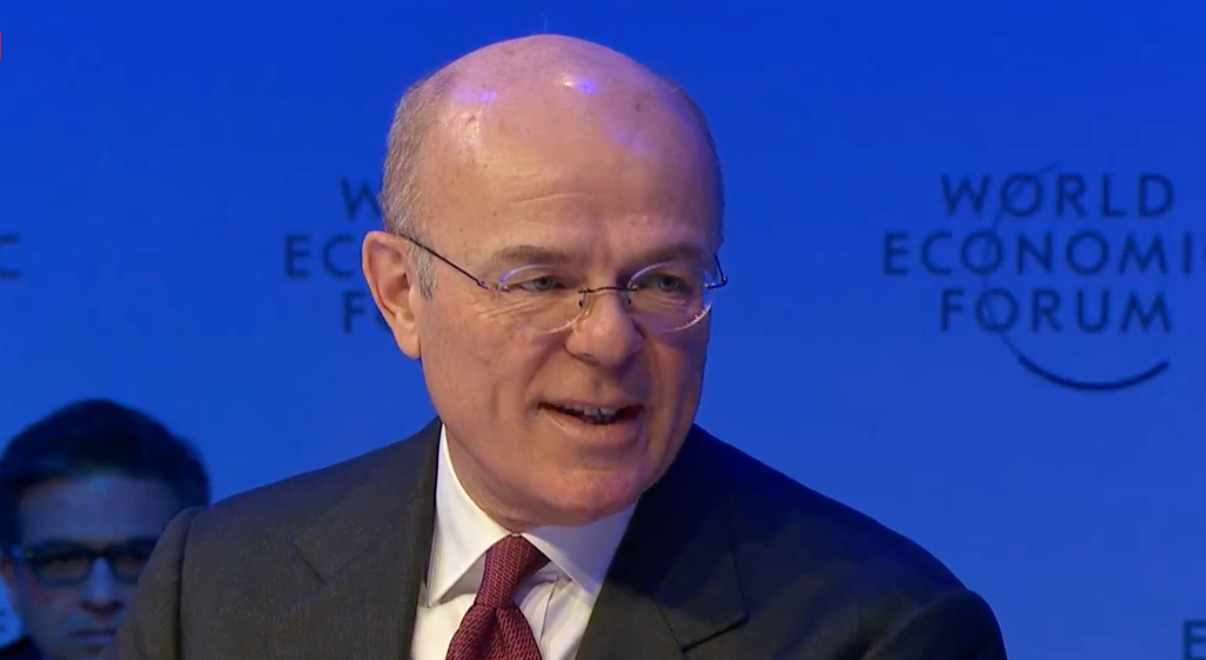

Mario Greco, the Chief Executive Officer (CEO) of Zurich Insurance Group, has called for tax changes designed to ensure carbon is effectively priced across the world.

Addressing an audience at the World Economic Forum’s (WEF) annual meeting held in Davos, Switzerland, Greco discussed the impacts of digital disruption and the changing climate on the global re/insurance industry.

Addressing an audience at the World Economic Forum’s (WEF) annual meeting held in Davos, Switzerland, Greco discussed the impacts of digital disruption and the changing climate on the global re/insurance industry.

Unsurprisingly, much of the noise from Davos 2020 is expected to focus on the changing climate and the urgent need to slow the warming of the seas and reduce greenhouse gas emissions.

With its extensive risk knowledge and experience, the insurance and reinsurance sector is well placed to help address the climate crisis, and has the capital and willingness to be able to drive change.

Discussing the climate, Greco said that the real question is what we can do individually or collectively to make adaption much faster.

“The world has moved based on price messages, price has not been helpful so far mainly because we’ve been moving the old system to make short-term actions.

“The distortion of short interventions has changed completely the nature of prices and we need some investments made for the longer term,” he continued.

Greco added that in terms of what Zurich can do, the only thing is to stop funding and stopping funding is a brutal reaction.

“I’d like to see tax changes that would make carbon effectively priced across the world in business decisions made. For our company, I commit over the next year to quickly and fast develop innovative changes to retail, new services for millennials and new initiatives in so-called well-care,” said Greco.

A large number of insurers and reinsurers have now made pledges to cease both underwriting and investments in certain coal-related businesses, and, the industry is increasingly working in the renewable energy arena, providing underwriting expertise and also capacity.

This is all happening during a time of great transformation for the risk transfer industry not only because of the changing climate, but also as a result of intensifying digital disruption.

“Digital disruption is changing completely the industry I live in, which is insurance,” said Greco. “It is calling for the industry to provide a completely different service level. The amount of transformation is so massive that I think we can imagine an insurance industry where we are dominated by different brands, or massive players that have significantly transformed.”

Ultimately, he continued, the transformation of the business model is essential to respond to climate risks, and the speed of transformation required is significant. According to Greco, price is a key issue in order to make insurance more available to support the climate related shifts that are needed to make the world a more sustainable place.

“What digital is making possible is that customers can finally see what are their choices, what are their opportunity and they can compare. Also moving out is easier, so they can choose one insurer over another.

“Retention loyalty is falling down significantly in our industry, which is a massive threat to the classical sustainability of our business,” said Greco.