Reinsurance News

Swiss Re news

News on one of the world’s largest reinsurance companies Swiss Re.

Swiss Re is a leading global reinsurance company and our news covers its announcements, people moves, results and financial performance, as well as analysis of reinsurance market trends and interviews.

Covéa and Swiss Re reported on verge of arbitration over COVID-19 BI claims

16th September 2020

According to reports in the French press, insurer Covéa is set to launch an arbitration with its reinsurer, Swiss Re, concerning COVID-19-related business interruption (BI) losses of at least €500 million. Reports state that both Covéa and Swiss Re are in the process of selecting their arbitrators as tensions between insurers ... Read the full article

Swiss Re steps up internal carbon levy

15th September 2020

As part of its efforts to transition to net-zero emissions in operations by 2030, Swiss Re has announced that it will increase its internal carbon levy to $100 per tonne as of 2021. The new levy is considerably higher than the current levy of $8 per tonne CO2, and is set ... Read the full article

More rate needed for industry to be sustainable: Swiss Re CEO Mumenthaler

14th September 2020

The reinsurance industry needs to secure more in the way of rate increases for it to be sustainable, according to Swiss Re's Group Chief Executive Officer (CEO) Christian Mumenthaler. Speaking in a video interview for the Artemis Live series from our sister website, ... Read the full article

“Timid” price increases not enough to cover exposure, says Swiss Re

11th September 2020

Executives at reinsurer Swiss Re have said that further rate improvements are needed after "timid" price increases across the reinsurance sector, which have ultimately failed to compensate for years of premium decline and the elevated claims load. Addressing the media this week as part of Swiss Re's virtual Rendez-Vous de Septembre ... Read the full article

Supply chain restructuring to generate $63bn in premiums: Swiss Re

10th September 2020

Swiss Re believes that supply chain restructuring resulting from the COVID-19 pandemic could drive new demand for insurance protections, and estimates that additional global premium volumes of around $63 billion could be generated over the next five years. The latest Swiss Re Institute sigma study explores the idea that global supply ... Read the full article

Swiss Re expects rate hardening to continue; sees underwriting discipline as key

8th September 2020

Reinsurance giant Swiss Re expects to see further rate hardening across all lines of business at the upcoming renewals, driven by a combination of the low interest rate environment and the need to cover rising loss trends. Further rate hardening in reinsurance is expected on the back of price improvements in ... Read the full article

Chinese residential protection a new risk pool for re/insurers: Swiss Re

7th September 2020

A new report by Swiss Re Institute has highlighted the opportunity for re/insurers to access a new risk pool by increasing the uptake of residential coverages in China. Analysts noted that residential insurance premiums totaled only CNY 9.1 billion (USD 3 billion) in 2019, which was less than 20% of all ... Read the full article

