Reinsurance News

Insurance and reinsurance pricing news

News on pricing in global insurance and reinsurance markets, with a particular focus on renewal rates on line in reinsurance and commercial insurance pricing trends.

Personal lines rates moderate through Q1: MarketScout

14th April 2023

Data from MarketScout shows that personal lines rates decreased slightly through the first quarter of 2023, with the US composite rate recorded at plus 5%. Homeowners and personal articles insurance on a composite basis were both down slightly in the Q1, analysts reported. But automobile insurance rates are increasing at plus 6.3% ... Read the full article

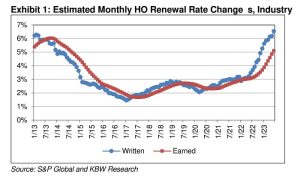

Homeowners renewal rate increases accelerate in March: KBW

12th April 2023

Analysts at KBW have reported that homeowners renewal rate increases are picking up steam, having accelerated to an estimated 5.9% in March. KBW notes that most homeowners insurers are raising rates, likely due at least in part to expected increases to both reinsurance rates and reinsurance attachment points, with the combined ... Read the full article

Berenberg foresees higher profitability for reinsurers

28th March 2023

Analysts at Berenberg expect to see higher future profitability for the reinsurance sector as the hard pricing environment looks to set persist and deliver higher returns on capital for reinsurers. The investment bank said that its broader view on reinsurance remains positive as the repricing of property catastrophe reinsurance has led ... Read the full article

Sapiens and WTW collaborate on pricing solution

28th March 2023

Global advisory, broking, and solutions company WTW and Sapiens, a global provider of software solutions for the insurance industry, have announced a collaboration aimed to enhance real-time pricing and speed to market for insurers. Sapiens will join WTW’s Insurance Technology Partner Network and together will deliver an integrated solution comprising Radar ... Read the full article

German public-sector insurer profits hit by reinsurance prices, claims inflation: Fitch

17th March 2023

According to analysts at Fitch Ratings, German public-sector insurers’ non-life underwriting profitability is likely to weaken in 2023, which will be driven by higher reinsurance prices and claims inflation. Fitch noted that it forecasts a net combined ratio of 98% for 2022 and 99% for 2023, compared with a five-year average ... Read the full article

US commercial prices up 4.8% through Q4: WTW

13th March 2023

US commercial insurance prices rose again in the fourth quarter of 2022, according to WTW’s Commercial Lines Insurance Pricing Survey (CLIPS), with the aggregate commercial price change measured at 4.8%. The survey compared prices charged on policies underwritten during the fourth quarter of 2022 with those charged for the same coverage ... Read the full article

Reinsurers to benefit from improved underwriting and investments in 2023, says Moody’s

28th February 2023

Analysts at Moody's expect the supply and demand imbalance in the global reinsurance market to persist amid a continuation of strong pricing, while credit conditions will also be supported by improved investment income on the back of rising interest rates. Moody's maintains its stable outlook for the global reinsurance sector in ... Read the full article

January reinsurance conditions “here to stay”: JP Morgan

27th February 2023

Analysts at JP Morgan have reported that the “resounding view” from reinsurers is that the hard market conditions experienced at the January 2023 renewals are “here to stay” for at least the remainder of the year. Looking ahead to the coming renewals in April and at mid-year, JP Morgan believes that ... Read the full article

AIG’s reinsurance spend up by less than 10% at “successful” renewal: CEO Zaffino

16th February 2023

AIG Chairman and Chief Executive Officer (CEO) Peter Zaffino has disclosed details of his company’s experience at the recent January reinsurance renewal period, which he says proved “exceptionally successful” given challenging market conditions. Specifically, he says AIG increased its overall spend by “less than 10%” on an absolute and risk adjusted ... Read the full article

Hard market to increase volatility for primary insurers: Goldman Sachs

13th February 2023

Analysts at Goldman Sachs have warned that hardening reinsurance market conditions are causing more volatility in the primary market, as carriers are forced to retain more risk on their balance sheets. At the same time, however, analysts observed that reinsurance pricing increases are not yet translating to revenue and top line ... Read the full article

Ivans Index shows strong start to year for renewal rates

10th February 2023

Data from the latest edition of the IVANS Index shows that average premium renewal rates were up across all lines of business over the month of January, with the exception of Workers’ Compensation. Increases were led by Business Owners Policy (BOP) and Commercial Property lines, which remain the highest premium renewal ... Read the full article

COVID losses in APAC could strain A&H reinsurers: Gallagher Re

9th February 2023

Analysts at Gallagher Re have warned that new COVID-19-related losses emanating from the Asia-Pacific region may put a strain on first-tier accident and health (A&H) reinsurers through 2023. The broker expects that the majority of these losses will be contained locally, but it does believe that the Lloyd’s market is likely ... Read the full article

Global commercial insurance rates continue to moderate in Q4: Marsh

3rd February 2023

Global commercial insurance prices increased 4% in Q4 of 2022, down from a 6% increase in Q3 and a 9% increase in Q2, according to Marsh's Global Insurance Market Index. Marsh's Index explains that this continues a trend of moderating increases that first began in Q1 of 2021. It adds that while ... Read the full article

Reinsurance market shift an opportunity to re-set profitability: JP Morgan

2nd February 2023

Analysts at JP Morgan have suggested that the reinsurance market shift is an opportunity for companies to re-set profitability and rebuild buffers. JP Morgan's analysts state that additional exposure growth on top is a bonus, though this is not something that the firm is looking out for. They write, "For the first ... Read the full article

Alternative capital shortage has rippled through property markets: RBC

26th January 2023

Analysts at RBC Capital Markets have suggested that a retrenchment in the alternative capital space has led to a further tightening of the retro market from 2022, causing a “ripple effect” on the available of capacity in the reinsurance property markets. Commenting on the current hard market environment and on specialty ... Read the full article