Reinsurance News

A.M. Best news

News featuring rating agency A.M. Best, including the latest reports, rating actions and analysis from the company, as well as news on A.M. Best’s analysis of the reinsurance sector.

Hannover Re’s Glencar Insurance receives A+ rating from A.M. Best

14th February 2019

Glencar Insurance Company (GIC), a newly established subsidiary of German reinsurer Hannover Re, has received a financial strength rating of A+ (Superior) from A.M. Best. The rating agency also assigned GIC a long-term issuer credit rating of “aa”, in addition to a stable outlook. A.M. Best explained that the ratings reflected GIC’s ... Read the full article

Investor losses drive retro pricing hikes amid flat 1/1 market: A.M. Best

11th February 2019

Large catastrophe losses and ongoing loss creep resulted in pricing hikes of up to 35% for the retrocession segment at the January 2019 renewals, as investors pushed for higher returns amid a predominantly flat rating environment, according to A.M. Best. Analysts said that property catastrophe retrocession was the brightest spot at ... Read the full article

Rejected Brexit deal fuels additional uncertainty for UK re/insurers: A.M. Best

17th January 2019

Global financial services ratings agency, A.M. Best, has said that the fact the UK Government's EU withdrawal agreement was defeated in the House of Commons, increases uncertainty surrounding the UK's trading relationship with the EU. Following the heavy defeat suffered by UK Prime Minister Theresa May on January 15th, 2019 a ... Read the full article

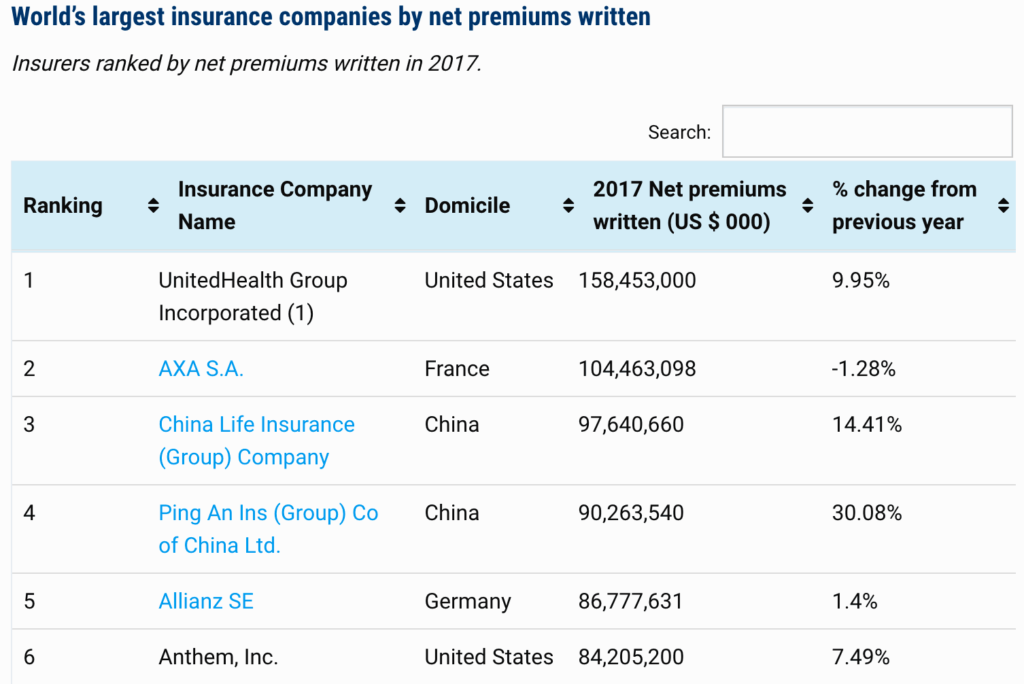

Berkshire Hathaway, Chinese insurers climb “World’s Largest” ranking

8th January 2019

The insurance operations of Warren Buffett's conglomerate Berkshire Hathaway Inc. and China's largest insurance companies are the biggest climbers in A.M. Best's ranking of the World's Largest Insurers. The ranking of the world's largest insurance companies is available to view here on Reinsurance News, in collaboration with A.M. ... Read the full article

