Reinsurance News

Reinsurance renewals news

Reinsurance renewals are the key points in the year when the majority of reinsurance contract renewal negotiations occur and are completed.

The reinsurance renewal seasons provide insight into reinsurance pricing, contract terms, reinsurance market positioning and the direction of future trends in the market.

Renewals an opportunity for global aerospace insurance market to re-set: Gallagher

16th January 2023

The 2022/2023 aerospace reinsurance renewals season is a chance to re-set retention levels, policy conditions and pricing levels to enable the global aerospace (GA) insurance market to continue to serve its end-user client base, according to Gallagher analysts. This opportunity presents itself as this renewals season for the global insurance market ... Read the full article

Falvey ups underwriting capacity with changes to program

13th January 2023

Specialist MGA Falvey Insurance Group has announced that it has increased its underwriting capacity from January 1st, via expanded partnerships with its key supporting carriers. In total, Falvey partners with 35 different carriers or syndicates on 36 different underwriting facilities via its 4 MGAs. Major changes to the program this year include ... Read the full article

IAG renews Berkshire Hathaway quota share, but relationship changed

12th January 2023

Australian insurer IAG has announced the renewal of its largest Whole of Account Quota Share (WAQS) agreement, with National Indemnity Company (NICO), a subsidiary of Berkshire Hathaway, but there have also been key changes to the terms of the relationship between the companies. For instance, Warren Buffett's company will be free ... Read the full article

TWIA may need $2.964bn of reinsurance for 2023, based on newly set 1:100 PML

12th January 2023

The Texas Windstorm Insurance Association's (TWIA) Actuarial & Underwriting Committee met yesterday to recommend the Board set $5.244 billion as the entity's 1-in-100 probable maximum loss (PML) for the upcoming storm season, which suggests that TWIA could end up buying some 46% more in reinsurance limit for 2023. Following a presentation ... Read the full article

FEMA shrinks NFIP reinsurance program by over 50% amid hard market

11th January 2023

The U.S. Federal Emergency Management Agency (FEMA) has completed its 2023 traditional reinsurance placement for the National Flood Insurance Program (NFIP), transferring an additional $502.5 million of flood risk to the private reinsurance market for a total premium of $90.2 million. Together with its three in-force catastrophe bond transactions, FEMA has ... Read the full article

IAG maintains $10bn cat reinsurance but increases first event retention

9th January 2023

Australian insurer IAG has completed its 2023 catastrophe reinsurance renewal, maintaining a flat gross protection cover at up to $10 billion, same as in 2022; its first event retention was increased “reflecting inflation and the global reinsurance market impacts”. The main cover provides gross protection for catastrophe losses of up to ... Read the full article

Renewals a success despite “disappointing” lateness: Gallagher Re’s Vickers

6th January 2023

The recent January 1 reinsurance renewals ultimately succeeded in meeting demand for coverage despite changes in pricing and structures, and with negotiations running down to the wire, Gallagher Re’s James Vickers has maintained. Gallagher Re’s 1st View report described 1/1 as “complex and in many cases frustrating” for both buyers and ... Read the full article

Retro capacity “materially constrained” at Jan 1, says Gallagher Re

6th January 2023

Non-marine retrocession capacity was "materially constrained" at the January 1st, 2023, reinsurance renewals, with widespread pressures on attachment levels as sellers' concerns around inflation and frequency of losses contributed to a challenging environment, according to Gallagher Re. The retro market has been constrained for some time, and reinsurance broker Gallagher Re's ... Read the full article

Property lines with poor loss history to see rate rises up to 150%: USI

5th January 2023

Broker and consulting firm USI Insurance Services has forecast that cat or non-cat property with poor loss history or poor risk quality may see rate increases of up to 150% in the first half of 2023. Following three years of a firming market with increased deductibles, valuation adjustments, and reductions in ... Read the full article

Direct & fac market proves resilient at Jan 1: Howden

5th January 2023

The global direct and facultative (D&F) market remained resilient at the January 1 reinsurance renewals, Howden reports, with capacity still available at the right price for most cedants, despite the challenging backdrop. The broker notes that a myriad of events came together to drive the hardest property catastrophe reinsurance market ... Read the full article

Renewals mark return to reinsurers driving primary behaviour: Gallagher Re’s Vickers

4th January 2023

The recent January 1 renewals period marked a return to a historical market dynamic in which reinsurers are the drivers of behaviour in the primary markets, James Vickers of Gallagher Re has asserted. Speaking to Reinsurance News alongside the release of Gallagher Re’s 1st View report, Vickers explained that reinsurers “are ... Read the full article

Reinsurers make “significant strides” at Jan renewals: Berenberg

4th January 2023

Analysts at investment bank Berenberg have reported that the reinsurance market made “significant strides to improve profitability” at the recent January 1 renewals, particularly in underperforming property natural catastrophe business. Early reports from insurance brokers including Guy Carpenter, Gallagher Re and Howden indicate that the highly anticipated hard ... Read the full article

Gallagher Re warns of damaged relationships following renewals

4th January 2023

Analysts at Gallagher Re have warned that many of the hard-fought positive outcomes for reinsurers at the recent January 1st renewals may have come at the expense of damaged client relationships. In its 1st View January reinsurance renewals report, the broker noted that the recent 1/1 period was “very tense” with ... Read the full article

Cat loss-hit property treaties in the U.S. see rate rises of +100% at 1/1: Gallagher Re

3rd January 2023

Analysis by reinsurance broker Gallagher Re reveals that some catastrophe loss-hit treaties in the U.S. witnessed rate increases of more than 100% at the January 1st, 2023, reinsurance renewals, as Hurricane Ian, other catastrophe and risk losses, inflation, and rising interest rates drove disruption in the market. Gallagher Re's 1st ... Read the full article

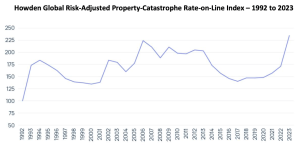

Multi-decadal high reinsurance rate rises achieved at Jan 1, says Howden

3rd January 2023

A myriad of events came together and drove the hardest property catastrophe reinsurance market in a generation at the key, January 1st, 2023, reinsurance renewals, with structures and coverage terms at the forefront of negotiations, according to re/insurance broker Howden. The coalescence of geopolitical and macroeconomic shocks, the ongoing war in ... Read the full article