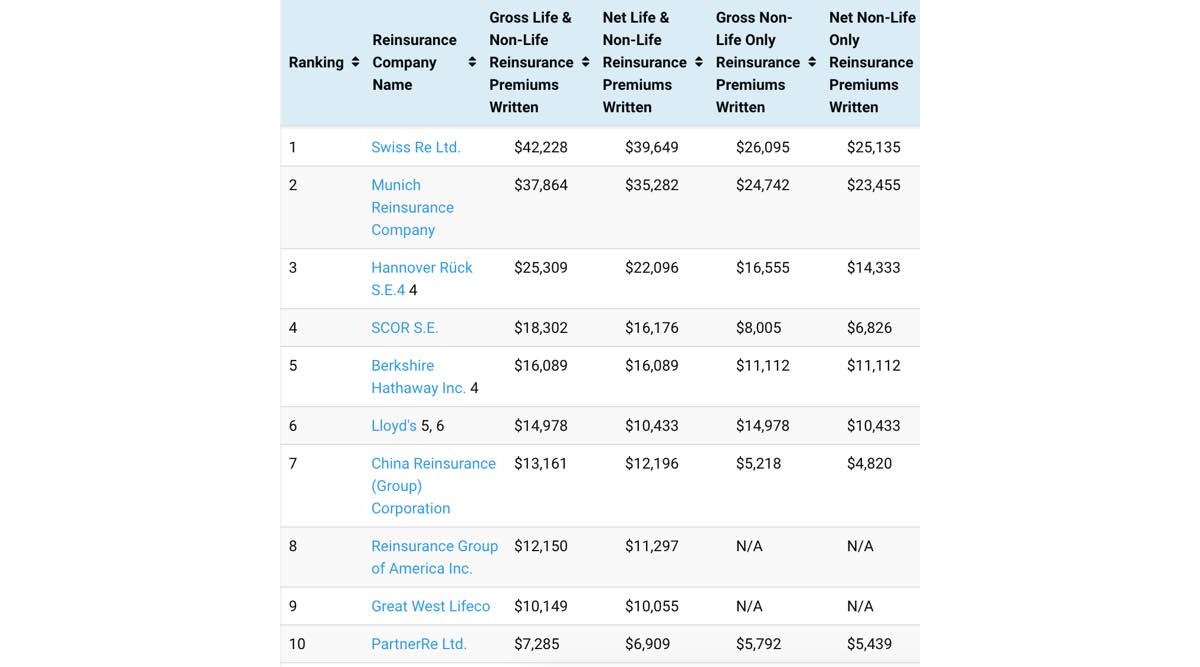

Average combined ratio of the world’s top reinsurers declined in 2019

2nd September 2020

Analysis of the Top 50 Global Reinsurance Groups reveals that, year-on-year, combined ratios trended higher for some of the largest players in the market in 2019 as underwriting profitability dipped for the cohort. When ranked by unaffiliated gross written premiums (GWP) in 2019, the top ten remains relatively unchanged year-on-year, ... Read the full article

Emerging market insurers to be hardest hit by COVID-19: Swiss Re

1st September 2020

Reinsurance giant Swiss Re has reported that emerging market insurers will be the hardest-hit globally by COVID-19. It is estimated that insurers will be hit with a 3.6 percentage point impact on premium growth in each of 2020 and 2021. However, China's insurance market is the exception, with average premium growth of ... Read the full article

World economic resilience to fall in 2020; protection gap hits $1.24tn: Swiss Re

26th August 2020

The impact of the ongoing COVID-19 pandemic is expected to drive an almost 20% reduction in global macroeconomic resilience in 2020, while the global protection gap (disparity between economic and insured losses) has hit a new high of $1.24 trillion, according to Swiss Re Institute. In its latest annual resilience indices, ... Read the full article

Google’s Verily launches insurance partnership with Swiss Re

25th August 2020

Swiss Re Corporate Solutions (Swiss Re CorSo), the commercial insurance arm of reinsurance giant Swiss Re, is backing a new Verily subsidiary focused on employer stop-loss called Coefficient Insurance Company. Verily is the life sciences and healthcare subsidiary of Alphabet, the parent of Google. The firm's new insurance subsidiary, Coefficient, has ... Read the full article

CPIC says Swiss Re investment helps optimise ownership structure

25th August 2020

China Pacific Insurance Company (CPIC) has said that an investment by Swiss Re has helped to optimise its ownership structure, after the reinsurer participated in CPIC’s recent listing on the London stock exchange (LSE). Alongside the release of its H1 results, CPIC explained that the investment from Swiss Re had “laid ... Read the full article

European reinsurers top tier globally by business profile: Fitch

24th August 2020

The four major European reinsurers - Munich Re, Swiss Re, Hannover Re and SCOR SE are among the top tier of global reinsurers by business profile, Fitch Ratings says. Large franchises and a high degree of diversification underpin Fitch's assessment of very strong business profile for each group. The capital adequacy of ... Read the full article

China’s insurance growth to be strongest worldwide in 2020: Swiss Re

21st August 2020

Thanks to China's effectiveness in implementing measures to help its economy rebound from the wide-ranging impacts of COVID-19, Swiss Re expects the country's insurance industry growth to be the strongest worldwide in 2020. Furthermore, the reinsurer sees double-digit growth in the country to resume in 2021. According to analysis from a Swiss ... Read the full article

Swiss Re co-leads new funding round for Chinese InsurTech Waterdrop

20th August 2020

Reinsurance giant Swiss Re, alongside China-based internet firm Tencent Holdings, has led a new $230 million funding round for Chinese online InsurTech firm, Waterdrop Inc. According to reports, the funding signals Swiss Re's first investment into an InsurTech startup in China and is part of the reinsurer's long-term commitment to the ... Read the full article