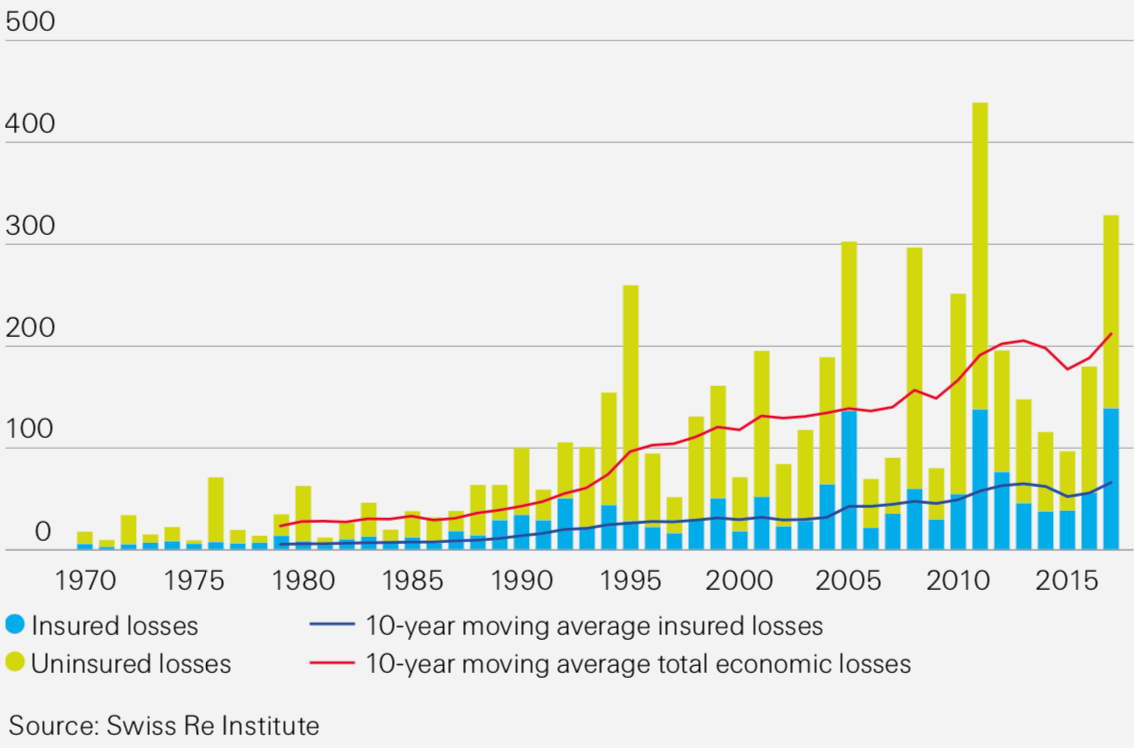

Swiss Re’s research institute, sigma, has reported that global insured losses from disaster events totalled a record US $144 billion in 2017, leaving a $193 billion deficit in coverage when compared with total global economic losses from natural disasters and man-made catastrophes, which reached $337 billion.

Sigma noted that this was the costliest single year ever for insured losses, with economic losses at the second highest level ever recorded, almost doubling the figure reported in 2016.

Global economic versus insured disaster losses by year – Source: Swiss Re

The main driver of both re/insured and economic losses were the three Atlantic hurricanes – Harvey, Irma, and Maria (HIM) – which inflicted total economic losses of $217 billion and left a protection gap of $125 billion after accounting for the $92 billion of insured losses.

It was also a significant year for global wildfire costs, which amounted to combined insurance losses of $14 billion, the highest ever recorded, with the October and December outbreaks in California alone causing economic losses of $13 billion.

According to sigma’s criteria, there were 301 catastrophes recorded across the world in 2017, down from 329 in 2016.

It also reported that more than 11,000 people died or went missing in disaster events over 2017, and that millions more were left homeless.

The most deadly events were the landslide and floods in Sierra Leone, which left 1,141 people dead or missing, and the flooding events across India, Nepal, and Bangladesh, which claimed over 1,000 lives.

Water damage also contributed heavily to the losses caused by HIM, with Harvey in particular unleashing unprecedented amounts of accumulated rain that caused catastrophic flooding and damaged around 200,000 homes and 500,000 vehicles.

Sigma found that the combined insured losses from HIM were equivalent to 0.5% of U.S gross domestic product (GDP) in 2017, with Harvey accounting for $30 billion, Irma for $30 billion, and Maria for $32 billion.

Martin Bertogg, Head of Catastrophe Perils at Swiss Re, commented: “After 12 years of no major hurricane making US landfall, 2017 is likely to go down as one of the most expensive North Atlantic hurricane seasons in history, in terms of both economic and insured losses.”

He added: “A key take away from HIM is that insurers need to consider multiple hurricanes occurring in a given year, as much as the severity of individual events, in their modelling of hurricane risk.

“This is important from a risk management perspective as it will help insurers – and, ultimately society – be better prepared for similar magnitude events in the future.”

Sigma suggested in the report that the North Atlantic is still likely to be in an active phase of hurricane activity, which entails a higher chance of hurricanes forming and making landfall.

It also warned that the frequency and severity of wildfire events are likely to continue to increase as summers become longer and warmer, and as more properties are built near undeveloped natural areas with vegetative fuels that are susceptible to fire hazards.