Reinsurance News

Reinsurance News

Reinsurance industry news, analysis, insight and interviews.

Reinsurance market news coverage provided everyday, on the top reinsurers and insurers, covering news topics of relevance to the reinsurance sector, as well as commercial and specialty insurance.

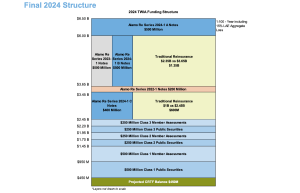

TWIA reinsurance renewal proceeds at pace. $750m placed, plus $1.4bn cat bond

3rd May 2024

With the Texas Windstorm Insurance Association (TWIA) requiring its largest reinsurance purchase on-record given its significant exposure growth, the residual market insurer is making rapid progress, with $750 million of its traditional reinsurance needs already secured in April. That is on top of a $1.4 billion Alamo Re 2024-1 catastrophe ... Read the full article

Ageas Re to further diversify portfolio with opportunities in Casualty space

17th April 2024

Following the response Ageas Re received from the market in its inaugural year of operation, the company is now looking to expand its portfolio with opportunities in the Casualty space. Ageas stated: “As a key engine for future growth Ageas Re remains set on becoming a full-service reinsurer in the long ... Read the full article

CG Re (Africa) to manage new Reinsurance Facility in the Democratic Republic of Congo

15th April 2024

CG Re (Africa) has obtained a mandate by the Minister of Finance of the Democratic Republic of Congo (DRC) to assist with the setup and management of a new specialty lines Reinsurance Facility. Administered by the Autorité de Régulation et de Contrôle des Assurances (ARCA), this new Facility for the Oil, ... Read the full article

Energy sector to benefit from Yard Insurance’s new reinsurance risk solutions

10th April 2024

South Africa-based Yard Insurance has launched its new reinsurance risk solutions for the energy sector. The company assists the energy sector to mitigate their unique risks against potential catastrophic losses like weather, rehabilitation and other complex issues. It does this by tailoring Alternative Risk Financing Models and creates insurance capacity via funded ... Read the full article

Re/insurers key in helping accelerate deployment of climate tech: The Geneva Association

9th April 2024

Re/insurers are essential to rolling out the climate technology needed for industries to decarbonise, according to a recent report by The Geneva Association, the global association of insurance companies. In a race to meet global climate targets, industries around the world are under increasing pressure to adopt new technologies and processes ... Read the full article

Scribestar launches new platform to streamline documentation production within reinsurance

8th April 2024

UK-based Scribestar, a legal and regulatory technology company, has announced the rollout of its unique platform solution tailored for the global reinsurance and ILS (Insurance-Linked-Securities) market. With this solution, Scribestar aims to provide a secure collaboration platform that uses automation and custom workflows to streamline the complex legal, regulatory, and administrative ... Read the full article

Public-private partnerships play a key role in climate adaptation: Swiss Re’s Menzinger

26th March 2024

Climate mitigation and adaptation is essential to continue reducing emissions to counter hazard intensification, and public-private partnerships play a key role in funding and enabling this, according to Ivo Menzinger, Head EMEA, Public Sector Solutions at Swiss Re. A recent report by the Swiss Re Institute revealed that global insured ... Read the full article

Fire safety reinsurance facility established by McGill and Partners finalised

13th March 2024

A new initiative has been set up which aims to help improve the availability of insurance for higher-risk buildings awaiting work to fix fire safety issues. The Fire Safety Reinsurance Facility will help to increase insurance market competition to cover properties affected by combustible cladding and other fire safety issues. From what ... Read the full article

Nirvana Insurance capacity growth supported by top-tier reinsurers

11th March 2024

Commercial insurer Nirvana Insurance has announced it has doubled capacity with the support of a number of top-tier reinsurance partners, becoming one of the fastest-growing trucking insurers of all time. Driven by artificial intelligence (AI), telematics, and computer vision, Nirvana was founded in 2021 looking to improve safety for everyone on ... Read the full article

Oman Re granted Retakaful licence

6th March 2024

Oman Re, the sole reinsurer in the Sultanate of Oman, has announced it has obtained a Retakaful licence by the Capital Market Authority. Granted on 22 February 2024, the licence empowers Oman Re to establish Retakaful operations, further solidifying its position in the market and enabling the provision of Shariah-compliant Retakaful ... Read the full article

Positive rate environment to continue as reinsurance market stabilises: Lockton

1st March 2024

Lockton expects a positive rate environment to continue in the first half of 2024, despite 1.1 renewal activity suggesting the reinsurance market is stabilising following difficult treaty renewals a year earlier. Rates for reinsurance catastrophe coverage flattened during this year’s 1.1 renewals, mainly backed by abundant capacity, which is similarly ramping ... Read the full article

CIS insurers to face new risks as they expand reinsurance business internationally: Moody’s

27th February 2024

To compete against international reinsurers’ better prices, and increase profitability, insurers in countries part of the Commonwealth of Independent States (CIS), will likely grow their reinsurance business, but this would also bring new risks, according to Moody’s analysts. According to the agency’s report, CIS insurers, led by companies in Uzbekistan and ... Read the full article

Rising reinsurance costs pose challenge for German P&C insurers: S&P

23rd February 2024

German property and casualty (P&C) insurers are grappling with mounting pressure due to surging reinsurance expenses, impacting both profitability and operational strategies, as highlighted by S&P Global Ratings, signaling potential adjustments within the sector. Reinsurance, a vital mechanism for insurers to mitigate risks by transferring a portion of their liabilities to ... Read the full article

Global Atlantic and Manulife close $10 billion reinsurance transaction

22nd February 2024

In a significant move within the insurance industry, Global Atlantic Financial Group (Global Atlantic) and Manulife Financial Corporation have successfully finalized a $10 billion reinsurance transaction. The deal, which was initially unveiled last December and has now reached completion, involves the reinsurance of a diverse portfolio of Manulife's life, annuity, and ... Read the full article

Bloomberg Intelligence forecasts continued dominance of alternative-reinsurance vehicles in 2024

22nd February 2024

Bloomberg Intelligence (BI) predicts that alternative-reinsurance vehicles will likely maintain their position as the primary source of new capacity in 2024, potentially impacting pricing dynamics in the reinsurance market, according to a recent report. In 2023, BI notes a negligible increase in balance-sheet reinsurance capacity, excluding Everest's capital raise, while catastrophe-bond ... Read the full article