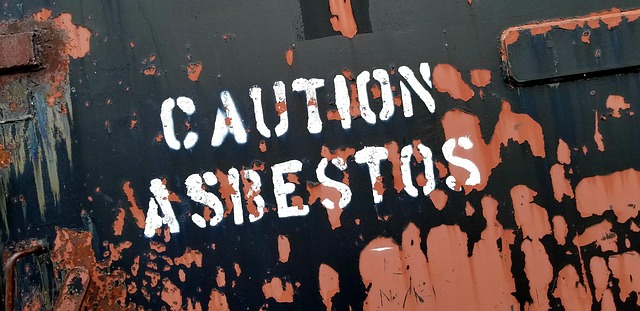

Asbestos and environmental claims continue to rise: A.M. Best

21st December 2018

Asbestos and environmental claims currently cost the property and casualty (P&C) re/insurance industry around $1.9 billion and $800 million in additional losses per year, respectively, and show no signs of slowing down, according to A.M. Best. The rating agency has raised its estimate of the ultimate net environmental losses for the ... Read the full article

Mexico’s insurance industry outlook stable, some volatility ahead: A.M. Best

21st December 2018

Mexico’s insurance industry is benefiting from strong capitalisation levels and operating performances of its companies, which in turn supports A.M. Best’s stable market segment outlook on the industry. However, the firm states that despite this stable outlook some volatility is to be expected across the industry’s operating performance in the last quarter ... Read the full article

Negative outlook placed on Brazil reinsurance market: A.M. Best

14th December 2018

Brazil’s reinsurance market has been given a negative market segment outlook by AM Best, with the rating agency citing persistent macroeconomic and political uncertainty; a declining interest rate environment, which has led to lower investment income; foreign exchange fluctuations; and evolving reinsurance market conditions. AM Best believes that, despite the negative ... Read the full article

Demand for non-life reinsurance to increase in 2019: A.M. Best

11th December 2018

Demand for non-life reinsurance is expected to increase over 2019, according to A.M. Best, due primarily to factors such as the return of U.S economic growth, as well as global growth and benefits from the U.S federal tax reform. Analysts at A.M. Best believe these conditions will provide opportunities for organic ... Read the full article

A.M. Best stable on reinsurance for 2019

6th December 2018

Global ratings agency A.M. Best has revised its outlook for the global reinsurance industry to stable from negative for 2019, driven by the convergence of traditional and third-party, or alternative reinsurance capital among non-life players. The ratings agency's revised outlook is also a result of more stable pricing, albeit at levels ... Read the full article

A.M. Best to set up post-Brexit hub in Amsterdam

4th December 2018

A.M. Best has announced plans to establish a new subsidiary in Amsterdam to ensure it can continue to deliver rating services throughout the European Union (EU) once the UK leaves in March 2019. The new subsidiary, called A.M. Best (EU) Rating Services B.V., has now been registered as a credit rating ... Read the full article

U.S P&C industry performance improves over 2018: A.M. Best

23rd November 2018

The U.S property and casualty (P&C) re/insurance industry posted strong results over the first nine months of 2018, improving its net underwriting income significantly due to growth in net written premiums and relatively flat losses, according to A.M. Best. The rating agency’s First Look report found that net premiums written grew ... Read the full article

Methodology update affected just 3% of EMEA re/insurers, says A.M. Best

22nd November 2018

The recent revisions that A.M. Best made to its Best’s Credit Rating Methodology (BCRM) and Best’s Capital Adequacy Ratio (BCAR) resulted in changes for just 3% of re/insurers in the Europe, Middle East & Africa (EMEA) region, according to analysts at the company. Speaking in an interview with A.M. BestTV, Mahesh ... Read the full article

Caribbean captives continue to outperform traditional markets: A.M. Best

20th November 2018

The captive insurance markets in Bermuda, the Cayman Islands and Barbados (BCIBs) continue to post strong double-digit RoEs and outperform more traditional commercial markets, according to analysts at A.M. Best. The rating agency noted that captive insurers remain the beneficiaries of very productive business models and strong loss control and risk ... Read the full article

A.M. Best expects UK firms to be able to write cross-border reinsurance post-Brexit

19th November 2018

Global ratings agency A.M. Best expects UK insurers and reinsurers will still be able to underwrite reinsurance on a cross-border basis post-Brexit, but warns that the Solvency II regulatory treatment of these contracts is dependent on the UK achieving reinsurance equivalence by the European Union (EU). The ratings agency continues to ... Read the full article

Re/insurers taking a “leading role” in the ESG agenda: A.M. Best

19th November 2018

In light of the current absence of any global guidance on how to integrate environmental, social and governance (ESG) criteria into business models, a number of major participants in the re/insurance industry have taken a “leading role” on these issues, according to A.M. Best. Re/insurers are uniquely positioned to tackle the ... Read the full article