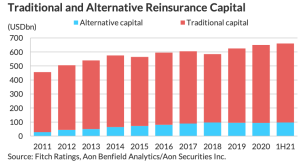

The reinsurance market is well capitalised and able to absorb demand for its coverage, according to data from Fitch Ratings.

Despite catastrophe losses of more than $100 billion 2021, Fitch reports that traditional and alternative reinsurance capital increased together by around 3-4%.

Despite catastrophe losses of more than $100 billion 2021, Fitch reports that traditional and alternative reinsurance capital increased together by around 3-4%.

As a result of this growth, the ratings agency feels the market is sufficiently capitalised to absorb greater demand for coverage.

“While the issuance activity of traditional reinsurers slowed in 2021 compared to 2020, the better underlying profitability helped them to strengthen their balance sheets,” says the ratings agency.

Fitch notes how the ILS market, and notably catastrophe bonds, experienced a record year of issuance in 2021, as shown by the most recent Artemis quarterly market report.

That work, available here and titled Q4 2021 Catastrophe Bond & ILS Market Report, shows that issuance hit new heights last year on the back of a record-breaking 2020.

Writing in the introduction to the report, Artemis said: “For the universe of traditional 144a property catastrophe bonds, it was the second most active fourth quarter ever, in terms of risk capital issued, at approximately $2.8 billion.”

“However, for the full-year, it was a record for property cat bond issuance, with more than $12.5 billion of risk capital issued covering a wide range of perils and geographies.”

Fitch notes that, “While alternative capital in total grew by 3%–4% in 2021, catastrophe bonds gained in importance at the expense of collateralised reinsurance programmes and sidecars, continuing a trend that started in 2019.”