Reinsurance News

Progressive H1 2022 results impacted by investment losses

18th July 2022

Property and auto-focused insurance group, The Progressive Corporation, has seen a significant dent in its H1 2022 results due to investments losses and the writedown of ARX Holdings impacting the property segment. Progressive’s total net unrealized losses on fixed-maturity securities year-to-date was $2,249.7 million, compared to the $448.5 million reported in ... Read the full article

WTW names Hector Martinez new LatAm head, Luis Maurette to retire

18th July 2022

Advisory and broking solutions company WTW has named Hector Martinez as its new head of Latin America. He is to succeed Luis Maurette, current head of the region and head of global sales and client management, who is to retire on 31 December, 2022. Maurette will work with Martinez and the three ... Read the full article

Top US P&C underwriters saw robust premium growth in 2021

18th July 2022

The top 10 U.S. property & casualty (P&C) underwriters, based on net premiums written, remained unchanged in 2021 when compared with the previous years, while Munich Re Americas moved four places to 15th, making it the highest ranked reinsurer on the list. Our directory of the Top ... Read the full article

Big data can contribute to healthy functioning of insurance markets: CIA

18th July 2022

Big data could be used by insurers to further refine classes of risk and determine better pricing and availability of insurance coverage to ensure a better match for policy owners, according to the Canadian Institute of Actuaries (CIA). In a recent statement, titled 'Big data and risk classification: Understanding the actuarial ... Read the full article

Admiral names Chief Risk & Compliance Officer

18th July 2022

UK insurer Admiral Group has announced the appointment of Keith Davies as Group Chief Risk and Compliance Officer with effect from September 2022. He will be responsible for developing and overseeing Admiral’s Risk and Compliance functions and frameworks, reporting to Milena Mondini de Focatiis, Admiral’s Group CEO. Davies has extensive experience in ... Read the full article

AM Best highlights Lloyd’s improved combined ratio in recent assessment

18th July 2022

AM Best’s recent assessment of Lloyd’s operating performance highlights the rating agency’s expectation that Lloyd’s will produce strong technical performance over the underwriting cycle, and that capital will continue to be attracted to the market. Analysts noted that improved pricing conditions, as well as a robust performance oversight by the corporation, ... Read the full article

PartnerRe acquisition could improve Covéa business profile: AM Best

18th July 2022

Analysts at AM Best have reported that the recent acquisition of PartnerRe could lead to an improvement in Covéa’s business profile by significantly diversifying its offerings on a product and geographic basis. The rating agency stated that its financial strength ratings for Covéa remain unchanged following the announcement last week ... Read the full article

Generali appoints Stefano Marsaglia to its board

18th July 2022

Assicurazioni Generali has appointed Stefano Marsaglia as a member of its Board, following the resignation of non-independent director Francesco Gaetano Caltagirone for undisclosed reasons. Stefano Marsaglia, who is 67 years old, has been appointed as an independent director. The Turin-born Italian citizen has a long experience in investment ... Read the full article

Suncorp continues simplification with sale of bank arm

18th July 2022

Suncorp Group has announced that it has signed a share sale and purchase agreement with Australia and New Zealand Banking Group Limited (ANZ) to sell its banking business. ANZ has agreed to a $4.9 billion deal to acquire Suncorp’s banking arm in a bid to boost the size of its mortgage ... Read the full article

On matching risk with capital in insurance

18th July 2022

The insurance industry has acquired a reputation for sluggishness. In my experience, however, the appetite to embrace change among insurers and reinsurers is strong. Especially when there is the very real prospect of improving the offering to customers, the products, the way businesses operate, and the efficiency of capital. Despite a number ... Read the full article

Club Vita makes new pension appointments

18th July 2022

Club Vita, a company specialising in longevity data analytics, has made several new appointments to its pension teams. Jill Gallagher joins as Head of Pensions, UK based in Club Vita’s Glasgow office. Gallagher has more than a decade of experience in supporting both private and public sector pension schemes ... Read the full article

UK motor claims inflation on the rise – WTW

18th July 2022

The inflation rate for motor claims settled in 2021 was over 6%, far higher than last year’s UK general inflation rate of 2.1%, according to new data from WTW. The average cost per claim in 2021 was £5349, up from £5037 the previous year. However, a combination of ... Read the full article

Nuveen announces two new hires to drive its institutional insurance business

18th July 2022

Global investment management firm, Nuveen has announced two strategic hires for its institutional insurance business. Lara Devieux has joined as Senior Managing Director, Head of Insurance Product, and Joseph Pursley has joined as Managing Director, Head of Insurance Distribution, Americas. The company has announced these hires it continues to expand its insurance ... Read the full article

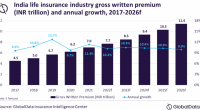

India’s life insurance industry to reach $150.6bn by 2026: GlobalData

18th July 2022

According to analysts at GlobalData, India’s life insurance industry is expected to grow at a compound annual growth rate (CAGR) of 10.3% through 2026, driven by growing awareness and positive regulatory landscape. It is forecasted to grow from $92.3 billion in 2021 to $150.6 billion in 2026, in terms of gross ... Read the full article

NFP forms captive management arm

18th July 2022

NFP, a property and casualty broker, has established NFP Captive Management (Alberta) Corp. and appointed two industry veterans in the captives and alternative risk space. This will enable NFP to form and administer Alberta-domiciled captive insurance companies for their clients. Joseph Seeger, managing director, co-lead, CRSG of NFP in Canada, ... Read the full article