Reinsurance News

Results news

News on reinsurance and insurance company quarterly and annual results or reporting. Detailing news on the financial performance of insurance and reinsurance underwriting companies and brokers.

RLI grows earnings in Q3 despite CR slide

22nd October 2020

US property and casualty insurer, RLI Corp., has improved its net earnings to $42.4 million in the third quarter of 2020, despite some deterioration in its combined ratio. Net earnings were up from $32.3 million for the same period last year, but operating income fell to $19.0 million from $25.9 million ... Read the full article

W.R. Berkley posts 93.7% combined ratio for Q3 despite cat impacts

21st October 2020

W.R. Berkley Corporation has reported operating income of $121.1 million for the third-quarter of 2020 and a combined ratio of 93.7%, despite the impacts of catastrophe events in the period. Operating income fell slightly from the $163.7 million reported for the third-quarter of 2019, while the insurer's net income also fell ... Read the full article

Munich Re adds €800mn of COVID-19-related losses in Q3

20th October 2020

Global reinsurer Munich Re has added a further €800 million of COVID-19-related losses in its reinsurance operation in the third-quarter of 2020, taking its total for the first nine months of the year to €2.3 billion. The German reinsurer explains that the losses were attributable to various lines of business, including ... Read the full article

Travelers’ Q3 net income rises as losses trigger full agg reinsurance recovery

20th October 2020

The Travelers Companies, Inc. has reported an improved net income of $827 million for the third-quarter of 2020, despite elevated catastrophe and non-catastrophe weather-related losses triggering a full recovery under the firm's Underlying Property Aggregate Catastrophe Excess-of-Loss Reinsurance Treaty. Net income improved by $431 million year-on-year in Q3 2020 as a ... Read the full article

Gjensidige Forsikring’s combined ratio improves to 78.2% in Q3

20th October 2020

General insurance provider, Gjensidige Forsikring Group, has reported an improvement in its combined ratio to 78.2% for its Q3 results, in comparison to its Q3 2019 result of 83.2%. The underwriting result was driven by 10% growth in earned premiums, an improved underlying frequency loss ratio and lower large losses. Earned premiums ... Read the full article

Kemper’s Q3 results to include cat losses of up to $68mn

20th October 2020

Kemper Corporation has announced that it anticipates its third quarter 2020 results will include pre-tax catastrophe losses ranging from $62 million to $68 million, primarily related to wildfire and hurricane events. The company notes that it does not expect ... Read the full article

R&Q’s pre-tax operating profit up 30%; COVID-19 dents investment result in H1

14th October 2020

Randall & Quilter Investment Holdings Ltd. (R&Q) has reported a 30% rise in pre-tax operating profit to £10.4 million (USD 13.4mn) for the first half of the year, while the impact of the COVID-19 pandemic on financial markets dented the firm's investment performance in the period. Pre-tax operating profit increased from ... Read the full article

COVID-19 disruption sees Helios post underwriting loss for H1

25th September 2020

Helios Underwriting has announced a £108,000 operating loss for the first half of 2020, with the COVID-19 pandemic causing a reduction in underwriting profits. The company says cumulative rate increases since 1 January 2018 are 28%. Losses of £5 million have been reserved for COVID-19 by the supported syndicates, of which 85% ... Read the full article

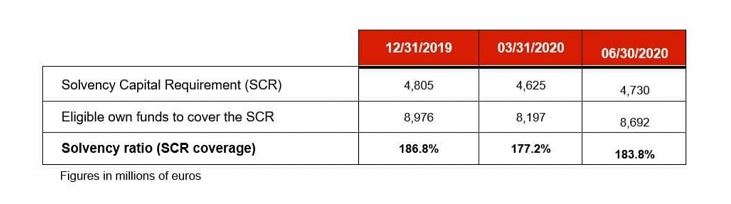

MAPFRE improves Q2 solvency ratio despite COVID challenges

21st September 2020

Spanish re/insurer MAPFRE has improved its Solvency II ratio in the second quarter of 2020, despite significant challenges associated with the COVID-19 pandemic. The company posted a ratio of 183.8% in Q2, representing a 6.6 percentage point increase on the 177.2% it recorded in Q1. It also compares with the Solvency II ... Read the full article

Allstate pegs August cat losses at $985mn

18th September 2020

US primary insurer Allstate has estimated its catastrophe losses for the month of August at $985 million, pre-tax. Losses during the period consisted of 11 events at an estimated cost of $969 million, pre-tax, plus unfavorable prior period reserve reestimates. Estimated catastrophe losses for the month include a $430 million impact of ... Read the full article

PIC completes £3.5bn of bulk annuity deals in H1

11th September 2020

Pension Insurance Corporation Group Limited (PICG), the parent company of specialist insurer Pension Insurance Corporation plc (PIC), completed £3.5 billion of bulk annuity deals in the first half of 2020. The firm also completed £47.7 billion in financial investments, compared to £40.9 billion across the whole of 2019. Reinsurance transactions covered £3.9 billion ... Read the full article

Continental Re secures $71.7mn gross premium income in H1

10th September 2020

Pan-African reinsurer Continental Reinsurance plc has reported a gross premium income of $71.7 million for the first half of 2020. This figure represents a 27% growth over the same period in 2019. Underwriting profit for the period stands at $6.9 million, an increase of 442% from the prior year period. Investment and other ... Read the full article

Lloyd’s falls to H1 net loss; expects gross COVID-19 claims of $6.5bn

10th September 2020

The specialist Lloyd's of London insurance and reinsurance marketplace has reported a loss of £0.4 billion (USD 0.5bn) in the first half of 2020, as COVID-19 related claims, after reinsurance recoveries, reached £2.4 billion (USD 3.1bn). On a gross basis, Lloyd's says that it expects to pay out up to £5 ... Read the full article

CCR’s premium income spikes; CCR Re’s combined ratio hits 105.2% in H1

9th September 2020

CCR Group, the state-backed French re/insurer, has reported net income of €28 million for the first-half of 2020, while premium income jumped 15%, year-on-year, to €1.068 billion. The insurer and reinsurer attributes the rise in premium income to the State-backed intercompany credit insurance scheme for SMEs launched as from April through ... Read the full article

Aspen falls to H1 loss, takes $187mn of COVID losses

4th September 2020

Bermuda-based insurer and reinsurer Aspen Insurance Holdings Limited has reported an operating loss of $48.2 million for the first six months of 2020, after taking $187.3 million of losses associated with the COVID-19 pandemic. Overall, COVID-19 related losses contributed 15.7% to Aspen’s combined ratio of 109.2% during this period. Excluding COVID-19 losses, ... Read the full article