Reinsurance News

Aon warns of severe convective storm risk, pegs US tornados as multi-billion dollar event

14th December 2021

Aon analysis of the devastating tornado outbreak which swept several US states over the weekend echos other outlet's in its expectation for both economic and insured losses to reach into the billions of dollars. Analysts note how the severe convective storm (SCS) peril has become an increasingly expensive one ... Read the full article

Ebix Europe to offer alternative trading platform for London Market

14th December 2021

London Market technology specialist Ebix Europe has announced that it is designing and developing a new electronic trading platform that will offer an alternative to the recently announced PPL platform. The platform, called PlacingHub, has been developed by Ebix Europe’s in-house specialists, and promises to offer users the equivalent functionality already ... Read the full article

Tremor sees $175m premium transacted in 2021, marketplace revenue swells 400%

14th December 2021

Leading online reinsurance pricing and placing platform Tremor transacted $175 million of premium in 2021 and achieved marketplace revenue growth of over 400% year over year. Tremor has seen over $275 million of reinsurance premium transacted on its marketplace since 2018. While the market has continued to harden overall and traditional reinsurance ... Read the full article

Swiss Re among investors in $1.4bn FWD capital raise

14th December 2021

Pan-Asian life insurer FWD Group Holdings Limited has announced that it has entered into subscription agreements with a number of investors, including reinsurer Swiss Re. Together, the investors agreed to participate in private placements which are to raise US $1.425 billion in aggregate. The private placements will take the form of cash ... Read the full article

US tornados to hit commercial multiperil, homeowners lines: AM Best

14th December 2021

AM Best is expecting losses from the weekend's devastating tornado outbreak to be concentrated in the commercial multiperil and homeowners lines, with some losses borne by auto physical damage. On December 10 more than 30 tornadoes were reported across five states—Arkansas, Illinois, Kentucky, Missouri, and Tennessee—causing widespread devastation and ... Read the full article

SiriusPoint helps create new Floridian insurer VYRD

14th December 2021

A new insurer serving homeowners in Florida has launched as a joint venture between specialty re/insurer SiriusPoint and insurtech Bolt. VYRD is set to deploy cutting-edge technology in its efforts to bring more choice and new solutions to customers in Florida. Residents in the state have faced rising prices as litigation costs ... Read the full article

