Reinsurance News

Reinsurance renewals news

Reinsurance renewals are the key points in the year when the majority of reinsurance contract renewal negotiations occur and are completed.

The reinsurance renewal seasons provide insight into reinsurance pricing, contract terms, reinsurance market positioning and the direction of future trends in the market.

Property cat pricing hasn’t improved enough to justify the exposure: Everest Re CEO Andrade

11th February 2022

Property catastrophe reinsurance pricing has been on the rise for some time now, but when you consider the impacts of consecutive above-average years of natural disaster events and losses, exacerbated by climate change, it simply hasn't moved enough, according to Juan Andrade, President and Chief Executive Officer (CEO) of Everest ... Read the full article

ARPC successfully renews $3.475bn terrorism retro program for 2022

9th February 2022

The Australian Reinsurance Pool Corporation (ARPC), which administers the country's terrorism insurance scheme, has renewed its $3.475 billion retrocession program for 2022 at the same price as the previous year. Combined with ARPC's net assets and the $10 billion Commonwealth guarantee, the renewal of the retro program provides scheme capacity of ... Read the full article

SCOR’s lower cat exposure driven by climate change not retro pricing, says Conoscente

8th February 2022

The 11% reduction of catastrophe exposures on SCOR's P&C in-force portfolio for 2022 was driven by the reinsurer's adjusted view of risk due to climate change, as the price rises achieved on the cat portfolio offset higher retrocession rates, according to Jean-Paul Conoscente, Chief Executive Officer (CEO) of SCOR Global ... Read the full article

SCOR grows P&C premiums by 19% at ‘complex’ Jan reinsurance renewals

8th February 2022

French reinsurer SCOR has reported premium growth of 19% and an overall average price increase of +4.9% in P&C reinsurance at a "complex" and "prolonged" January 1st, 2022 renewals. SCOR notes that 1/1 "evidence the continuing hardening of the P&C treaty reinsurance market," driven by heightened losses from natural catastrophes, attritional ... Read the full article

