would slow, with respondents only anticipating strong increases for natural catastrophe exposure property reinsurance.

It is also worth noting that the number of cedants anticipating no change to pricing has grown from the previous year’s survey, and a very small percentage also expect a decline in prices for property lines covering the US and/or Caribbean.

In contrast, Moody’s notes that last year’s survey found that cedants overwhelmingly expected prices to rise, with few expecting no change and none expecting price declines.

As highlighted by Moody’s recent 2021 Reinsurance Outlook, the firm expects recent catastrophe losses, a general rise in loss costs, and the industry’s reassessment of the impact of secondary perils – less severe but more frequent natural catastrophes such as wildfires – to drive continued pricing gains.

“We anticipate price increases across all major lines,” analysts explained. “Property catastrophe reinsurance will likely register the strongest gains, driven respectively by recent significant catastrophe losses and the expectation at least a minor increase in natural catastrophe risk as the frequency of weather-related catastrophes is likely to continue to increase with climate change.”

Around 45% of cedants said reinsurance costs were rising partly because reinsurers had concluded that prices were previously too low to compensate them for the risks they were taking, and expect the industry to keep pushing for higher rates.

Most respondents felt that price increases would depend to some extent on losses from this year’s US hurricane and wildfire seasons, but longer term trends such as social inflation and increasingly frequent and severe weather catastrophes due to climate change were also a concern for pricing.

Moody’s reports that 74% of buyers expect to see higher property reinsurance rates next year, down from 93% in 2020, but up from 43% in 2019.

In terms of casualty prices, all respondents expect to see further increases next year albeit at a more moderate level. Eighteen percent of respondents anticipate price increases of 5% or more, significantly down from 53% last year.

Also worth noting, survey respondents viewed lower traditional reinsurance capacity as a greater influence on prices than a lack of capacity from the alternative reinsurance capital market, with just 10% citing a shortage of alternative capital as a main driving of price firming, versus 26% in 2020.