Typhoon Nanmadol, which impacted southern Japanese islands Kyushu and Shikoku as well as the western and central regions of Japan’s main island of Honshu in September, is estimated to have caused an insured market loss of roughly USD 773 million (JPY 114 billion), according to an initial estimate from PERILS.

The catastrophe loss aggregator explains that this figure includes the losses from the property lines of business as sustained by the Japanese non-life sector, and is based on data collected from most of the country’s non-life insurance market.

The catastrophe loss aggregator explains that this figure includes the losses from the property lines of business as sustained by the Japanese non-life sector, and is based on data collected from most of the country’s non-life insurance market.

The approximately USD 773 million inured loss total excludes losses from motor physical damage and goods covered by transportation-related policies.

This is the first estimate from PERILS for the event, with the next update from Typhoon Nanmadol expected to made available by December 20th, 2022, three months after the event end date of September 20th, 2022.

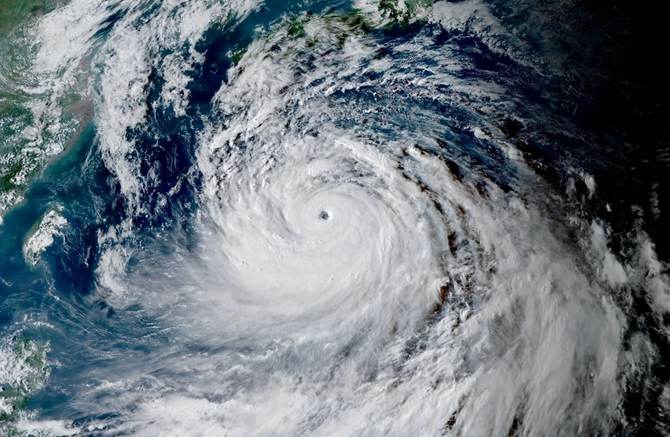

The 14th named storm in the 2022 Western North Pacific typhoon season, Typhoon Nanmadol made landfall on September 18th, 2022, near the city of Kanoshima on southern Kyushu Island.

The storm brought strong winds and torrential rain resulting in flooding and landslides. The strongest gust, 183 km/h, was recorded at Yakushima Airport to the south of Kyushu.

In Misato town in Miyazaki prefecture, 907mm of rain was record within a 72-hour period, which is twice the monthly average in September for the region, notes PERILS.

“Despite causing widespread disruption and extensive property damage, the loss to the insurance industry from Typhoon Nanmadol was lower than initially feared,” says PERILS. “In comparison to the major 2018/19 typhoon events (e.g., Jebi or Hagibis), the lower-than-expected loss level can be attributed to Nanmadol’s track, which ran through an area of lower value concentration and the fact that the affected areas are frequently exposed to extreme weather events and therefore well prepared to withstand their impact.”

Takashi Goda, Senior Advisor for Japan at PERILS, commented: “This is the first qualifying loss event since PERILS started providing coverage for Japan earlier this year. Major landfalling typhoons can have a devastating impact. Our hope is that the PERILS loss reports will be useful for risk assessment, helping to increase market transparency, and providing additional means to secure risk capital, particularly for critical perils. We know that compiling loss information requires significant input from numerous parties.

“As we move forward, our aim is to continue to work closely with the data-providing companies to facilitate the best-possible quality of the data produced, which we believe will benefit all stakeholders.”

Luzi Hitz, Chief Executive Officer (CEO) of PERILS, added: “In these challenging times for the global re/insurance industry, having reliable industry loss numbers is more important than ever. Initial loss forecasts for Typhoon Nanmadol compared it to Typhoon Jebi which generated a loss of more than one trillion Yen for the Japan non-life industry. Our systematic, bottom-up approach, where we collect the loss information directly from the affected primary insurance companies, now shows that the Nanmadol loss is far lower, a fact which will likely be welcomed by the industry given the current market environment and availability of Cat capacity.”