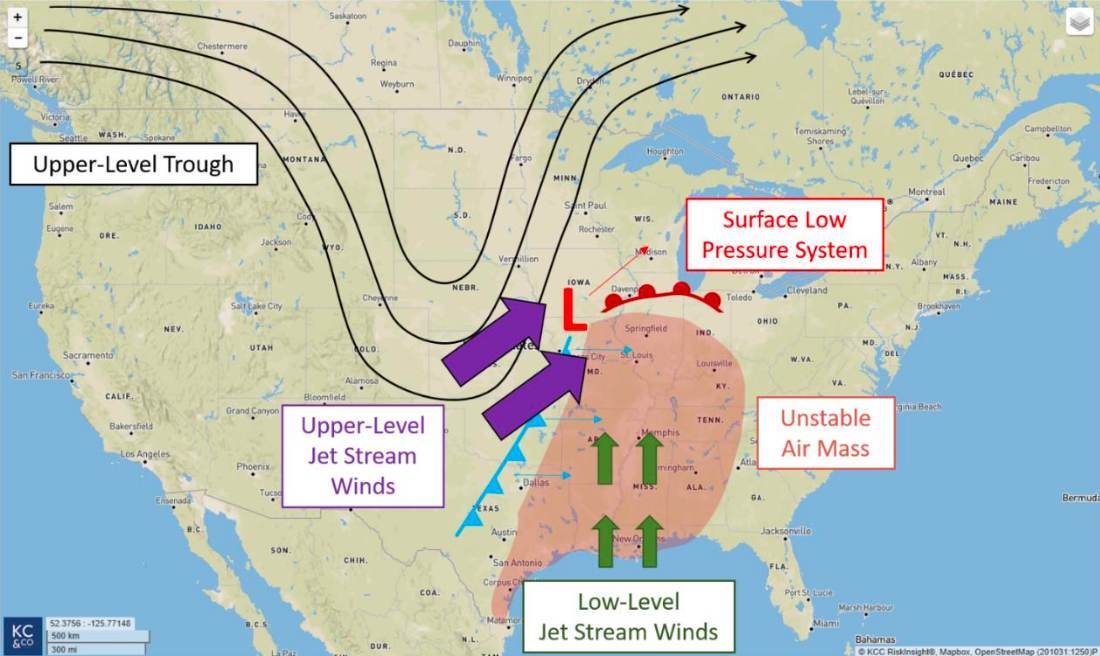

Insured loss from U.S. SCS & tornado outbreak seen at $3bn by KCC

14th December 2021

Analysis from catastrophe risk modelling firm, Karen Clark & Company (KCC), estimates that the insurance industry loss from the recent severe convective storm (SCS) outbreak in the U.S. will be around $3 billion. The SCS outbreak, which brought damaging winds and hail, occurred over December 9th - 12th and saw tornado ... Read the full article

Liberty Mutual names Damon Hart as EVP

14th December 2021

Liberty Mutual Insurance has appointed Damon Hart as Executive Vice President and Chief Legal Officer. Hart succeeds Jim Kelleher, who announced he will retire at the end of this year. Previously, Hart was promoted to Deputy Chief Legal Officer in 2020 and prior to this, served as Senior Vice President and ... Read the full article

Alastair Swift named LIIBA representative on LMG board

14th December 2021

The London Market Group has announced that Alastair Swift, Head of Corporate Risk & Broking at GB Willis Towers Watson, has joined its board. Swift will be one of the elected board members chosen to represent LIIBA (the London and International Insurance Brokers’ Association) on the LMG Board. “Alastair Swift brings a ... Read the full article

Execs see positives in late renewals as market discipline persists: KBW

14th December 2021

After recent meetings with insurance and reinsurance company executives, analysts at KBW have highlighted how the late January 1st, 2022, renewals season could be positive. According to one executive, the late reinsurance renewal season is positive as in general, brokers look to place highest-quality accounts first in order to set the ... Read the full article

