Reinsurance News

Great-West Lifeco

Canada Life Re reports record earnings for 2023

19th February 2024

Canada Life Re, comprised predominantly by the Capital and Risk Solutions division, has reported “record” $794 million in earnings for 2023, as its parent company, Great-West Lifeco, sees strong earnings of $3.7 billion for the year. For the fourth quarter of 2023, the Capital and Risk Solutions division base earnings grew ... Read the full article

Great-West Lifeco completes sale of Putnam Investments to Franklin Templeton

8th January 2024

Great-West Lifeco, an international financial services holding company has completed the sale of Putnam Investments to Franklin Resources, Inc., operating as Franklin Templeton, an independent and diversified asset manager. According to the announcement, the transaction is not expected to have a material financial impact for Great-West Lifeco at close. The company ... Read the full article

Great-West Lifeco sees base earnings increase to $950m in Q3

10th November 2023

Great-West Lifeco Inc. reported a solid increase in its base earnings in the third quarter of 2023, as they rose from $809 million to $950 million. The firm attributed the sharp increase primarily to business growth, as well as higher average equity markets and interest rates. At the same time, Great-West Lifeco ... Read the full article

Great-West Lifeco announces CFO succession plan to drive long-term growth

15th May 2023

Jon Nielsen has been appointed as the CFO designate of Great-West Lifeco Inc., effective September 5, 2023, and will assume the role of Chief Financial Officer in the first quarter of 2024. Garry MacNicholas, the current CFO, has made the decision to retire in the second quarter of 2024. To ensure ... Read the full article

Great-West Lifeco records $100m Hurricane Ian reinsurance provision

19th October 2022

International financial services company Great-West Lifeco has announced that it will record a provision of US $100 million for estimated reinsurance claims expected to result from Hurricane Ian. Lifeco mainly has interests in life insurance, health insurance, retirement and investment services, and asset management business. But it also writes retrocessional property catastrophe ... Read the full article

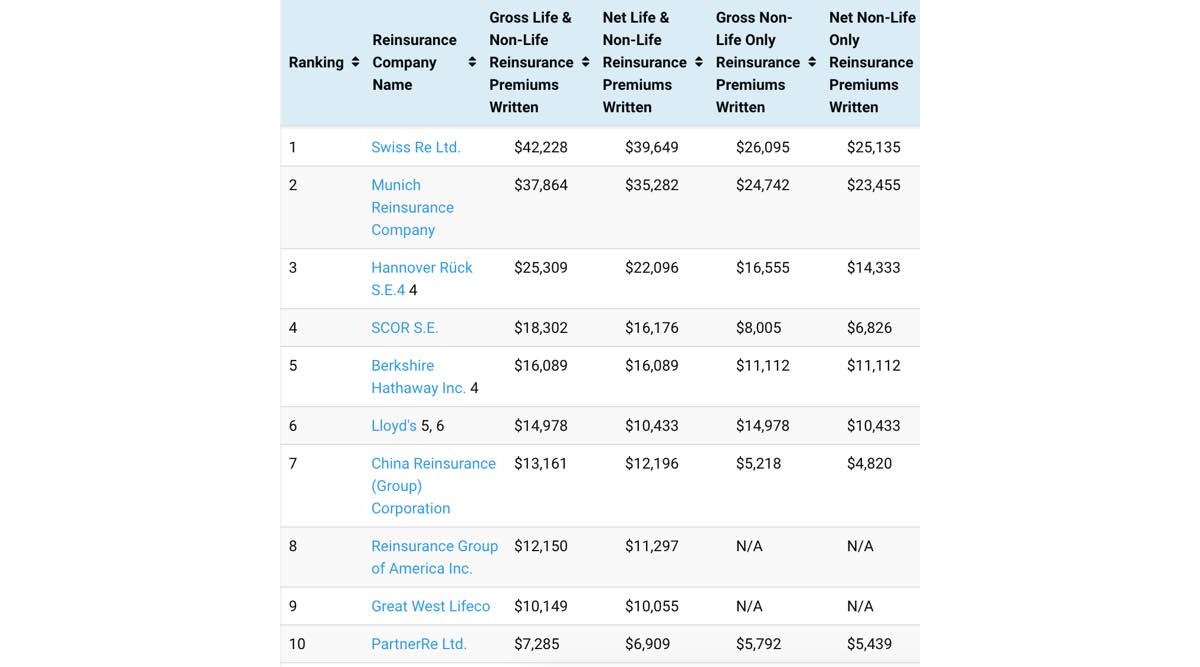

Average combined ratio of the world’s top reinsurers declined in 2019

2nd September 2020

Analysis of the Top 50 Global Reinsurance Groups reveals that, year-on-year, combined ratios trended higher for some of the largest players in the market in 2019 as underwriting profitability dipped for the cohort. When ranked by unaffiliated gross written premiums (GWP) in 2019, the top ten remains relatively unchanged year-on-year, ... Read the full article

Great-West Lifeco announces key leadership changes

18th February 2020

Insurance-centered financial holding company Great-West Lifeco has made a series of leadership changes, including the appointment of Arshil Jamal to the newly-created role of President and Group Head, Strategy, Investments, Reinsurance and Corporate Development. Jamal, who currently serves as President and COO, Europe & Reinsurance, will be focused on identifying and ... Read the full article

Protective completes reinsurance transaction with Great-West Lifeco

4th June 2019

Great-West Lifeco Inc. subsidiary, Great-West Life & Annuity Insurance Company (GWL&A) has completed the sale, via reinsurance of all of its individual life insurance and annuity business to Protective Life Insurance Company, a subsidiary of Protective Life Corporation. The transaction was previously announced on January 24th, 2019 and the business sold includes bank-owned ... Read the full article

Great-West Lifeco estimates HIM losses of $175 million

31st October 2017

Great-West Lifeco Inc. has said that hurricanes Harvey, Irma, and Maria will result in a combined after-tax reinsurance loss of $175 million for the company, which will be included in its third-quarter results. Great-West Lifeco provides property catastrophe protection to reinsurers through its subsidiary, London Reinsurance Group Inc., making it exposed to ... Read the full article