Reinsurance News

Insurance and reinsurance pricing news

News on pricing in global insurance and reinsurance markets, with a particular focus on renewal rates on line in reinsurance and commercial insurance pricing trends.

Hurricane Ian to “dramatically” impact Florida rates: MarketScout

7th October 2022

Analysts at MarketScout, a Managing General Agent, Lloyd's Coverholder and wholesale broker, have suggested that losses from Hurricane Ian will “dramatically” impact insurance pricing across both commercial and personal lines. MarketScout data shows that the commercial market composite rate for the third quarter 2022 increased 5.28%, with property rates up 7.67%. It’s ... Read the full article

Hannover Re “well positioned” to benefit from hard market: analysts

7th October 2022

Following Hannover Re’s recent investor day in London, analysts have reported that they remain confident the reinsurer is “well positioned” to benefit from an increasingly hard pricing environment next year. JP Morgan said it remains positive on Hannover Re due to its stable and high returns versus reinsurance peers, clear evidence ... Read the full article

Inflation could “absolutely dominate” reinsurance outlook: PwC’s Bichard

4th October 2022

Jim Bichard, Global Insurance Leader for PwC, has warned that inflationary challenges could “absolutely dominate” the insurance and reinsurance landscape in the near future. Speaking to Reinsurance News at the recent RVS 2022 event in Monte Carlo, Bichard identified the main trends under discussion as the scarcity of available reinsurance capacity ... Read the full article

Industry seeks more convergence between actuarial and data science, says Akur8

4th October 2022

According to Akur8’s first Global Pricing Survey, 83% of key players in the insurance pricing community believe the convergence between actuarial and data science would be highly valuable to their team in the future. The survey notes that pricing teams across the insurance industry are committed to activating the power of ... Read the full article

JP Morgan confident that reinsurance pricing will increase in 2023

26th September 2022

Analysts at JP Morgan are confident that the reinsurance market will show further hardening in 2023, despite already seeing several years of prices increasing. The report states that at the 2022 mid-year renewals, the market saw some business unable to be placed at all, particularly in lower layers on reinsurance programmes. ... Read the full article

Lloyd’s market not yet universally hard: Patrick Tiernan

23rd September 2022

Chief of Markets Patrick Tiernan has cautioned that the insurance and reinsurance marketplace at Lloyd’s of London is “not yet universally hard” and has emphasised the need for rate adequacy amid challenging conditions. Addressing an audience as part of the Lloyd's market Q3 update, Tiernan acknowledged that syndicates are currently operating ... Read the full article

Reinsurance on cusp of true hard market: JMP

16th September 2022

Analysts at JMP Securities have reported that the property reinsurance market maybe be “on the cusp” of a truly hard pricing environment, ahead of the January 1 renewals. Following its discussion at the Rendez-Vous de Septembre event in Monte Carlo this year, JMP concluded that the reinsurance sector is clearly in ... Read the full article

Hiscox sees opportunities at hard 1/1: Kathleen Reardon

11th September 2022

Kathleen Reardon, Chief Executive Officer (CEO) at Hiscox Re & ILS, has said that she sees “interesting opportunities” for her company at the upcoming January 1st renewals, as signs point to continued reinsurance price increases. Speaking in a recent interview with Reinsurance News, Reardon explained that “the direction of travel currently ... Read the full article

Premium rates remain up YoY despite monthly fluctuations: IVANS

9th September 2022

Premium renewal rates for major commercial lines of business remain up year-over-year, according to the latest edition of the IVANS Index, despite fluctuations on a monthly basis. All lines of business expect Workers’ Compensation were up YoY, the Index shows, with BOP and Commercial Property showing the highest average increases. Month-over-month, BOP ... Read the full article

Reinsurance pricing to remain strong regardless of benign hurricane season: Morgan Stanley

7th September 2022

Analysts at Morgan Stanley have said reinsurance pricing will remain strong regardless of a potentially benign hurricane season in 2022. The report notes there have been no hurricanes in the first half of 2022's Atlantic storm season, with only three named tropical storms. Morgan Stanley reviewed the list of landfall hurricanes on ... Read the full article

Reinsurance sector to benefit from rising prices & strong investment income: Moody’s

6th September 2022

According to a Moody’s Investors Service report, reinsurance earnings will be strengthened by increasing prices and higher investment income amid rising interest rates. Catastrophe losses and a heightened perception of risk following the pandemic have fuelled an increase in demand for both primary commercial and reinsurance property and casualty (P&C) protection, ... Read the full article

Changes in risk appetite & models skepticism highlighted by AM Best

1st September 2022

Rating agency AM Bests’ latest reinsurance market report highlights that the global risk environment is continuing to get more complex, notably with traditional nat cat models being subjected to renewed scrutiny due to the increase in the frequency of events in the last five years. These events are usually attributable to ... Read the full article

Reinsurance rates to increase regardless of cat activity: Fitch

26th August 2022

Analysts at Fitch Ratings have argued that reinsurance rates will continue to harden during the January 2023 renewals, even in the absence of significant catastrophe losses throughout the second half of the year. In a new report, the rating agency notes that, at $34 billion, H1 worldwide insured natural catastrophe losses ... Read the full article

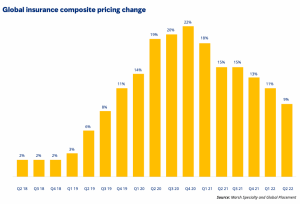

Marsh Index shows moderating trend for pricing through Q2

2nd August 2022

Global commercial insurance prices increased 9% in the second quarter of 2022, down from an 11% increase in Q1, according to the latest Global Insurance Market Index by re/insurance broker Marsh. While this does represent the 19th consecutive quarter of increases, analysts note that the rate of increase continued to moderate ... Read the full article

Rate increases will persist and could be in “low double-digit” region – Berenberg

27th July 2022

Berenberg expects rate increases in 2H 2022 to persist in loss-affected lines and programmes where loss experience has been elevated in recent years - and forecasts these to be in the low double-digit region. Reinsurers have been able to obtain price hikes of 10-30% in programmes with poor loss ... Read the full article