Reinsurance News

Reinsurance renewals news

Reinsurance renewals are the key points in the year when the majority of reinsurance contract renewal negotiations occur and are completed.

The reinsurance renewal seasons provide insight into reinsurance pricing, contract terms, reinsurance market positioning and the direction of future trends in the market.

1/1 renewals “very late” as reinsurers maintain discipline: KBW

10th December 2021

Analysts at KBW have reported that 1/1 renewal negotiations for property and casualty (P&C) business are running “very late” as reinsurers have managed to remain disciplined on pricing in the lead-up. After meeting with several reinsurance company executives in Bermuda, KBW analysts are anticipating “solid rate increases overall” for P&C business ... Read the full article

AM Best maintains stable outlook on global reinsurance amid positive pricing momentum

8th December 2021

Heightened demand for protection, continued positive price momentum and a disciplined underwriting environment has seen ratings agency A.M. Best maintain its stable outlook on the global reinsurance industry. AM Best's latest reinsurance market segment report highlights some positive and negative factors for the sector as the new year edges closer. Underpinning the ... Read the full article

Double-digit rise in property cat reinsurance rates for 2022, Fitch says

7th December 2021

Fitch Ratings analysts forsee double-digit premium rate rises for property catastrophe cover in 2022, following an insured loss total of close to $100 billion in 2021 and the prospect of natural catastrophe claims increasing in frequency and severity. In fact, reinsurance rates across catastrophe-related lines of business are expected to rise ... Read the full article

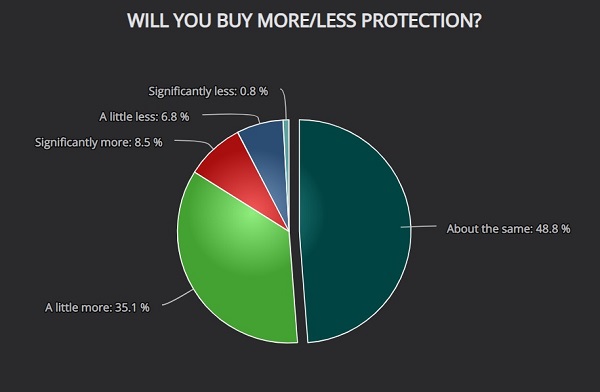

Buyers plan to use more reinsurance & ILS next year, survey shows

3rd December 2021

Data from the latest Reinsurance News market survey, undertaken in collaboration with our sister-site Artemis, shows that protection buyers are planning to purchase more reinsurance and retrocession next year, in addition to utilizing more ILS backed capacity. The survey looked at responses from hundreds of identifiable market participants, of which more ... Read the full article

Re/insurance pricing undergoing “period of dislocation”: HX’s Flandro

29th November 2021

David Flandro, Managing Director at HX Analytics, has said that the re/insurance market is “clearly going through a period of dislocation” when it comes to pricing, with multiple factors set to influence trends at the upcoming 2022 renewals. Speaking as part of HX’s re/insurer earnings review for Q3, Flandro noted that ... Read the full article