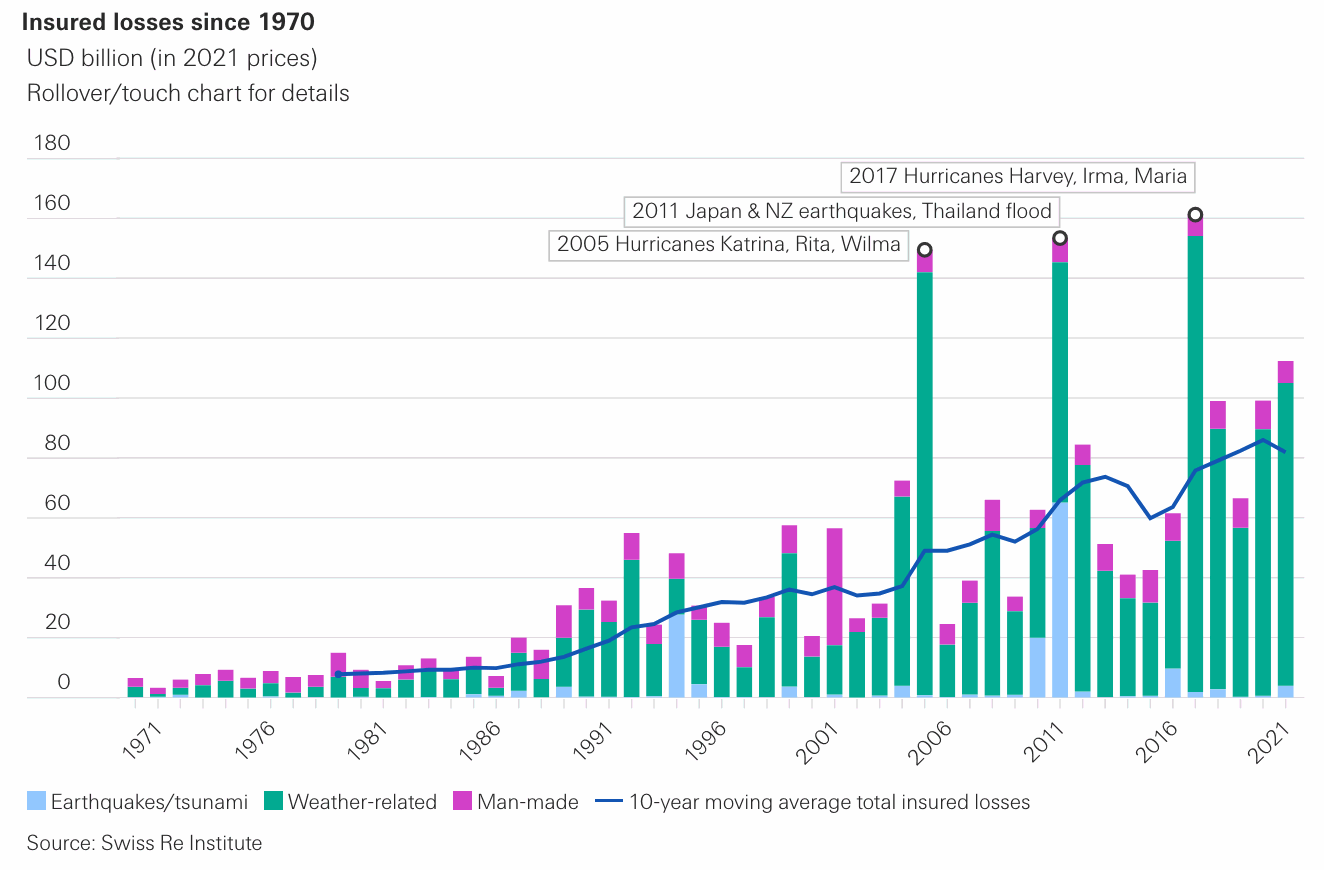

Re/insured losses from catastrophes to hit $112bn in 2021, says Swiss Re

14th December 2021

Swiss Re has estimated that insurance and reinsurance industry losses from natural catastrophe events in 2021 has increased to $105 billion, with man-made disasters resulting in an additional $7 billion of losses. According to Swiss Re Institute's preliminary sigma estimates, this is the fourth highest annual insured loss bill from nat ... Read the full article

Brit partners with Lloyd’s to pilot continuous contracts for coverholders

14th December 2021

Brit Ltd (Brit) has piloted the first continuous binder at Lloyd’s, which is planned to launch in January 2022. The new forms of contract aim to improve efficiencies by replacing the traditional annual renewal cycle, which can often be time and labour intensive and result in capacity being confirmed weeks or ... Read the full article

Reinsurer data capabilities provide edge amid ESG integration: Jefferies

14th December 2021

Analysts at Jefferies have suggested that reinsurers’ data capabilities should provide them with a pricing advantage as environmental, social and governance (ESG) considerations are increasingly integrated into the insurance sector. The firm believes that climate change presents both significant opportunities and risks for the non-life insurance industry, although it says many ... Read the full article

WTW hires Tim Rourke as UK Head of P&C Pricing, Product, Claims and Underwriting

14th December 2021

Willis Towers Watson has appointed Tim Rourke as the new UK Head of P&C Pricing, Product, Claims and Underwriting in the company’s Insurance Consulting and Technology business. He succeeds Graham Wright in this role, who is taking on a new challenge outside of the company. Rourke most recently served as Head of ... Read the full article

Tysers adds Lee Jenkins to Bloodstock team

14th December 2021

Lloyd’s broker Tysers has announced the addition of Lee Jenkins as a Director within its Bloodstock team. In this role, Jenkins will focus on developing new market opportunities and identifying areas for business growth. This appointment is the latest in a string of senior hires across Tysers in broking, claims and operations ... Read the full article