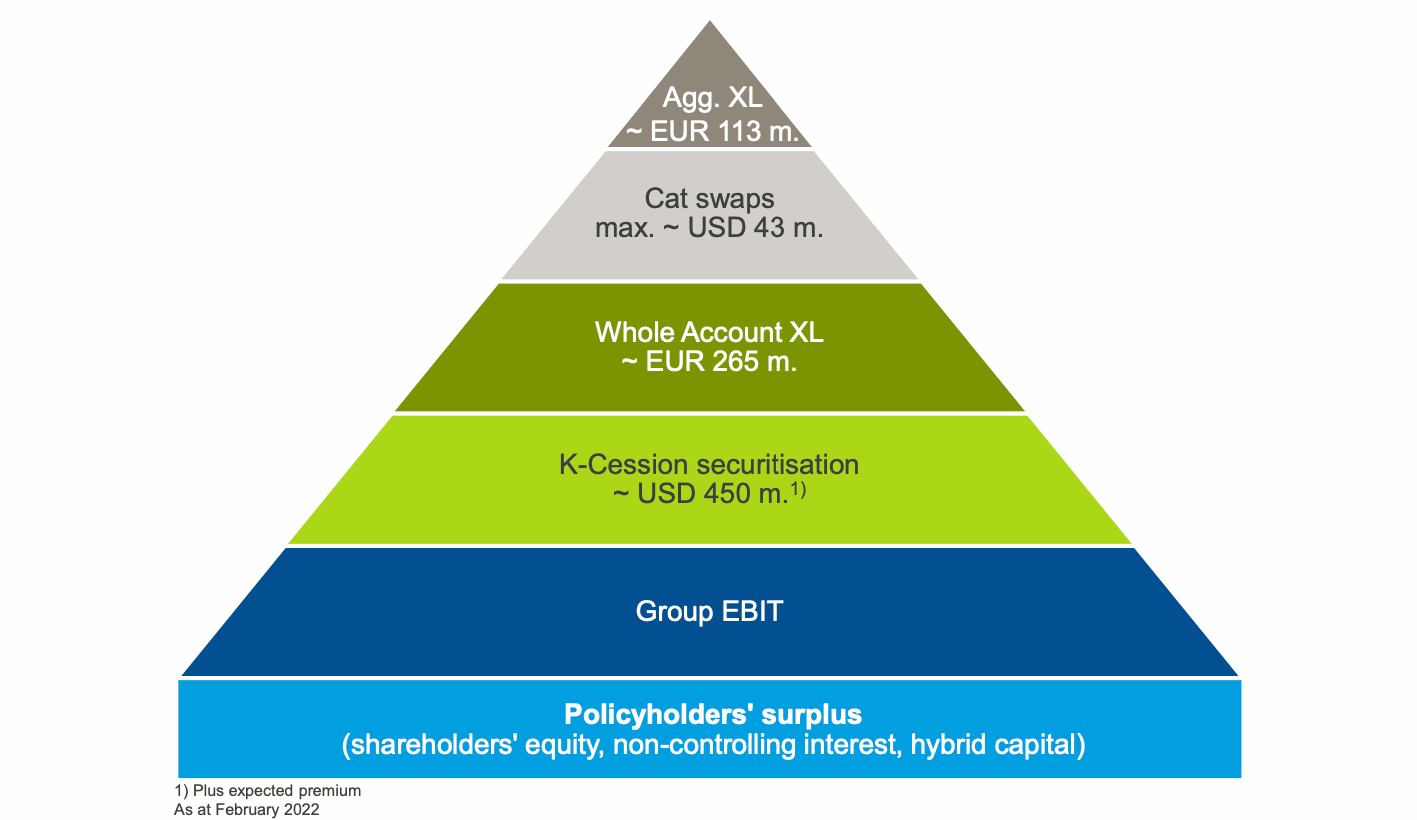

Hannover Re’s aggregate XoL retro cover shrinks by almost 50% at Jan renewal

7th February 2022

For 2022, the size of Hannover Re's aggregate excess-of-loss (XoL) worldwide retrocession reinsurance layer has decreased by almost 50% to approximately €113 million, as the German reinsurer navigated more challenging retro market conditions at the January 1st renewals. As forecast towards the end of last year, aggregate retro capacity was harder ... Read the full article

Markel eyes 90% reinsurance combined ratio after shift in focus

3rd February 2022

By 2023, Markel Corporation is hopeful of achieving at least a 90% combined ratio in its reinsurance business after its decision to reduce volatility in the book by transitioning the property line to its insurance-linked securities (ILS) operation Nephila. Markel began this process in the first quarter of 2021, and ... Read the full article

Hannover Re expects improved rate trends to persist at upcoming renewals

3rd February 2022

Sven Althoff, Board Member for Property and Casualty (P&C) at global reinsurer Hannover Re, said this morning that the company expects the "broad trend of improved rates will continue to apply both at the insurance and at the reinsurance level" at the April and mid-year renewals. Early this morning, Hannover ... Read the full article

Hannover Re grows book by 8.3% at Jan 1 reinsurance renewals

3rd February 2022

German reinsurance giant Hannover Re achieved average inflation and risk-adjusted price increases of 4.1% at the January 1st, 2022, reinsurance renewals, as the company grew its book by 8.3%. Hannover Re notes the influence of considerable natural catastrophe losses on market pricing, especially in Europe and North America, alongside the low ... Read the full article

London Market reinsurers look to casualty at Jan 1: Miller

2nd February 2022

Reflecting on the January 1 renewal period, analysts at Miller have noted that casualty business became relatively more attractive to reinsurers in the London Market, following another year of elevated losses in the property catastrophe space. Miller observed a “mixed set of outcomes” at the crucial 1/1 reinsurance renewals, with a ... Read the full article

Reinsurance cycle to catch primary through 2022: Goldman Sachs

1st February 2022

Analysts at Goldman Sachs believe that the reinsurance pricing cycle could catch up with the primary cycle through 2022 and into 2023. Despite the market now being five years into a hard cycle, Goldman Sachs notes that the traditional industry has remained strongly capitalised, meaning the supply of reinsurance has been ... Read the full article

NFIP keen to work with private sector; sees reinsurance partnerships as mutually beneficial

31st January 2022

The U.S. Federal Emergency Management Agency’s (FEMA) National Flood Insurance Program (NFIP) is eager to continue working with the private sector to help close the country's flood protection gap and has called on its reinsurance partners to encourage clients to explore flood risk. "We want to continue to work with the ... Read the full article

AXIS cut reinsurance property & cat premiums by 45% at 1/1

27th January 2022

Bermuda-based insurer and reinsurer, AXIS Capital Holdings Limited, further reduced the volatility of its portfolio at the Jan 1, 2022, renewals, cutting its reinsurance property and property catastrophe premiums by 45%. The company's President and Chief Executive Officer (CEO), Albert Benchimol, confirmed on a recent earnings call that AXIS advanced its ... Read the full article

RenRe couldn’t have had a better renewal, says CEO O’Donnell

27th January 2022

After achieving numerous goals at the January 1st, 2022, reinsurance renewals, Kevin O'Donnell, President and Chief Executive Officer (CEO) of Bermuda-based RenaissanceRe, feels that the reinsurer has constructed the most efficient portfolio possible. "We had a strong January 1 renewal," said O'Donnell, speaking yesterday during the company's Q4 and full-year 2021 ... Read the full article

Floridian P&C insurers seek higher rates and sustainable profits

24th January 2022

Concerns over sustainable underwriting profits has seen three domestic property insurers in Florida file for a state-wide average rate change, highlighting that the market for homeowners and commercial property insurance is still under pressure in the state. The carriers believe that significant additional rate is required to make it an economic ... Read the full article

Better than expected 1/1 conditions leave Conduit Re’s Eckert bullish on outlook

21st January 2022

For Class of 2021 reinsurance start-up, Conduit Re, market conditions at the January 1st, 2022, renewals were ahead of expectations, leading the company's Chairman, Neil Eckert, to be optimistic for the months ahead. Earlier this week, $1.1 billion start-up reinsurer Conduit Re reported its January 2022 trading statement, which showed ... Read the full article