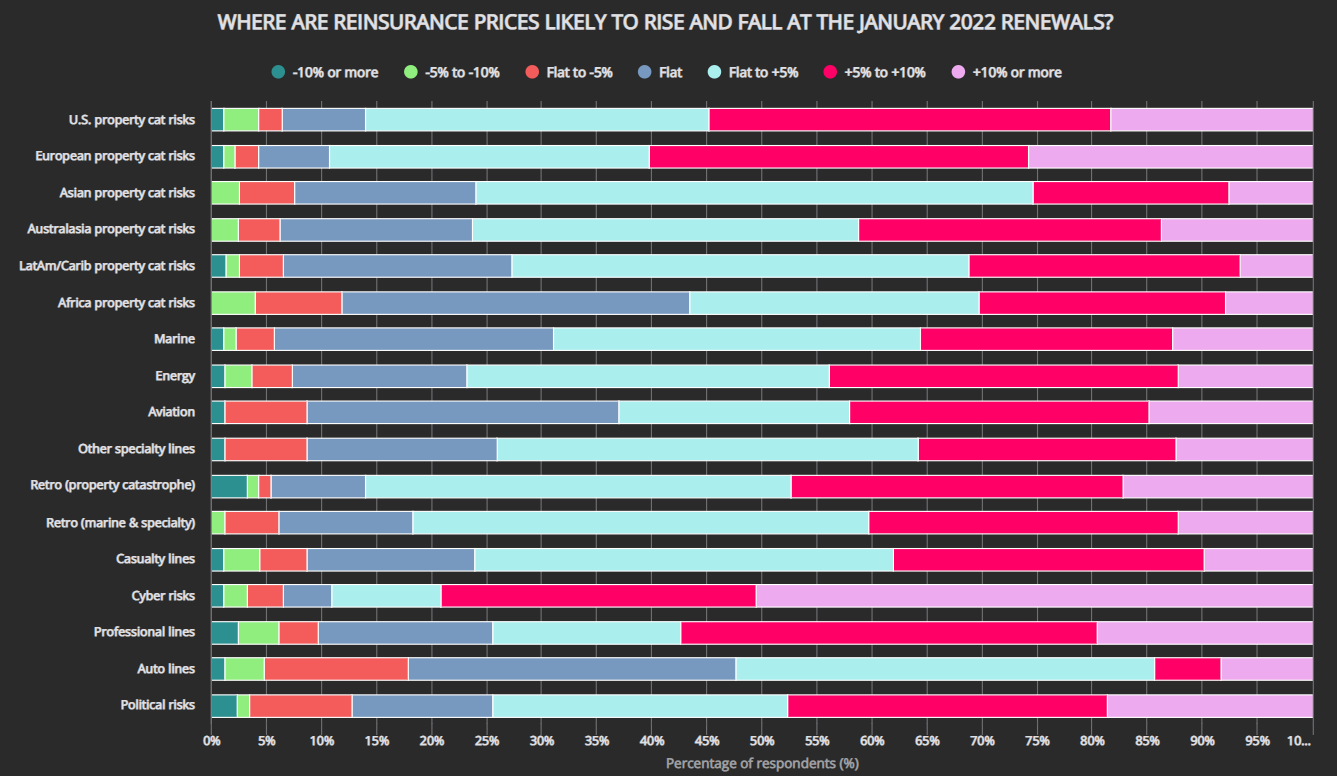

Reinsurance pricing expectations high across lines, survey shows

26th November 2021

Data from the latest Reinsurance News market survey, undertaken in collaboration with our sister-site Artemis, shows that market participants overall are expecting price rises across all business lines next year, with loss-affected lines in particular forecast for large increases. The survey looked at responses from hundreds of identifiable market ... Read the full article

Reinsurers could step back from secondary perils next year: Peel Hunt

25th November 2021

Analysts at Peel Hunt have speculated that the reinsurance industry may step back and lower its exposure to secondary perils next year, leaving primary insurers to take on more of the risks. As the renewal season progresses, Peel Hunt notes that reinsurers will currently be reassessing their property catastrophe risk appetite ... Read the full article

Re/insurers shift focus as renewal activity stalls, say analysts

24th November 2021

As insurers and reinsurers shift focus ahead of the key January 1st, 2022 renewals, there's uncertainties around the property catastrophe space while activity for 1/1 is reportedly behind schedule, according to Morgan Stanley. Analysts at Morgan Stanley recently hosted the firm's insurance corporate access day, which featured nine property and casualty ... Read the full article

Reinsurers eager to diversify amid uninspiring COP26 outcome, say analysts

16th November 2021

Some re/insurers are expected to retreat from the property catastrophe space in 2022 as the elevated frequency and severity of secondary perils adds pressure to margins, leading to greater diversification towards other classes of business, reports Peel Hunt. Despite several years of rate increases, a notable rise in losses from secondary ... Read the full article

Reinsurance industry must remediate, repair and improve: Heerasing, SiriusPoint

16th November 2021

Despite some improvements, the reinsurance sector continues to struggle to produce a meaningful return on capital, and as pressure builds on the impacts of climate change and secondary peril losses, there’s a real need for further rate momentum, according to Bobby Heerasing, Head of International Strategic Business Development, SiriusPoint. With the ... Read the full article

Reinsurers will find common ground on pricing at renewals: TigerRisk’s Gulbransen

12th November 2021

Despite significant pressure following another year of elevated catastrophe losses, reinsurers and clients will likely manage to find “common ground” on structure and pricing at the 2022 renewals, according to TigerRisk’s Wade Gulbransen. Gulbransen, who serves as Head of North America at the re/insurance risk, capital and strategic advisor, recently spoke ... Read the full article

Zurich won’t change reinsurance significantly despite aggregate exhaustion: CFO Quinn

11th November 2021

Insurer Zurich has no intentions to significantly alter its use of reinsurance protection despite the impacts of hurricane Ida and the European floods exhausting the company's aggregate catastrophe cover in the third quarter, according to Chief Financial Officer (CFO), George Quinn. Alongside robust premium growth, Zurich's Q3 2021 results highlighted ... Read the full article

More rate needed, but cat is clearly a profitable line: Munich Re CFO

10th November 2021

While many of the catastrophe prone markets have already experienced hardening over the past few years, higher prices are still required for some of the less impacted geographies and perils, but overall, Munich Re is pleased with the profitability of its catastrophe book, according to its Chief Financial Officer (CFO), ... Read the full article

Greenlight Re ‘middle-of-the-road’ on cat risk, ‘sceptical’ ahead of 1/1: CEO Burton

8th November 2021

After disappointing property catastrophe rate increases at the January 1st, 2021 reinsurance renewals, Simon Burton, Chief Executive Officer (CEO) of Greenlight Re, is sceptical ahead of year-end, but feels comfortable with the firm's current catastrophe exposure. Catastrophe losses of almost $26 million contributed 19.1 points to Greenlight Re's 109.3% combined ratio ... Read the full article

Illogical to decline potential cat opportunity: Lancashire CEO Maloney

5th November 2021

Alex Maloney, Chief Executive Officer (CEO) of Lancashire Holdings, confirmed yesterday that the specialty re/insurer intends to maintain its catastrophe footprint for 2022, stating that it would be "counter to our DNA" to retreat from an improved underwriting opportunity. In announcing its results for the first nine months of the ... Read the full article