Reinsurance News

Results news

News on reinsurance and insurance company quarterly and annual results or reporting. Detailing news on the financial performance of insurance and reinsurance underwriting companies and brokers.

P&C underwriting loss driven by expenses in auto lines: AM Best

6th October 2022

The US property and casualty (P&C) industry recorded a $6.3 billion net underwriting loss in the first six months of 2022, down $11.4 billion from the prior year period, with the personal lines segment, specifically the auto lines, responsible for this decline, according to an AM Best report. The Best’s Special ... Read the full article

West of England P&I Club reports improved operating results

6th October 2022

For the first time in five years, the West of England P&I Club, an insurance provider to the global maritime and offshore industries, has reported that it has returned an underwriting surplus in its 20 August financial results, with a combined ratio of 97.9% at the mid-year point. West of England ... Read the full article

Aston Lark reports 75% growth in revenue in 2021 results

3rd October 2022

Aston Lark is reporting a 75% growth in revenue, growing to £160.1 million, and 82% growth in EBITDA in 2021, according to its latest results. The company’s organic growth in commission and fees of 11%, was mostly due to a positive result against a backdrop of the economic environment during the ... Read the full article

Helios Underwriting reports loss after tax of £3.9m in H1 2022 results

29th September 2022

Lloyd's focused investment vehicle, Helios Underwriting, has released its unaudited results for H1 2022, saying that it saw gross written premiums (GWP) rise by 133% to £124m over the period. Elsewhere, the firm reported a loss after tax of £3.9m, a much-worse result than in H1 2021 when it reported a ... Read the full article

D&O insurance results improve, though premium growth stalls: Fitch

20th September 2022

According to Fitch Ratings, the U.S. Directors & Officers (D&O) insurance results in the first half of 2022 have improved, though premium growth has stalled. The D&O insurance line has experienced some of the most pronounced pricing increases over the last three years among all commercial lines, with shifts in underwriting ... Read the full article

Skuld reports positive $18m result for H1 in significant year-on-year improvement

16th September 2022

Marine insurance provider, Skuld, has reported a positive bottom-line result of $18 million for the first six months of its 2022/23 financial year, compared with negative $24.9 million from the same period last year. The company noted that the outcome was mainly driven by a positive technical result, along with a ... Read the full article

CCR Re maintains non-life profitability as GWP rises 15% in H1 2022

9th September 2022

CCR Re, the French state-owned reinsurer, has reported a 15% year-on-year rise in gross written premiums (GWP) for the first half of 2022, as the firm achieved profitable and diversified growth. The rise in premiums to €764 million compares with the €665 million recorded in the first half of 2021. At ... Read the full article

Lloyd’s falls to £1.8bn loss on investments, reserves £1.1bn for war in Ukraine

8th September 2022

The specialist Lloyd's insurance and reinsurance marketplace has today reported an overall loss of £1.8 billion for the first half of 2022, but despite reserving £1.1 billion for claims related to the war in Ukraine, the underwriting performance improved. The net loss reported today compares with profit of £1.4 billion a ... Read the full article

Aspen improves underwriting, grows reinsurance premiums

7th September 2022

Bermuda-based insurer and reinsurer, Aspen Insurance Holdings, has reported improved underwriting income for the first six months of 2022, as top line growth helped to offset a moderate increase in catastrophe losses. Underwriting income for H1 amounted to $156.5 million, up from $59.4 million for the same period last year, resulting ... Read the full article

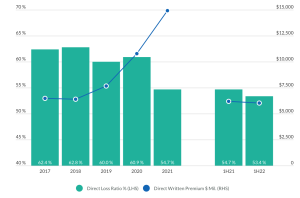

P&C reinsurers post 13% premium growth through H1: RAA

6th September 2022

New data released by The Reinsurance Association of America (RAA) shows an increase in both profitability and net premiums for US property and casualty (P&C) reinsurers through the first half of 2022. The data, collected by RAA from 17 reinsurers globally, shows that the combined ratio for the group improved marginally ... Read the full article

R&Q falls to $137m loss for H1

5th September 2022

Bermuda based insurer R&Q Insurance Holdings Ltd has reported an overall loss of $136.7 million from operations before income taxes across its business segments during the first six months of 2022, following large investment losses caused by volatile market conditions. The negative performance follows on from a loss of $45.4 million ... Read the full article

ABIR sees 21% year-over-year growth in NPW in 2021 global underwriting results

1st September 2022

Member companies of the Association of Bermuda Insurers and Reinsurers (ABIR) reported a substantial 21% year-over-year increase in net premium written in 2021. ABIR’s global underwriting report, released earlier this week, comprises data from 25 of 29 member re/insurers for the calendar year of 2021. The group generated net premium written of ... Read the full article

Santam passes most of $257m flood loss to reinsurers

1st September 2022

South African insurer Santam has reported its results for the first six months of 2022, which include a gross exposure of R4.4 billion (USD 257 million) to flooding in the KwaZulu-Natal province. However, the company’s net impact from the floods was limited to R566 million (USD 33 million) thanks to its ... Read the full article

Fitch notes marginal improvement in operating earnings for North American P&C

31st August 2022

Fitch Ratings has said that the North American property/casualty (P/C) insurance GAAP results for H1 2022 showed marginal operating earnings improvement, with sharp deterioration in personal lines performance amid rising inflation and accelerating personal auto loss-cost trends that was more than offset by strong underwriting improvement across most commercial lines ... Read the full article

Bermudian reinsurers’ underwriting lacklustre over last half decade: S&P

31st August 2022

S&P Global Ratings has released a new note, saying that the underwriting performance of Bermudian re/insurers has been lacklustre over the last five year with only a few companies being profitable. However, the organisation posited that better days could be ahead after half a decade of underperformance. It said that pricing ... Read the full article